- United States

- /

- Gas Utilities

- /

- NYSE:UGI

Upbeat Earnings Revisions and Utility Upgrades Might Change the Case for Investing in UGI (UGI)

Reviewed by Sasha Jovanovic

- In recent days, UGI Corporation received several upward earnings estimate revisions and positive analyst outlooks, reflecting increasing confidence in its fiscal 2025 performance. The company’s ongoing natural gas infrastructure upgrades and continued focus on regulated utility investments have also attracted market attention due to their potential to enhance operational stability.

- The convergence of analyst upgrades and infrastructure modernization efforts suggests growing optimism about UGI’s future earnings potential and stable value proposition in regulated markets.

- To assess how these upward earnings revisions influence UGI’s longer-term outlook, we’ll explore their effect on the investment narrative and analyst expectations.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

UGI Investment Narrative Recap

For shareholders, the long-term case for UGI rests on its ability to deliver predictable growth from regulated utility investments while navigating structural declines in fossil fuel demand and ongoing margin pressures, especially in its international LPG and AmeriGas businesses. Recent upward earnings estimate revisions have boosted short-term sentiment, but these changes are not likely to materially shift the biggest near-term catalyst, anticipated regulatory rate approvals in Pennsylvania, or the most important risk, which remains persistent demand erosion in legacy energy segments.

Among UGI’s recent announcements, its continued investment in natural gas main replacement projects across Pennsylvania stands out. These infrastructure upgrades support the company’s focus on safety and reliability, which is pivotal as UGI seeks rate case approvals that could fuel future revenue and offset margin challenges brought by declining LPG volumes and customer attrition.

However, despite growing analyst optimism, investors should not overlook the structural demand risk facing UGI’s European LPG business as...

Read the full narrative on UGI (it's free!)

UGI's projections show $9.0 billion in revenue and $794.3 million in earnings by 2028. This is based on analysts' expectations for 7.0% annual revenue growth and a $376.3 million increase in earnings from the current level of $418.0 million.

Uncover how UGI's forecasts yield a $41.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

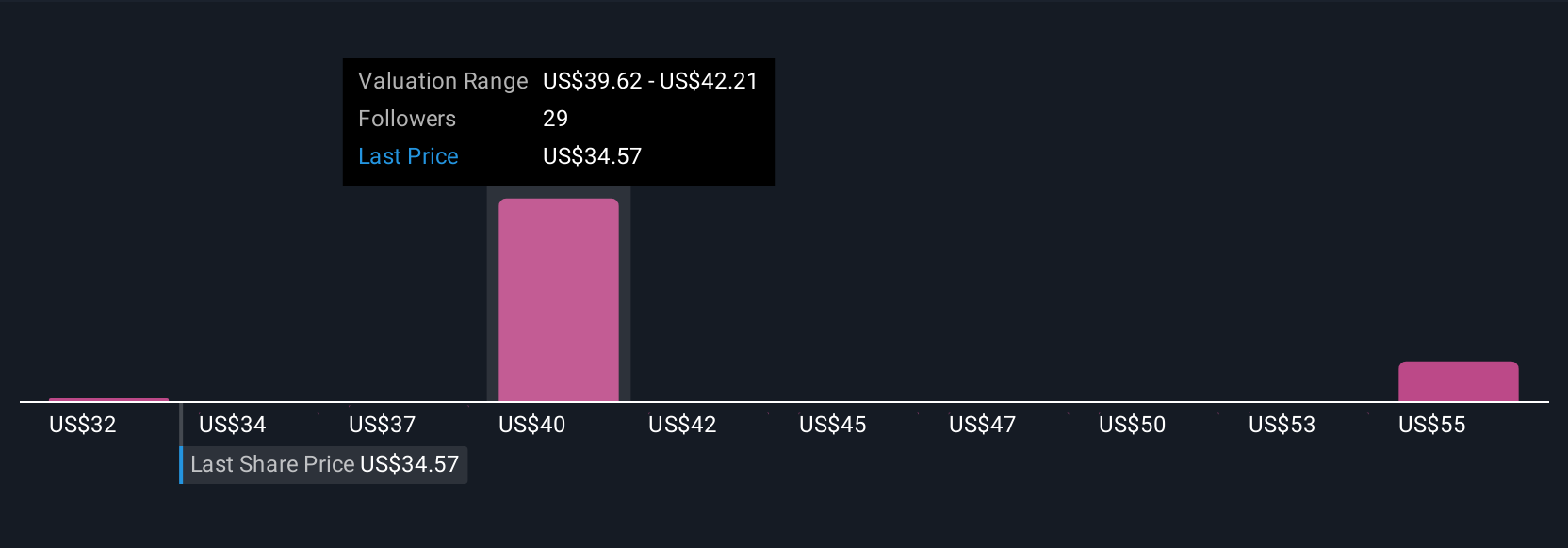

Five Simply Wall St Community members estimate UGI’s fair value between US$31.87 and US$56.76, capturing both lower and higher outlooks. While these views differ widely, ongoing LPG demand erosion in Europe remains a key area for close monitoring and could influence the overall direction of future valuations.

Explore 5 other fair value estimates on UGI - why the stock might be worth just $31.87!

Build Your Own UGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UGI research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UGI's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UGI

UGI

Engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives