- United States

- /

- Water Utilities

- /

- NYSE:WTRG

Should You Take a Fresh Look at Essential Utilities After Its 9.3% Year-to-Date Gain?

Reviewed by Bailey Pemberton

If you’re here, you’re probably weighing the pros and cons of holding onto, buying, or maybe even selling Essential Utilities stock. You’re not alone. Plenty of investors are keeping a close watch on this company, drawn in by its track record and the recent rhythm of its share price. Over the last week, Essential Utilities inched up by 0.7%, which could signal growing optimism, while its nearly flat 30-day return of 0.1% suggests the market is still sizing up its next move. Zoom out to the year; returns stand at 9.3% year-to-date and 6.6% over the past 12 months. This reminds us that this isn’t a one-hit wonder. Over a 5-year stretch, the average annual gain of 7.3% speaks to staying power in a sector that isn’t usually a hotbed of dramatic swings.

Some of this stability stems from the nature of the water utilities industry, but investors should also consider how a shift in market risk appetite or broader infrastructure trends have swayed valuations recently. And speaking of value, Essential Utilities sports a value score of 3 out of 6, meaning it checks half of the boxes for being undervalued by major criteria. That’s a decent start, but it’s only part of the story.

So how does Essential Utilities stack up under the microscope of different valuation methods? Is there a smarter way to figure out if it’s truly undervalued? Let’s dig into how analysts approach this, and stay tuned for an even more insightful perspective as we wrap up the article.

Approach 1: Essential Utilities Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation approach that estimates a stock’s fair price by projecting its future dividend payments and discounting them to today’s value. This method works well for companies like Essential Utilities, which offer predictable dividend streams.

Looking at the numbers, Essential Utilities paid a dividend per share of $1.48 over the last year and maintains a solid return on equity of 8.92%. The company currently pays out about 61% of its profits as dividends, a healthy rate that leaves room for reinvestment and future growth. DDM growth expectations have been conservatively capped at 3.08% per year, which aligns with long-term estimates for stable but moderate expansion.

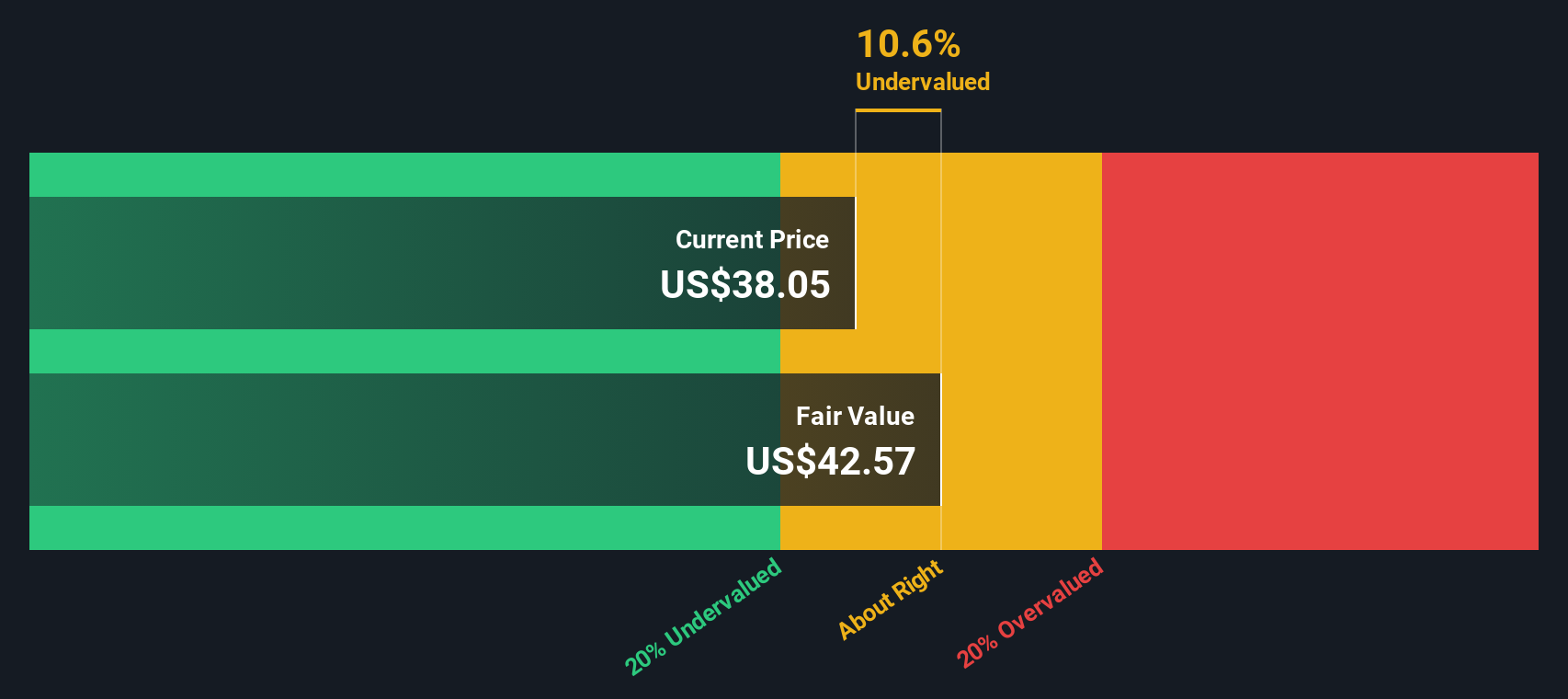

Based on these inputs and analyst assumptions, the DDM model produces an intrinsic value of $40.03 per share. This value is about 1.6% above the stock’s current price, indicating that Essential Utilities is priced very close to its estimated fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Essential Utilities's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Essential Utilities Price vs Earnings

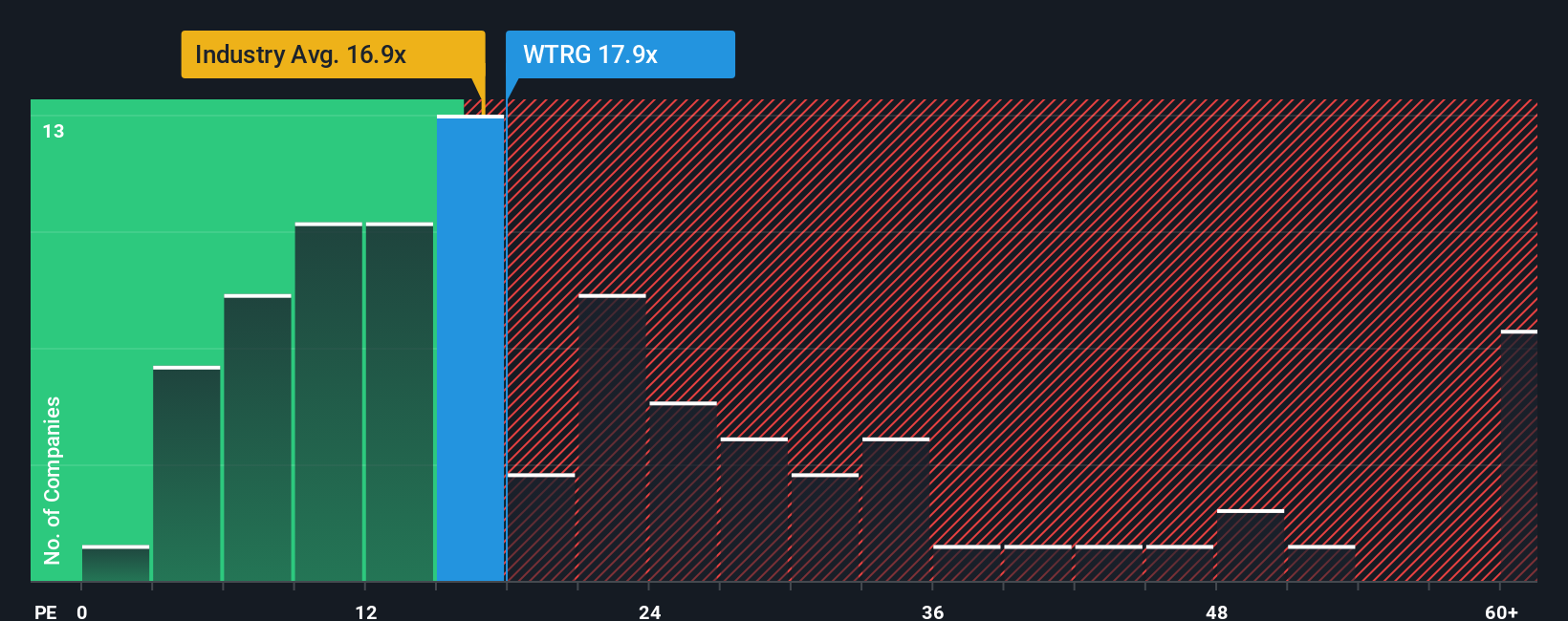

The price-to-earnings (PE) ratio is a widely used valuation measure for established, profitable companies like Essential Utilities. Since the company generates steady earnings, the PE multiple helps investors assess how much the market is willing to pay for each dollar of its earnings today.

What counts as a "normal" or "fair" PE ratio is not one-size-fits-all. Higher growth prospects and lower risk environments generally warrant higher multiples, while slower growth or greater uncertainty usually pull them down. Context matters, so comparing to relevant benchmarks provides a richer picture.

Essential Utilities currently trades at a PE ratio of 17.1x. This is just above the water utilities industry average of 16.7x but below the peer average of 20.9x. Simply Wall St’s proprietary Fair Ratio for Essential Utilities is 18.7x, calculated by factoring in the company’s earnings growth outlook, sector traits, profit margin, market cap, and risk profile.

The Fair Ratio is a more complete yardstick than simply comparing against peers or the broader industry. It reflects Essential Utilities’ unique strengths and challenges, offering a better sense of what an investor should reasonably pay in today’s market conditions.

With the current PE (17.1x) just under the Fair Ratio (18.7x), Essential Utilities appears to be priced about right relative to its growth and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essential Utilities Narrative

Earlier, we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. In simple terms, a Narrative is your investment story; it’s how you connect what you believe about Essential Utilities' future with the company’s financial outlook and what you consider a fair value. Instead of relying solely on formulas, Narratives let you factor in your view on its revenue, margins, and earnings as well as broader trends shaping its future.

Narratives transform the numbers into meaningful insights by tying together the company’s business story, your financial forecast, and a resulting value estimate. These are not complex tools. On Simply Wall St’s Community page, Narratives are easy to use and are trusted by millions of investors. They help you quickly see how your perspective compares to others, and support decisions on when to buy or sell by charting your fair value against the market price.

Best of all, Narratives are updated automatically whenever new information arises, such as earnings releases or major news, helping you keep your assessment fresh and your decisions timely. For Essential Utilities, for instance, the most optimistic investor sees a fair value of $56, while the most cautious believes $42 is appropriate. Narratives let you decide where your perspective sits based on what you think will really happen.

Do you think there's more to the story for Essential Utilities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essential Utilities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTRG

Essential Utilities

Through its subsidiaries, operates regulated utilities that provide water, wastewater, and natural gas services in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives