- United States

- /

- Renewable Energy

- /

- NYSE:VST

How Investors May Respond To Vistra (VST) Securing 20-Year Nuclear Deal and Expanding Gas Capacity

Reviewed by Sasha Jovanovic

- In late September 2025, Vistra Corp. announced a 20-year power purchase agreement to deliver 1,200 megawatts of carbon-free electricity from its Comanche Peak Nuclear Power Plant, alongside a decision to construct two advanced natural gas units at the Permian Basin Power Plant, boosting total site capacity to 1,185 megawatts.

- This combination of long-term nuclear contract certainty and major gas capacity expansion reflects Vistra's dual approach to serving growing power needs with both clean and reliable generation.

- We’ll examine how Vistra’s new 20-year nuclear supply agreement supports its investment narrative focused on stable, diversified growth.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Vistra Investment Narrative Recap

To own Vistra shares right now, an investor needs confidence in the company's ability to deliver sustained growth through a mix of long-term, carbon-free contracts and large-scale generation projects. The recent 20-year power purchase agreement and the expansion in Texas provide near-term visibility for cash flow, which may help support the main short-term catalyst, robust earnings from stable contracts, even as elevated debt amid ongoing project financing remains the largest risk; at present, the impact of these announcements on this risk appears limited.

Vistra's announcement of a private offering of senior secured notes is especially relevant here, as proceeds are intended for refinancing, general corporate purposes, and, potentially, acquisition funding. This move underscores how funding large projects and deals is central to Vistra's strategy but also keeps leverage a key point of attention for shareholders tracking both value creation and risk management.

Yet, despite the strong contract wins, investors should not lose sight of...

Read the full narrative on Vistra (it's free!)

Vistra's outlook anticipates $24.5 billion in revenue and $3.4 billion in earnings by 2028. This scenario is based on revenue growing at 9.8% per year and a $1.2 billion increase in earnings from the current $2.2 billion.

Uncover how Vistra's forecasts yield a $223.92 fair value, a 11% upside to its current price.

Exploring Other Perspectives

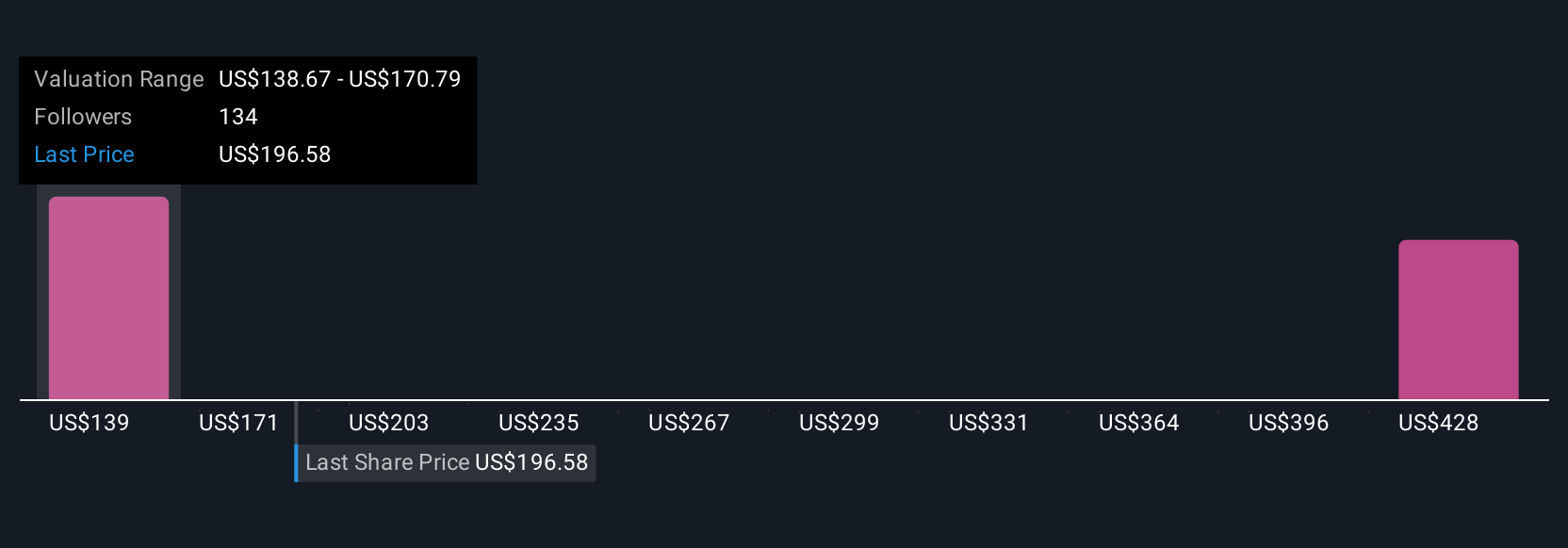

Fifteen community fair value estimates for Vistra range from US$142 to US$407, reflecting sharply different expectations among Simply Wall St Community members. With the company’s debt levels staying elevated to support growth, your view on financial flexibility and earnings visibility could be critical.

Explore 15 other fair value estimates on Vistra - why the stock might be worth 30% less than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives