- United States

- /

- Other Utilities

- /

- NYSE:UTL

New Forecasts: Here's What One Analyst Thinks The Future Holds For Unitil Corporation (NYSE:UTL)

Celebrations may be in order for Unitil Corporation (NYSE:UTL) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

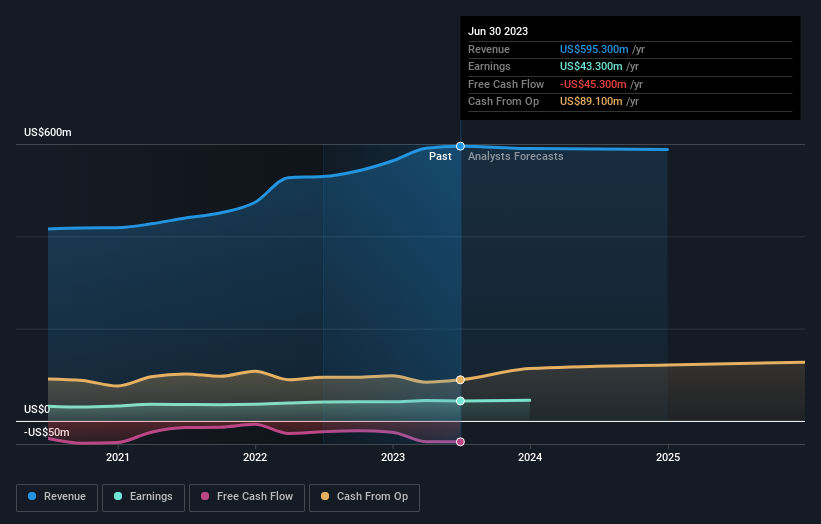

Following the latest upgrade, Unitil's sole analyst currently expects revenues in 2023 to be US$590m, approximately in line with the last 12 months. Per-share earnings are expected to rise 2.2% to US$2.75. Prior to this update, the analyst had been forecasting revenues of US$528m and earnings per share (EPS) of US$2.77 in 2023. It seems analyst sentiment has certainly become more bullish on revenues, even though they haven't changed their view on earnings per share.

Check out our latest analysis for Unitil

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Unitil's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 1.8% by the end of 2023. This indicates a significant reduction from annual growth of 6.4% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 1.4% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Unitil is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analyst reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. Given that the analyst appears to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Unitil.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Unitil going out as far as 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UTL

Unitil

A public utility holding company, engages in the distribution of electricity and natural gas.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion