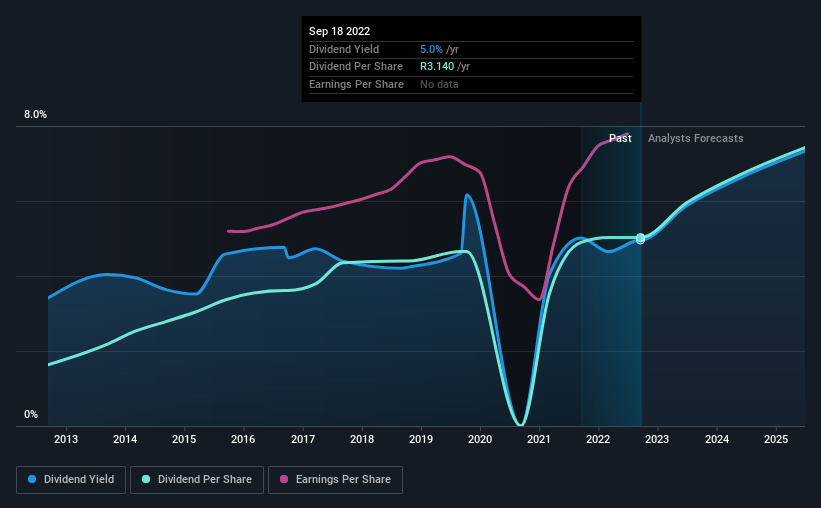

The board of FirstRand Limited (JSE:FSR) has announced that it will be paying its dividend of ZAR4.67 on the 17th of October, an increased payment from last year's comparable dividend. This makes the dividend yield 5.0%, which is above the industry average.

View our latest analysis for FirstRand

FirstRand's Dividend Forecasted To Be Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained.

FirstRand has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Based on FirstRand's last earnings report, the payout ratio is at a decent 59%, meaning that the company is able to pay out its dividend with a bit of room to spare.

Over the next 3 years, EPS is forecast to expand by 37.2%. The future payout ratio could be 59% over that time period, according to analyst estimates, which is a good look for the future of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2012, the dividend has gone from ZAR1.02 total annually to ZAR3.14. This means that it has been growing its distributions at 12% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

FirstRand Could Grow Its Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that FirstRand has grown earnings per share at 5.9% per year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Our Thoughts On FirstRand's Dividend

In summary, while it's always good to see the dividend being raised, we don't think FirstRand's payments are rock solid. While FirstRand is earning enough to cover the dividend, we are generally unimpressed with its future prospects. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for FirstRand (of which 1 shouldn't be ignored!) you should know about. Is FirstRand not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:FSR

FirstRand

Provides transactional, lending, investment, and insurance products and services in South Africa, rest of Africa, the United Kingdom, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.