- United States

- /

- Gas Utilities

- /

- NYSE:SR

A Fresh Leader at Spire (SR): Assessing the Company's Valuation Following an Executive Appointment

Reviewed by Kshitija Bhandaru

Spire (NYSE:SR) is in the spotlight this week, following the announcement that Steve Greenley will step in as executive vice president and chief operating officer this October. Greenley brings more than 25 years of experience from leadership roles at Enbridge and CenterPoint Energy, positioning him as a seasoned addition at a pivotal time. For investors, changes on the executive team often signal a shift in priorities or the next phase of growth, especially when a new leader brings a fresh perspective from a major peer in the energy sector.

The stock has shown steady momentum over the past year, climbing 20% and outperforming many utility peers. This momentum has been driven in part by annual revenue and net income growth of 8% and 9%, respectively, reflecting Spire’s ability to execute. While Greenley’s appointment is the latest headline, Spire’s broader trend has been one of gradual but consistent growth rather than big swings. This makes the current moment feel like more than an ordinary leadership shuffle.

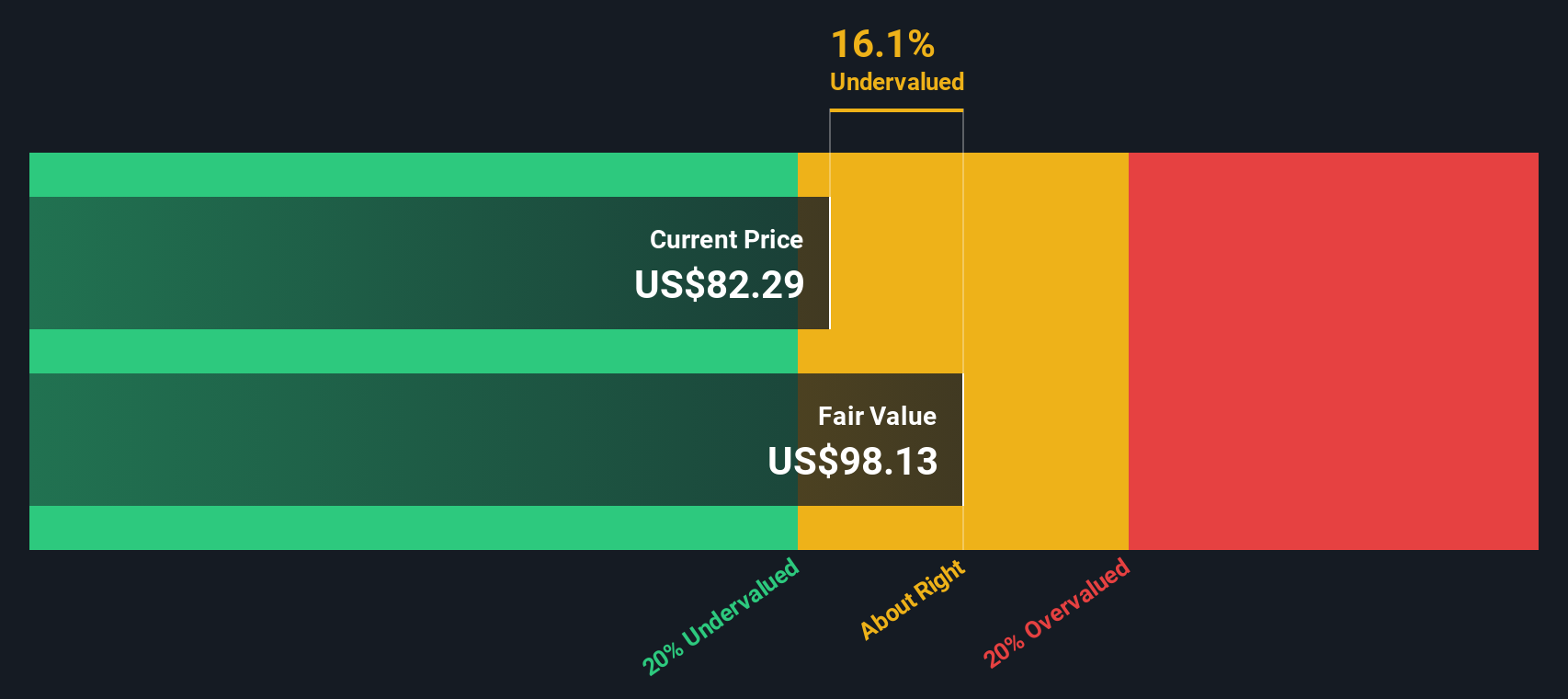

With the market digesting this new direction and the stock trading near its recent highs, is Spire a bargain at today’s price, or has the market already factored in the promise of future gains?

Most Popular Narrative: 5.0% Undervalued

According to the most widely followed narrative, Spire is currently priced about 5% below its estimated fair value, signaling modest undervaluation in the market.

Significant and ongoing investments in infrastructure modernization and system resilience, supported by constructive regulatory frameworks and reliable cost recovery mechanisms, are growing Spire's regulated asset base. This should result in higher allowed returns and gradual increases in net income.

Curious about how analysts see Spire's steady expansion and diversification? There is one financial assumption in this narrative forecast that could change everything, and it does not come from pricing alone. Want to know the critical factor that puts Spire on track for a much higher valuation? This also requires the market to believe in future financial multiples more aggressive than most gas utilities get. The full breakdown reveals the bold projections and why the smallest change in the numbers could be a game-changer for this stock.

Result: Fair Value of $80.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, accelerating decarbonization and shifting regulatory priorities could limit future growth. This may put pressure on Spire’s earnings and its industry-leading valuation.

Find out about the key risks to this Spire narrative.Another View: Discounted Cash Flow Tells a Similar Story

Rather than focusing just on how the market values utility stocks, our DCF model analyzes Spire's future cash flows and also points to it being undervalued. However, can cash flow estimates truly capture external challenges?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Spire Narrative

If you see things differently or want to chart your own view, you can build your perspective from the latest data in just a few minutes. Do it your way

A great starting point for your Spire research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Unique stocks are waiting beyond Spire, ready to set you apart from the crowd. See what else could be fueling tomorrow’s gains.

- Seize potential windfalls with penny stocks with strong financials featuring overlooked companies delivering strong financial results and upside that larger stocks can’t match.

- Ride the next wave in health innovation by checking out healthcare AI stocks, where breakthroughs in artificial intelligence are transforming care and driving new growth stories.

- Boost your returns and income by selecting companies with generous payouts using the dividend stocks with yields > 3% for top dividend earners boasting yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives