- United States

- /

- Other Utilities

- /

- NYSE:WEC

Did Datacenter Demand and Renewables Push Just Shift WEC Energy Group's (WEC) Investment Narrative?

Reviewed by Sasha Jovanovic

- In early October 2025, Citigroup initiated coverage on WEC Energy Group and reiterated positive analyst ratings, spotlighting the company's anticipated growth from datacenter projects with technology leaders such as Microsoft and Oracle, as well as significant renewable investment plans.

- An important insight is that WEC's combination of accelerated gas infrastructure replacement, favorable regulatory prospects, and long-term renewable initiatives positions it to benefit from both rising large-customer demand and supportive policy trends.

- We'll examine how the anticipated demand from datacenter expansion factors into WEC Energy Group's updated investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

WEC Energy Group Investment Narrative Recap

To be a WEC Energy Group shareholder today, you need to believe in the strong, multi-year power demand from datacenter expansion and successful execution of WEC’s $28 billion infrastructure plan. The recent Citigroup coverage highlights these growth drivers, but the short-term outlook hinges on the timing and magnitude of new datacenter loads, the biggest risk remains whether these large customers ramp up as quickly as forecasted. The Citigroup news affirms the company’s exposure to this catalyst but does not materially change the underlying risk profile.

Of the recent announcements, WEC’s updated Q3 and 2025 annual earnings guidance stands out. This reinforces near-term earnings visibility, even as investor focus sharpens on whether datacenter projects and policy tailwinds can help offset financing and regulatory uncertainties in the coming quarters.

Yet, for all the promise of new demand, it’s the regulatory and permitting outcomes, including tariff approval and renewable tax guidance, that could quietly reshape WEC’s true earnings capacity…

Read the full narrative on WEC Energy Group (it's free!)

WEC Energy Group's narrative projects $10.8 billion revenue and $2.1 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $0.4 billion earnings increase from $1.7 billion.

Uncover how WEC Energy Group's forecasts yield a $113.12 fair value, in line with its current price.

Exploring Other Perspectives

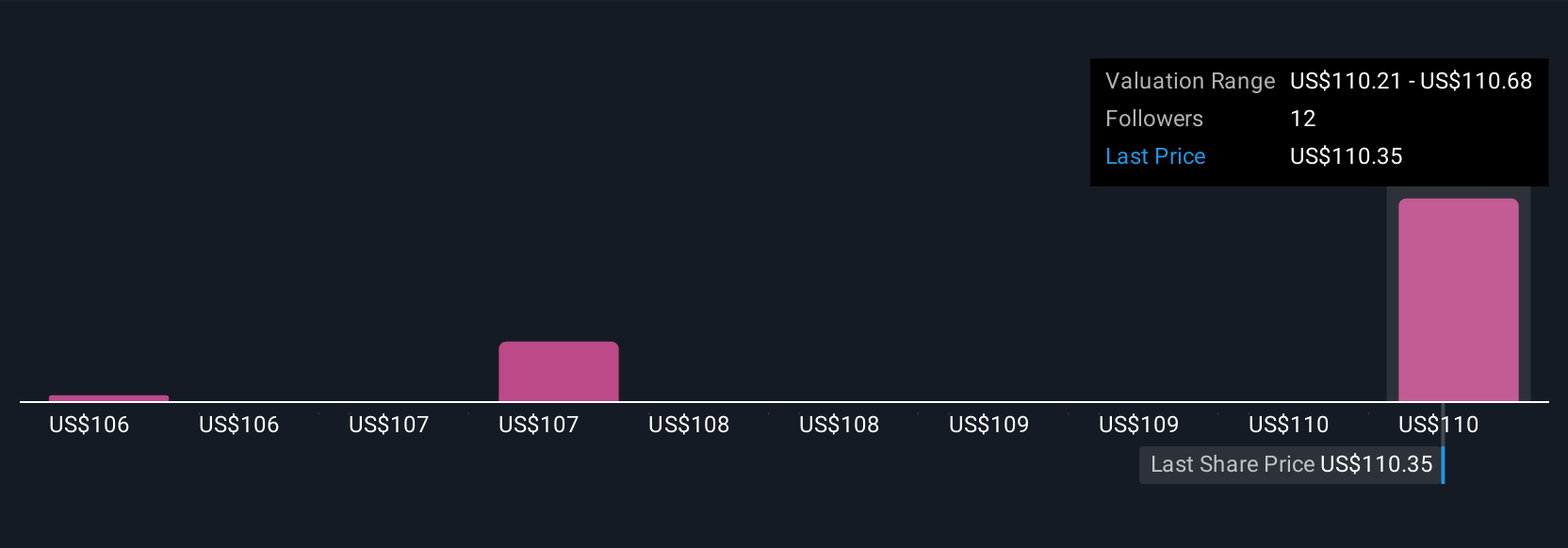

Four fair value estimates from the Simply Wall St Community range from US$106 to US$121 per share. These varied perspectives exist as WEC faces both massive capital needs and heightened scrutiny around securing timely approvals and cost recovery for new infrastructure.

Explore 4 other fair value estimates on WEC Energy Group - why the stock might be worth as much as 6% more than the current price!

Build Your Own WEC Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEC Energy Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WEC Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEC Energy Group's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives