- United States

- /

- Electric Utilities

- /

- NYSE:POR

High-Tech Demand and Clean Energy Investments Might Change The Case For Investing In Portland General Electric (POR)

Reviewed by Sasha Jovanovic

- Portland General Electric recently reported strong second quarter results, citing significant industrial electricity demand from high-tech and data center customers, alongside reaffirmed 2025 earnings guidance and progress on clean energy projects such as wind and battery storage.

- The company also announced plans for a new holding company structure, streamlined regulatory agreements to improve rate recovery, and a five-year US$6.5 billion capital expenditure plan targeting grid and renewable investments.

- Let's examine how Portland General Electric's robust growth in high-tech customer demand could influence its long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Portland General Electric Investment Narrative Recap

To be a shareholder in Portland General Electric, you need to believe in the sustained growth of Oregon's high-tech and data center sectors as primary drivers of long-term electricity demand and in the company's ability to balance accelerated clean energy investments against regulatory, execution, and pricing risks. The latest news reinforces the near-term catalyst, demand from these transformative customers, but does not materially shift the biggest risk: whether PGE can recover rising infrastructure costs through regulatory rate processes without significant margin compression.

Among the company's announcements, the streamlined regulatory agreements aimed at improving rate recovery are particularly relevant. These agreements could support short-term earnings stability and help address a core risk, especially as PGE commits to a US$6.5 billion capital expenditure plan concentrated on renewables and grid modernization, areas central to both growth opportunities and potential execution pitfalls.

However, investors should be aware that while demand looks promising, uncertainty remains for those focused on...

Read the full narrative on Portland General Electric (it's free!)

Portland General Electric's narrative projects $4.0 billion revenue and $479.0 million earnings by 2028. This requires 4.7% yearly revenue growth and a $185.0 million earnings increase from the current $294.0 million.

Uncover how Portland General Electric's forecasts yield a $46.36 fair value, a 6% upside to its current price.

Exploring Other Perspectives

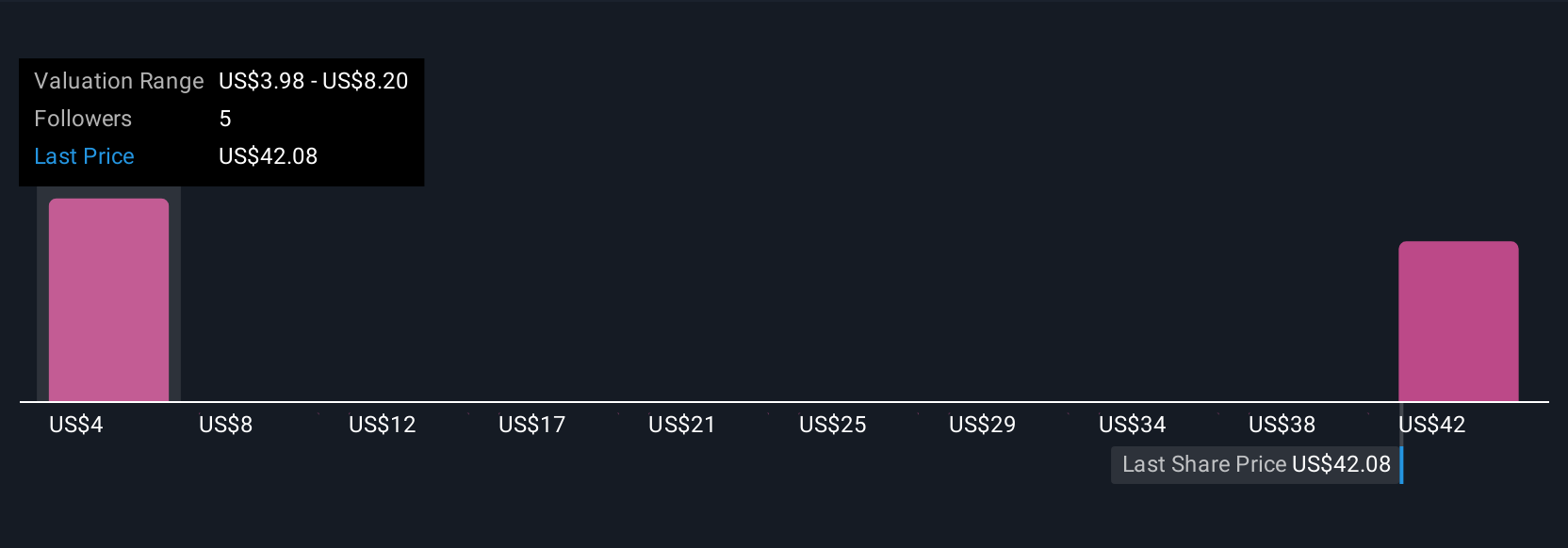

Community fair value estimates for Portland General Electric range from just US$3.98 to US$54.07, based on three independent Simply Wall St Community perspectives. This wide spectrum underscores that many see opportunity in industrial demand growth, but plenty remain cautious about the company’s cost recovery and profit margin outlook, encouraging you to explore these diverse viewpoints for a more comprehensive picture.

Explore 3 other fair value estimates on Portland General Electric - why the stock might be worth as much as 23% more than the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

No Opportunity In Portland General Electric?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives