- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Should Icahn’s Board Influence and S&P Upgrade Prompt a Fresh Look at Southwest Gas (SWX)?

Reviewed by Sasha Jovanovic

- Southwest Gas Holdings recently announced an amended cooperation agreement with Carl Icahn and the Icahn Group, which will see four Icahn Designees nominated to the board at the 2026 annual meeting, and also secured an upgrade to 'BBB+' from S&P Global Ratings following its complete exit from the Centuri business.

- This dual development highlights ongoing governance changes driven by shareholder involvement and a stronger credit standing as the company refocuses on its regulated utility operations.

- To understand the potential impact of this enhanced shareholder oversight and credit upgrade, we will examine how these factors might influence Southwest Gas Holdings' investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Southwest Gas Holdings Investment Narrative Recap

To be a shareholder in Southwest Gas Holdings, you would need to believe in the resilience and long-term relevance of its regulated natural gas utility business, particularly as it pivots away from non-core operations. The recent board agreement with Carl Icahn and the S&P credit upgrade together may provide greater board oversight and financial stability, but do not materially shift the key near-term catalysts around regulatory cost recovery or the main risk tied to shifting energy policy and decarbonization trends.

One of the most relevant announcements is the company reaffirming its 2025 earnings guidance of US$265 million to US$275 million after its Centuri exit. This suggests that despite transformative governance and capital structure changes, management is continuing to emphasize earnings stability, a crucial point for those tracking the impact of regulatory changes and the evolving policy environment on cash flows.

However, investors should be aware that accelerating electrification mandates and stricter environmental regulations could still...

Read the full narrative on Southwest Gas Holdings (it's free!)

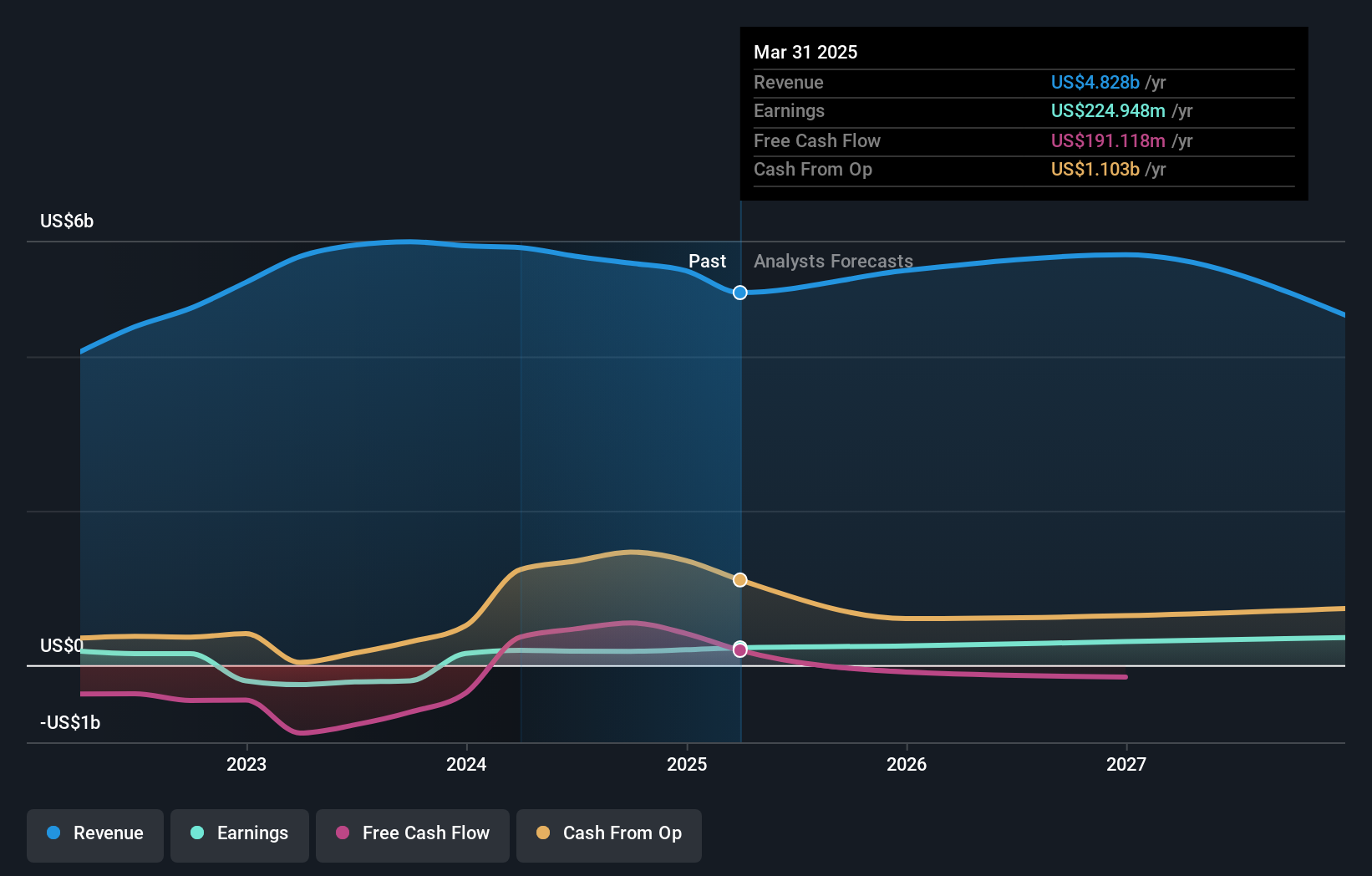

Southwest Gas Holdings is forecast to generate $4.5 billion in revenue and $409.8 million in earnings by 2028. This outlook is based on a projected 1.8% annual decline in revenue, and an increase in earnings of $216.1 million from the current $193.7 million.

Uncover how Southwest Gas Holdings' forecasts yield a $82.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Southwest Gas Holdings range widely from US$33.14 to US$82.50 across three independent perspectives. With decarbonization policies identified as a major risk, these diverging views reflect considerable uncertainty about the future shape of the company’s regulated utility earnings and asset base.

Explore 3 other fair value estimates on Southwest Gas Holdings - why the stock might be worth less than half the current price!

Build Your Own Southwest Gas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Southwest Gas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Gas Holdings' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives