- United States

- /

- Electric Utilities

- /

- NYSE:SO

Southern (SO): Evaluating Valuation After Analyst Spotlight and New Nuclear Milestones at Plant Vogtle

Reviewed by Kshitija Bhandaru

Southern (SO) has been making headlines after being highlighted as a top pick in the U.S. nuclear energy sector, largely due to its major role at Plant Vogtle and other operational milestones. Recent analyst coverage has brought extra attention to the company, sparking further interest from investors seeking clarity on its growth path and broader market positioning.

See our latest analysis for Southern.

Southern’s recent buzz around new milestones at Plant Vogtle arrives as the stock steadily builds momentum, notching a 19.5% year-to-date share price return and a robust 12.8% total shareholder return over the past year. Over the longer haul, total shareholder returns of more than 100% in five years highlight growing confidence in the company’s outlook and capacity to deliver for investors.

If news in the utilities space has you thinking about what’s next, now is the perfect time to broaden your search and explore fast growing stocks with high insider ownership

With shares now trading just below analyst targets after a strong run and steady gains, is Southern an undervalued opportunity for investors, or has the market already priced in the company’s next phase of growth?

Most Popular Narrative: Fairly Valued

With Southern's fair value pegged at $97.15, just a hair above the last close of $98.08, the most popular narrative sets up a case for a tightly balanced valuation. The numbers suggest a market consensus that incorporates both optimism and caution, leaving little margin for an easy verdict on value.

The expansion of large-scale electrification projects, including hyperscaler data centers and industrial developments, across Alabama, Georgia, and Mississippi is materially increasing Southern's load outlook. This has resulted in regulatory approvals and filings for up to 10 GW of new generation and $13 billion of incremental capital investment, which is driving long-term earnings and rate base growth.

Curious how these massive infrastructure bets translate into future profits? The pricing reflects bold projections about Southern's growth levers and a margin story with unusual stability. Want the inside numbers powering this valuation? The full narrative explains the exact scenario analysts are considering. Read on for the figures behind the story.

Result: Fair Value of $97.15 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming concerns such as higher capital needs and potential shareholder dilution could quickly challenge the optimistic outlook if demand weakens or costs escalate.

Find out about the key risks to this Southern narrative.

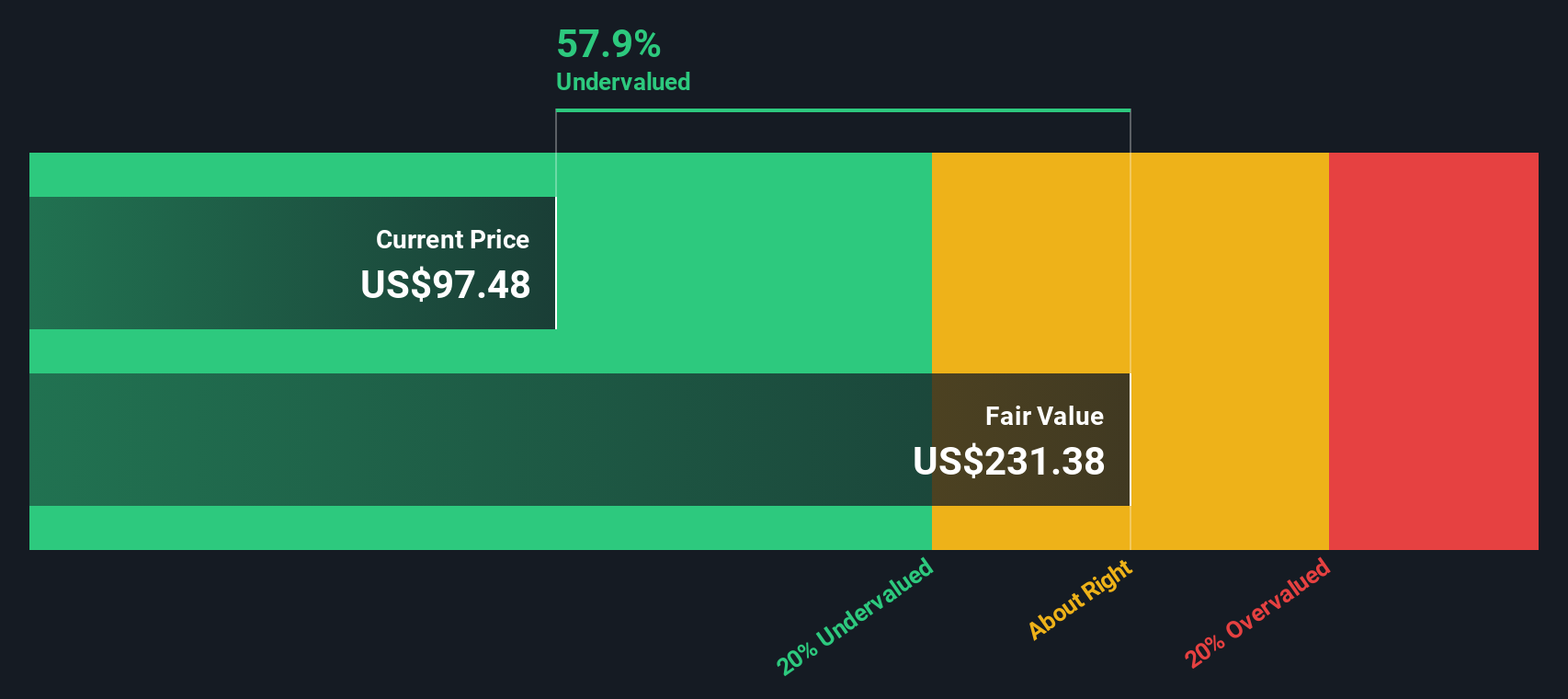

Another Angle: DCF Fair Value Suggests Deeper Discount

A different take comes from the SWS DCF model, which points to a fair value of $225.94 for Southern, far above the current share price. This method implies the stock could be significantly undervalued and raises questions about whether the market is missing long-term growth potential or if DCF assumptions are too optimistic. Which lens will prove more accurate over time?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Southern Narrative

If you see things differently or want to dive into the numbers yourself, you can shape your own storyline in just a few minutes. Do it your way

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give your portfolio a new advantage by tapping into off-the-radar trends and income opportunities other investors might miss. Don’t let the next big story pass you by. Start your search here:

- Accelerate your wealth-building journey by targeting high yields with these 18 dividend stocks with yields > 3% offering payouts above 3% and robust fundamentals to match.

- Seize breakthroughs in artificial intelligence by analyzing these 25 AI penny stocks driving innovation and reshaping entire industries at the cutting edge.

- Stay ahead of the value curve with these 891 undervalued stocks based on cash flows, spotlighting hidden gems the market has yet to fully appreciate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives