- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Announces Quarterly Dividend Increase

Reviewed by Simply Wall St

Vistra (NYSE:VST) recently announced its earnings report, revealing stronger year-over-year sales growth, yet accompanied by a widening net loss. Alongside the financial disclosures, the company increased its quarterly dividendto $0.225 per share, reflecting growing confidence in the ongoing financial strategy. Additionally, updates on the stock buyback program highlight an aggressive approach to reducing outstanding shares. These actions have coincided with a notable 37% price increase for Vistra over the past month. Meanwhile, broader market trends reveal rising stock indices, driven by positive earnings and reduced global trade tensions. Vistra's activities may have complemented these market movements, solidifying investor interest.

We've discovered 3 risks for Vistra that you should be aware of before investing here.

Find companies with promising cash flow potential yet trading below their fair value.

Vistra's recent financial updates, particularly the dividend increase and share buyback program, suggest a commitment to rewarding shareholders, which aligns with its previously reported strong capital return strategies. Over the past five years, Vistra's total shareholder return, including both price appreciation and dividends, soared by a very large percentage, reflecting its efforts to position itself as a robust player in the industry. In comparison, over the past year alone, Vistra outperformed the US market, which returned 10.6%, and the broader US Renewable Energy industry with a 19.6% return. This underlines Vistra's resilience and capability to weather market fluctuations while maintaining growth and investor interest.

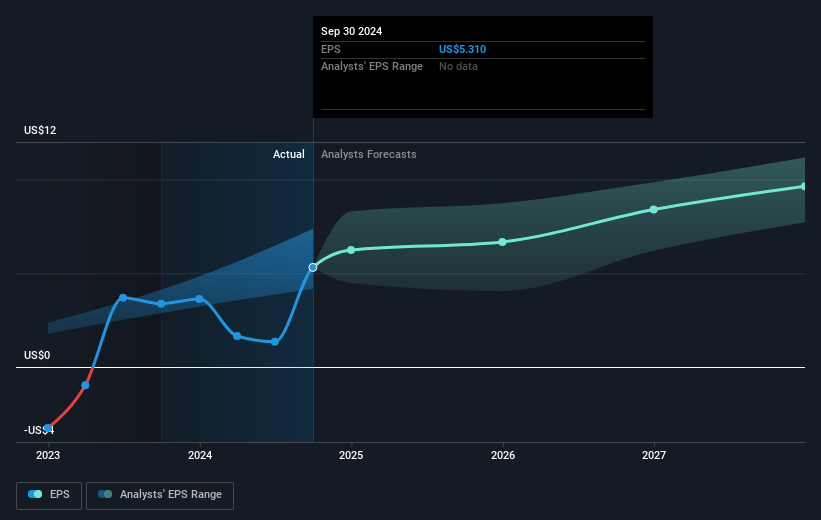

The recent announcements are likely to influence future revenue and earnings forecasts. Vistra's strategic focus on expanding renewable energy capacity may enhance revenue opportunities, driven by increasing demand from sectors like AI and data centers. Analysts forecast revenue to grow annually by 9.1%, driven by these investments and market trends. However, the 37% share price increase over the past month needs to be viewed in context with the price target of US$163.61, which suggests limited potential upside from the current price of US$144.8. This implies a moderate room for growth as forecasted improvements align with long-term strategic goals. Investors should consider these projections and ongoing market conditions in their evaluation of Vistra's potential.

Get an in-depth perspective on Vistra's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives