- United States

- /

- Renewable Energy

- /

- NYSE:ORA

Assessing Ormat Technologies (ORA) Valuation After Strong One Year Return And Elevated P/E Ratio

Ormat Technologies (ORA) is back on investors’ radar after a strong 1 year total return of 89.93%, prompting a closer look at how its geothermal, recovered energy and storage operations are shaping the story.

See our latest analysis for Ormat Technologies.

Recent trading has cooled after a strong run, with a 1 day share price return of 4.37% and a 7 day share price return of 5.28% pulling back some of the 89.93% 1 year total shareholder return. The latest 30 day and 90 day share price returns of 4.09% and 6.86% respectively indicate momentum that has built over time rather than appearing overnight.

If this geothermal and clean power story has caught your attention, it could be a good moment to widen your search with our screener of 87 nuclear energy infrastructure stocks as another way to look at energy transition opportunities.

After an 89.93% 1 year total return, a recent 1 day decline of 4.37% and a 7 day decline of 5.28% raise a simple question: is Ormat still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 4% Undervalued

At a last close of $121.26 versus a fair value estimate of $126.30, the prevailing narrative sees modest upside grounded in specific project and policy assumptions.

Recent federal permitting reforms and policy support have significantly expedited geothermal project development timelines in the U.S., enabling Ormat to accelerate greenfield expansion and release more projects for construction, likely driving faster revenue growth and increased long-term cash flows. Extension of production and investment tax credits (PTC/ITC) for geothermal and energy storage projects through at least 2033 reduces capital costs, de-risks new project development, and boosts net margins and earnings over the next decade.

Curious what sits behind that fair value gap? The narrative focuses on sustained revenue growth, stable margins, and a premium future earnings multiple that usually belongs to faster growing sectors.

Result: Fair Value of $126.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can shift quickly if battery supply rules affect the storage segment or if high capital spending meets tougher funding conditions and squeezes returns.

Find out about the key risks to this Ormat Technologies narrative.

Another View: High P/E Signals A Very Different Story

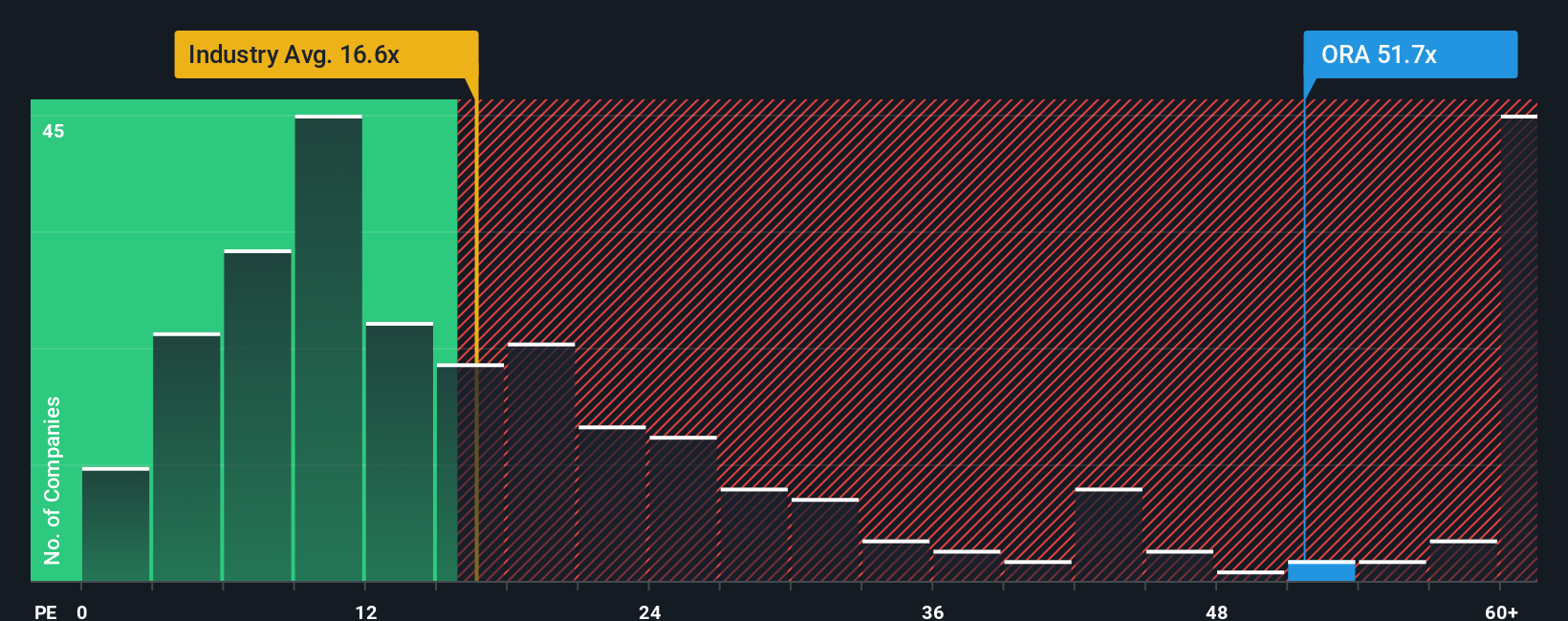

While the fair value narrative suggests Ormat is 4% undervalued at $126.30, the current P/E of 55.3x paints a very different picture. It sits well above the estimated fair ratio of 21.2x, the global renewable energy average of 16.6x, and the 17.2x peer average. This points to meaningful valuation risk if expectations cool.

In simple terms, you are paying several turns higher than both the fair ratio the market could move toward and what similar companies trade on. The key question is whether Ormat’s growth and policy support are enough to justify that premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ormat Technologies Narrative

If parts of this story do not quite fit your view, or you prefer to work through the numbers yourself, you can build a tailored thesis in minutes: Do it your way.

A great starting point for your Ormat Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ormat has sparked your interest, do not stop here, use the Simply Wall Street Screener to uncover more focused ideas that could sharpen your portfolio.

- Target value opportunities by scanning companies trading below their estimated worth through our 55 high quality undervalued stocks and see which names stand out to you.

- Strengthen your income stream by reviewing 15 dividend fortresses that aim to pair higher yields with resilient cash generation.

- Dial down risk by filtering for 81 resilient stocks with low risk scores that score well on stability, so you are not relying on one story alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORA

Ormat Technologies

Engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, France, Indonesia, the Philippines, and internationally.

Proven track record with very low risk.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion