- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (VST): Examining Valuation as Analyst Optimism Grows on Data Center-Driven Power Demand

Reviewed by Kshitija Bhandaru

Recent analyst coverage has put Vistra (VST) front and center for investors. The company’s profile is rising as data center expansion and infrastructure upgrades drive electricity demand, particularly with supportive Texas ERCOT market conditions in play.

See our latest analysis for Vistra.

Vistra’s share price has cooled off a bit in the short term, slipping about 4% over the last month. This follows a powerful run earlier in the year. Momentum remains strong, with the stock still up 34.5% year-to-date and delivering a remarkable 55.3% total shareholder return over the past year. This reflects growing confidence in Vistra’s long-term role as demand for electricity accelerates.

If the renewed momentum around energy infrastructure is on your radar, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With analyst upgrades and industry tailwinds boosting Vistra’s profile, the key question now is whether shares still offer value for prospective investors or if the market has already factored in the company’s promising growth outlook.

Most Popular Narrative: 11% Undervalued

Compared to the last close price of $201.35, the most widely followed narrative suggests Vistra’s fair value is $226.45. The valuation reflects optimism about earnings and profit margin expansion in the context of surging electricity demand.

Progress on large-scale, multi-decade contracts, such as potential colocation and long-term supply agreements with hyperscalers and data centers, provides a forward pipeline for stable, premium cash flows that are likely to support strong, visible earnings growth.

Curious what forecasted revenue growth, profitability jumps, and ambitious future earnings numbers underpin this bullish outlook? Dig into the key assumptions powering these fair value calculations. The most surprising figure could shift your view on Vistra’s potential for years to come.

Result: Fair Value of $226.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution hiccups on large battery projects or sudden power market volatility could quickly dampen earnings momentum and challenge Vistra’s optimistic outlook.

Find out about the key risks to this Vistra narrative.

Another View: Multiples Tell a Cautionary Story

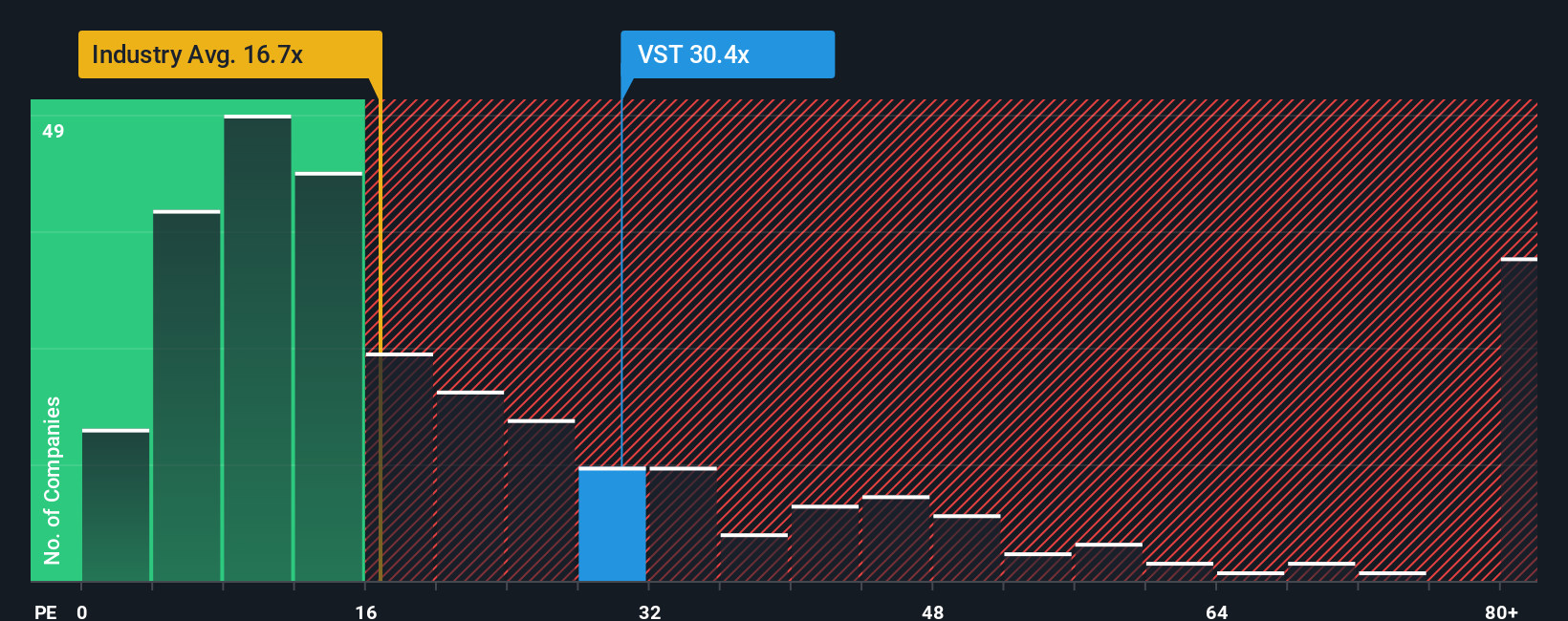

While the fair value estimate presents Vistra as a bargain, a look at its price-to-earnings ratio offers a more guarded perspective. At 31.1 times earnings, Vistra trades higher than the global renewable energy industry average of 16.6 times. However, it is less expensive than peer averages at 36.5 times. The fair ratio, based on market regression, is 41. This poses a question for investors: could the stock rerate higher, or is there valuation risk if growth expectations stumble?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you see things differently or like to reach your own conclusions using the numbers, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Now is the perfect time to seek out your next opportunity in fast-changing markets. Make smarter moves by handpicking unique stocks using fresh insights:

- Spin your portfolio toward high potential by checking out these 3596 penny stocks with strong financials with solid financials and serious upside.

- Step ahead of market trends by tapping into innovation driving gains in healthcare with these 33 healthcare AI stocks.

- Unlock cash-flow bargains by pinpointing great value using these 877 undervalued stocks based on cash flows before others spot them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives