- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (OKLO) Surges 171% Last Quarter With Russell Indices Addition

Reviewed by Simply Wall St

Oklo (OKLO) witnessed a remarkable price increase of 171% over the last quarter, aligning with significant corporate developments. The company's addition to numerous Russell indices, such as the Russell 3000 and Russell 2000, reflects its enhanced market perception and potential for growth. Meanwhile, strategic collaborations with Hexium and TerraPower to advance domestic production of enriched uranium, coupled with business expansions including Atomic Alchemy Inc.'s new facility, illustrate Oklo's commitment to growth in the nuclear technology sector. These activities contrast the broader market's flat performance in the last week and bolster Oklo’s standout growth amidst stable market conditions.

Oklo's total shareholder return over the past year reached a very large 615.71%, a stark contrast to the company's recent quarter rise of 171%. When compared to the broader US market's 11.4% return and the US Electric Utilities industry's 17.4% return over the past year, Oklo significantly outperformed both benchmarks. This exceptional performance highlights the positive market reception to Oklo's recent corporate actions.

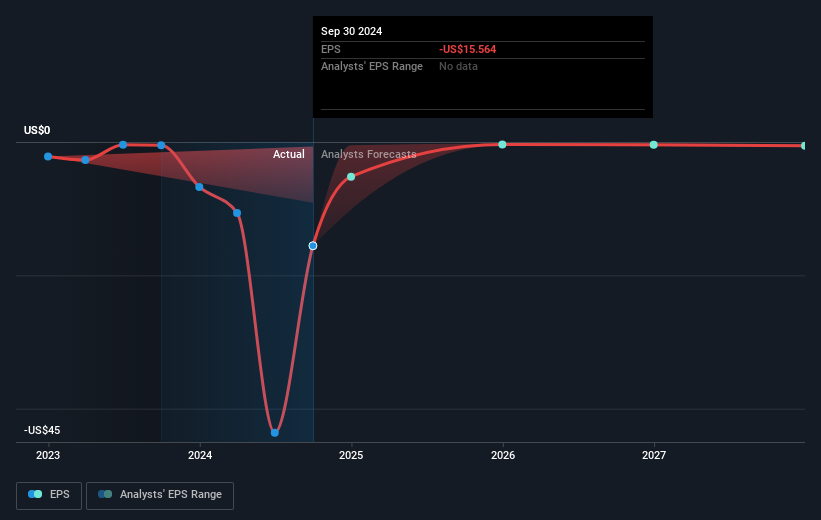

The company's initiatives, such as entering Russell indices and forming alliances with Hexium and TerraPower, have not yet translated into positive revenue or earnings, as evidenced by the forecast of continued unprofitability. Despite having a current share price of US$62.41, which is above the analyst consensus price target of US$59.74, investor expectations may be set on future potential rather than immediate profitability. The considerable price increase alongside a lack of revenue forecasts indicates that investor sentiment is driven by Oklo's growth activities rather than immediate financial results.

Learn about Oklo's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives