- United States

- /

- Gas Utilities

- /

- NYSE:SR

Spire (SR) Valuation Check After 28% One-Year Gain and Premium Utility Pricing

Reviewed by Simply Wall St

Spire (SR) has quietly put together a solid run this year, with the stock up about 22% year to date and nearly 28% over the past year, easily outpacing many utilities peers.

See our latest analysis for Spire.

The latest move to around $83 per share builds on steady buying over recent months, with a 90 day share price return of about 9 percent and a one year total shareholder return above 28 percent. This suggests positive momentum rather than a speculative spike.

If Spire’s run has you thinking about where else consistent compounding might show up, it could be worth scanning fast growing stocks with high insider ownership for the next set of under the radar growers.

With the shares already near analysts’ targets and trading at a premium to some peers by intrinsic metrics, the key question now is whether Spire still offers upside or if the market has fully priced in its growth.

Most Popular Narrative Narrative: 10.9% Undervalued

With Spire last closing at $83.31 versus a narrative fair value around $93.50, the current setup leans toward underappreciated earnings power and dividend potential.

Significant and ongoing investments in infrastructure modernization and system resilience supported by constructive regulatory frameworks and reliable cost recovery mechanisms are growing Spire's regulated asset base, which is expected to result in higher allowed returns and gradual increases in net income.

Recent large rate case settlements and refinement of weather normalization and cost recovery mechanisms in Missouri are set to increase annualized revenues by $210 million and reduce earnings volatility, directly supporting margin expansion and providing a more stable foundation for future earnings.

Want to see why a steady utility is being priced for a richer future earnings stream, plus a higher profit multiple than today, and how that math stacks up?

Result: Fair Value of $93.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained decarbonization policy shifts or tougher regulatory decisions on cost recovery could slow gas demand, squeeze margins, and cap valuation multiple expansion.

Find out about the key risks to this Spire narrative.

Another Angle on Valuation

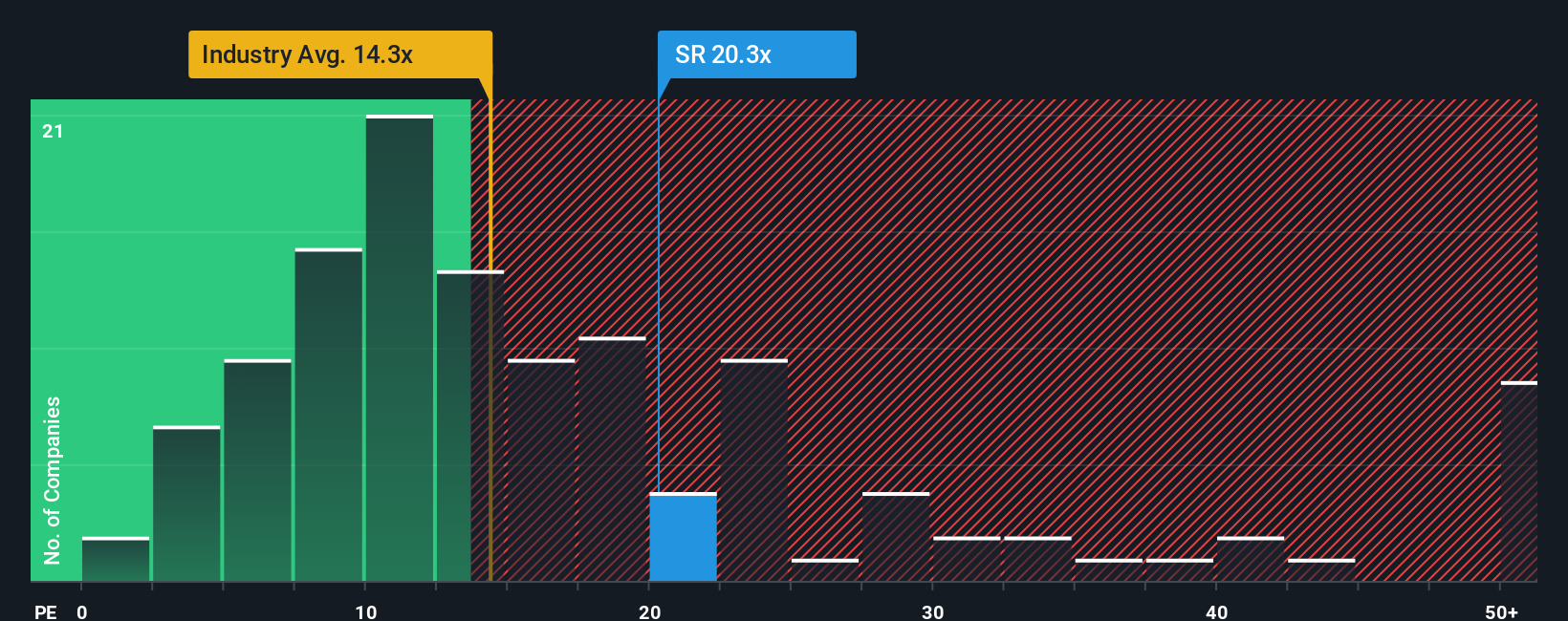

On earnings, Spire looks less of a bargain. It trades at about 19.2 times earnings, richer than both US gas utility peers at 17.6 times and the global group at 13.8 times, even though our fair ratio sits near 19.6 times. Is the premium really worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spire Narrative

If you see the numbers differently or prefer to dig into the details yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Spire research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your momentum going and use the Simply Wall St Screener to pinpoint fresh opportunities before others notice them, so your capital keeps working as hard as you do.

- Capture resilient income by targeting companies offering reliable yields with these 13 dividend stocks with yields > 3% that can support your portfolio through different market cycles.

- Position yourself at the heart of technological transformation by focusing on these 26 AI penny stocks that are reshaping industries with real world AI adoption.

- Capitalize on mispriced opportunities by scanning these 908 undervalued stocks based on cash flows that show strong cash flow potential yet still trade at appealing valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)