For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Nictus (JSE:NCS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Nictus

How Fast Is Nictus Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Nictus's EPS has grown 30% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Nictus's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Nictus is growing revenues, and EBIT margins improved by 2.3 percentage points to -22%, over the last year. That's great to see, on both counts.

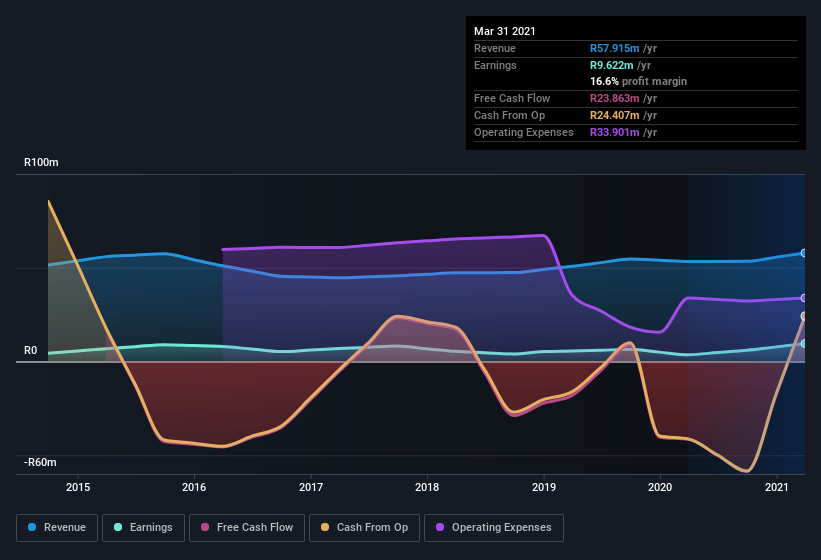

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Nictus is no giant, with a market capitalization of R53m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Nictus Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Nictus, is that company insiders paid R121k for shares in the last year. While this isn't much, we also note an absence of sales. We also note that it was the Non-Executive Director, Nicolaas Tromp, who made the biggest single acquisition, paying R56k for shares at about R0.56 each.

On top of the insider buying, we can also see that Nictus insiders own a large chunk of the company. Indeed, with a collective holding of 60%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, Nictus is a very small company, with a market cap of only R53m. So despite a large proportional holding, insiders only have R32m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Gerard de V. Tromp, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Nictus with market caps under R2.9b is about R4.3m.

The Nictus CEO received total compensation of only R420k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Nictus To Your Watchlist?

You can't deny that Nictus has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 5 warning signs for Nictus you should be aware of, and 2 of them are potentially serious.

The good news is that Nictus is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nictus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:NCS

Nictus

An investment holding company, operates as a retailer of household furniture, electrical appliances, and home electronics under the Nictus brand in South Africa.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives