- United States

- /

- Electric Utilities

- /

- NYSE:SO

Is Southern’s Rally Justified After 8% Gain and Recent Analyst Upgrades in 2025?

Reviewed by Bailey Pemberton

If you’re wondering whether Southern’s latest rally means it’s finally time to make a move, you’re not alone. With the stock closing at $99.72 and notching an 8.1% gain over the past month, there’s a clear sense of momentum that’s hard to ignore. Even viewed over the longer term, Southern has more than doubled over five years, up an impressive 105.1%. This steady march higher, highlighted by a 3.7% return just in the last week and 21.5% year-to-date, has naturally piqued investor interest and, perhaps, raised questions about how much upside could truly remain.

Some of this recent optimism tracks with broader market shifts that have improved sentiment toward companies in Southern’s sector. Investors appear to be rethinking risk, and a wave of fresh capital is rewarding those with solid fundamentals. But even with price gains like these, is Southern still undervalued at this level? On our valuation checklist, Southern scores a 3 out of 6, meaning it is undervalued in half of the key areas analysts watch closely.

Of course, a single score cannot tell the whole story. This is why it’s worth breaking down exactly how Southern measures up across different valuation approaches before we introduce one of the most insightful ways to judge a company’s true worth. Let’s take a closer look at what those numbers are really saying.

Why Southern is lagging behind its peers

Approach 1: Southern Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to present value. This method helps determine what Southern may be really worth today, based on what it is expected to earn over time.

Currently, Southern’s last twelve months of Free Cash Flow stand at negative $583 Million. However, analysts expect significant growth; by 2027, Free Cash Flow is projected to reach $2.1 Billion, and by 2035, extrapolated estimates put it at over $14.2 Billion. These figures reflect robust annual increases, mainly in the later years of the forecast period. The model used here is a 2 Stage Free Cash Flow to Equity approach, which factors in both analyst estimates for the next few years and extended projections beyond that using internal assumptions.

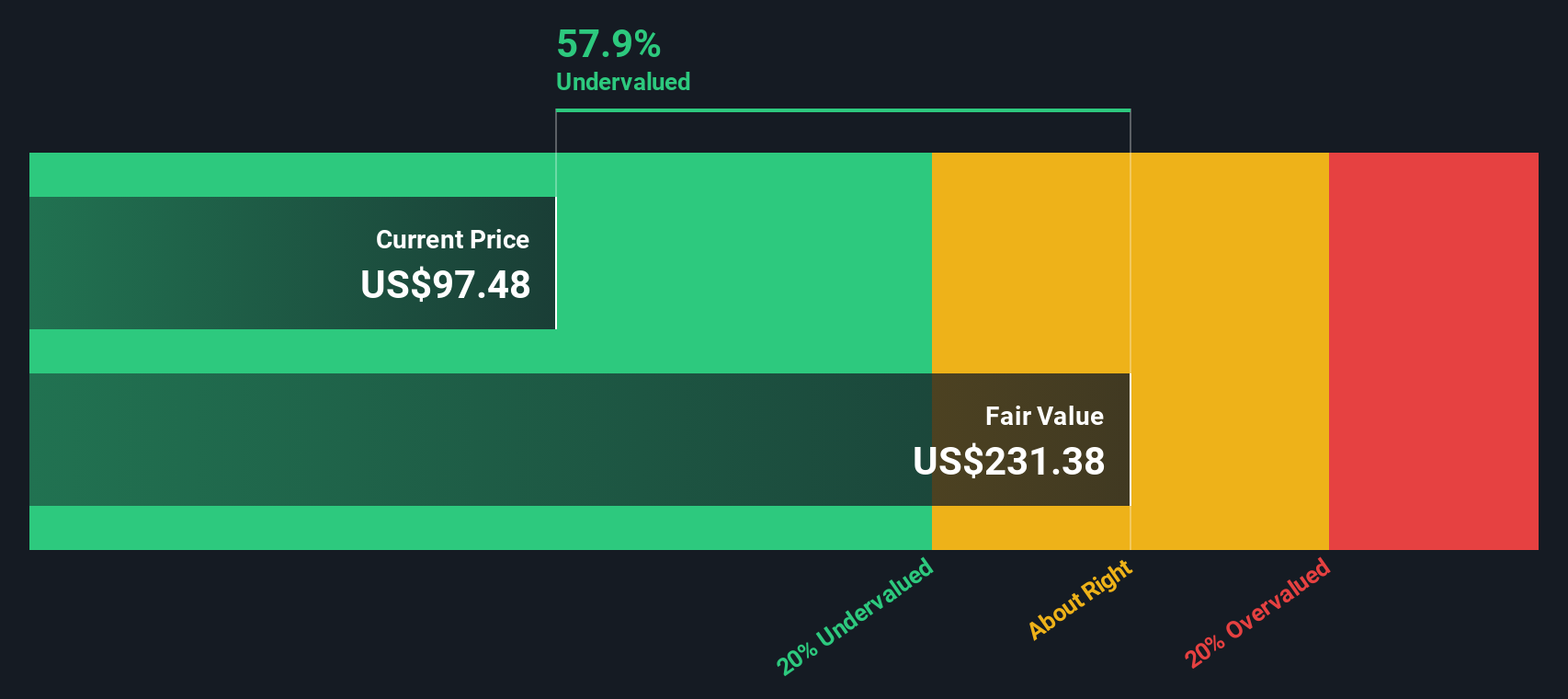

The result of this thorough DCF analysis suggests that Southern’s intrinsic value is $231.38 per share, much higher than the recent closing price of $99.72. This implies the stock is trading at a 56.9% discount, signaling meaningful undervaluation based on long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Southern is undervalued by 56.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Southern Price vs Earnings (P/E)

For profitable companies like Southern, the Price to Earnings (P/E) ratio is a popular way to assess whether a stock looks cheap or expensive relative to how much it earns. It is a straightforward method, particularly suitable when a business has reliable profits, as it allows investors to quickly compare market price against annual net income.

What is considered a “normal” or “fair” P/E ratio depends on factors such as growth expectations and the risks facing the business. Companies expected to grow faster, or that are perceived as safer, often command higher P/E multiples, while those with slower growth or higher risk might deserve lower ratios.

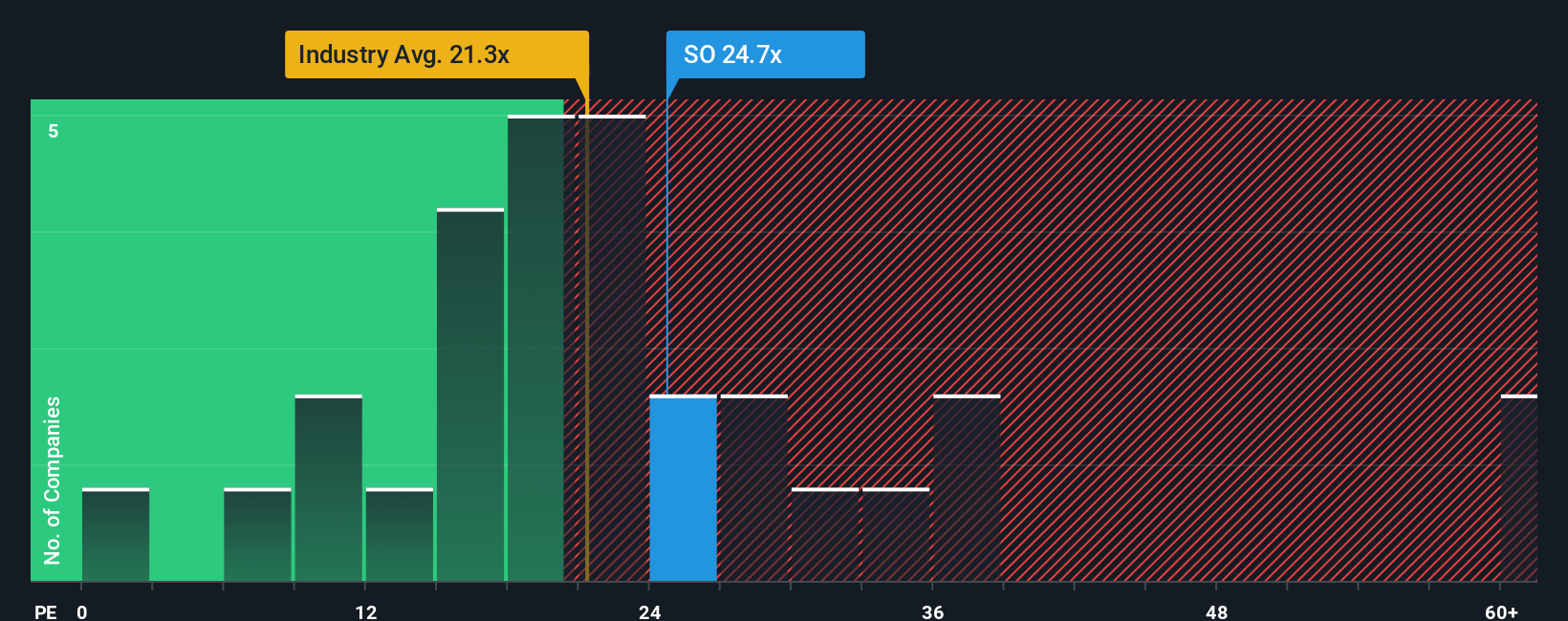

Southern currently trades on a P/E of 25.6x. This is a little above the average for Electric Utilities, which sits at 21.3x, but below the peer average of 27.6x. However, comparing with simple averages rarely tells the whole story, since every business has its own growth, profit profile, and risk factors.

This is where the “Fair Ratio” comes in. Simply Wall St’s proprietary Fair Ratio for Southern is 23.0x, which takes into account the company’s earnings growth, profit margin, industry characteristics, market capitalization, and risk. Unlike industry averages or peer groups, this contextualized metric offers a more customized view of what would be a reasonable valuation for Southern specifically.

In this case, Southern’s current P/E of 25.6x is not far off from its Fair Ratio of 23.0x. The difference is just 2.6x, indicating that the current price is a bit higher than ideal, but not meaningfully so.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Southern Narrative

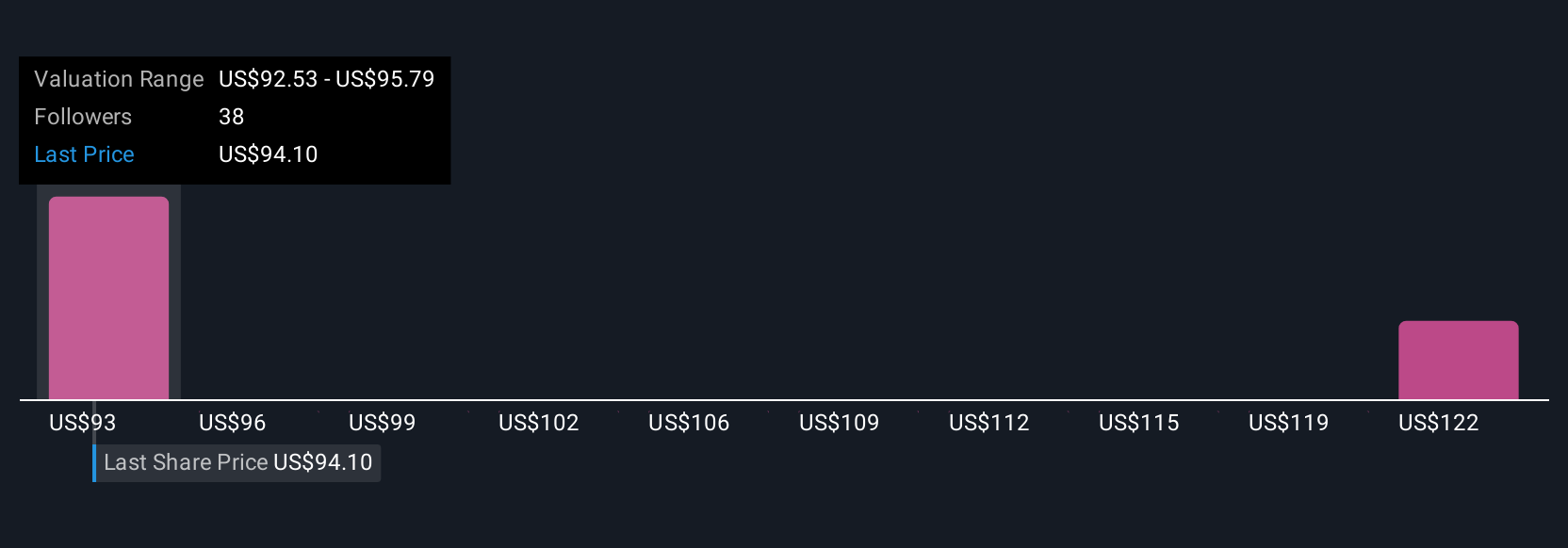

Earlier, we mentioned there is an even better way to understand a company’s value, so let’s introduce you to Narratives. A Narrative is more than just numbers; it is your story of how a company will grow, based on assumptions and forecasts you believe are most likely. Narratives connect your view of Southern’s business, such as how you think electrification or renewables will shape its future, to hard financial forecasts and then to a fair value estimate you can benchmark against the current price.

Available on Simply Wall St's Community page and used by millions of investors, Narratives are an easy, accessible tool that empowers you to visually map your perspective and update it dynamically as new information arrives, whether it is major news or a fresh set of earnings results. This helps you decide when to buy, sell, or hold by seeing how your fair value changes over time.

For example, right now, some investors believe Southern could be worth as much as $108 per share if robust renewables growth and regulatory support continue, while others see fair value closer to $75 due to higher capital needs and uncertain policy. Narratives let you quickly explore these different paths and make smarter decisions based on your own expectations.

Do you think there's more to the story for Southern? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives