- Malaysia

- /

- Medical Equipment

- /

- KLSE:KOSSAN

Nam Long Investment Leads Three Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by fluctuating interest rates and uneven economic indicators, investors are closely monitoring trends that could impact their portfolios. In such an environment, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Medley (TSE:4480) | 34% | 28.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 48.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.6% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

We'll examine a selection from our screener results.

Nam Long Investment (HOSE:NLG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nam Long Investment Corporation operates in the real estate sector in Vietnam with a market capitalization of approximately ₫16.93 billion.

Operations: The company generates its revenue primarily from real estate operations and development, totaling approximately ₫3.15 billion.

Insider Ownership: 21.9%

Nam Long Investment, despite a recent net loss of VND 76.85 billion and a downturn in quarterly sales from VND 235.13 million to VND 204.64 million, is projected to see significant growth with earnings and revenue expected to increase by approximately 29% annually over the next three years. This growth outpaces the broader VN market forecasts of 18.2% for earnings and 16.8% for revenue, indicating potential recovery and expansion ahead. However, its forecasted Return on Equity remains low at around 7.3%.

- Dive into the specifics of Nam Long Investment here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Nam Long Investment's current price could be inflated.

Kossan Rubber Industries Bhd (KLSE:KOSSAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kossan Rubber Industries Bhd is a Malaysia-based investment holding company that specializes in the production and international sale of latex disposable gloves, with a market capitalization of approximately MYR 6.28 billion.

Operations: The company generates revenue primarily through three segments: latex disposable gloves contributing MYR 1.35 billion, clean-room products adding MYR 102.09 million, and technical rubber products accounting for MYR 197.38 million.

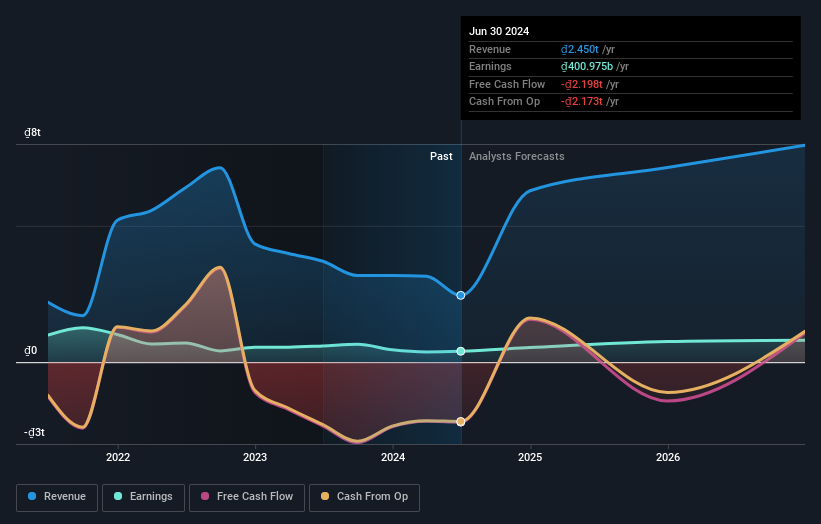

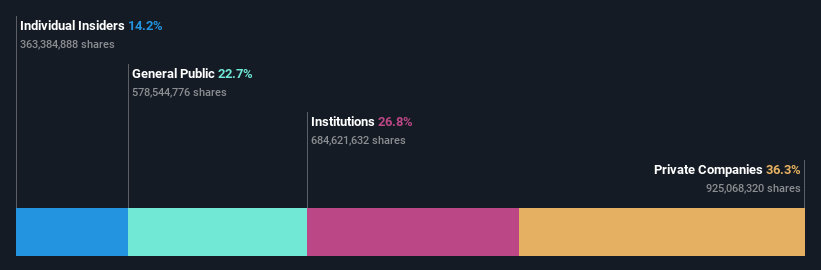

Insider Ownership: 14.2%

Kossan Rubber Industries Bhd has demonstrated robust earnings growth of 61.6% over the past year, with expectations to maintain a strong pace at 38.68% annually. Despite substantial one-off items affecting its financial results, revenue is also set to outpace the Malaysian market with an 18.5% annual increase. However, its forecasted Return on Equity is relatively low at 5.5%. Recent developments include a confirmed dividend and significantly improved quarterly net income and sales figures from last year's losses.

- Delve into the full analysis future growth report here for a deeper understanding of Kossan Rubber Industries Bhd.

- The analysis detailed in our Kossan Rubber Industries Bhd valuation report hints at an inflated share price compared to its estimated value.

Dodla Dairy (NSEI:DODLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dodla Dairy Limited operates in the production and sale of milk and dairy products both within India and internationally, with a market capitalization of approximately ₹67.40 billion.

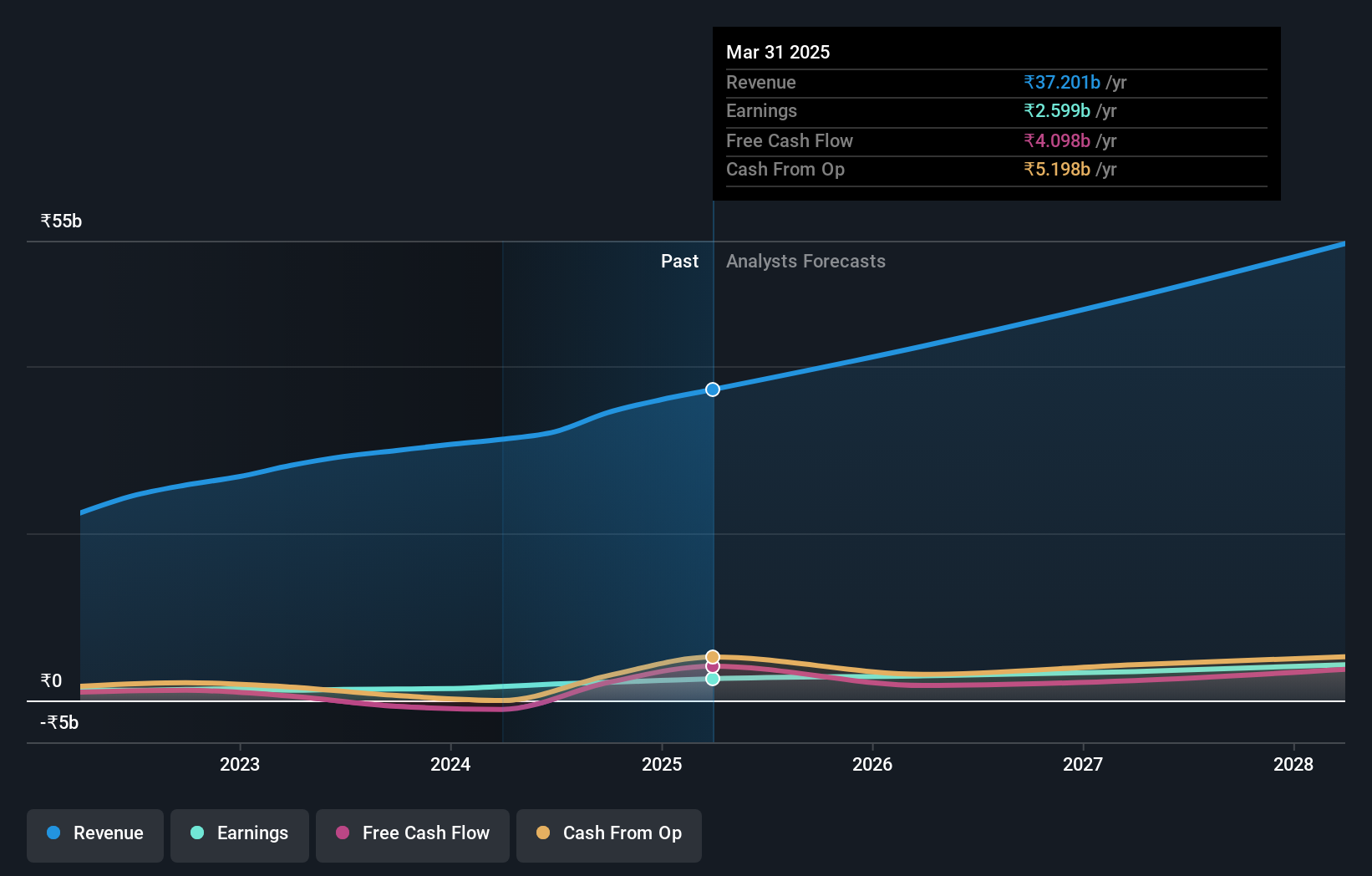

Operations: The company generates revenue primarily through the sale of milk and dairy products, totaling approximately ₹31.25 billion.

Insider Ownership: 26.7%

Dodla Dairy Limited, with substantial insider transactions recently, shows promising growth prospects. The company reported a significant increase in earnings by 36.4% over the past year and expects to continue this trajectory with an annual earnings growth forecast of 23.86%. Despite a low forecasted Return on Equity at 17.2%, recent strategic moves like the inauguration of a new production facility indicate potential for sustained operational expansion. Insider activities and consistent financial performance underscore its status in the market, balancing growth potential against some financial metrics that lag behind benchmarks.

- Unlock comprehensive insights into our analysis of Dodla Dairy stock in this growth report.

- According our valuation report, there's an indication that Dodla Dairy's share price might be on the expensive side.

Next Steps

- Discover the full array of 1451 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kossan Rubber Industries Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:KOSSAN

Kossan Rubber Industries Bhd

An investment holding company, manufactures and sells latex disposable gloves in Malaysia and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives