- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

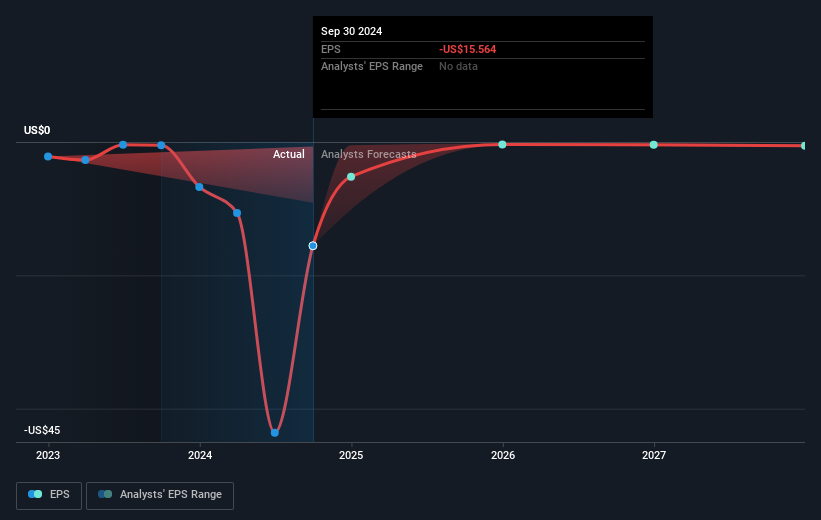

Oklo (NYSE:OKLO) Sees Stock Fall 5% Last Quarter After Reporting Higher FY 2024 Loss

Reviewed by Simply Wall St

Oklo (NYSE:OKLO) is navigating significant regulatory engagements and board reshuffles as it presses ahead with its Aurora Powerhouse project. The company faced a 5% decline in its stock price over the last quarter, coinciding with its announcement of a notably higher loss for the fiscal year 2024 compared to the previous year. This decline in stock price came amidst a broader market characterized by a 1.7% drop over the past week, influenced by tariff impacts and economic data releases. The market's volatile environment likely affected Oklo's stock performance alongside internal financial challenges.

We've identified 3 weaknesses for Oklo (1 is significant) that you should be aware of.

Over the three-year period, Oklo's total shareholder return achieved an impressive 129.41%, highlighting a compelling long-term performance despite recent challenges. During the past year, Oklo outpaced both the broader US market and the US Electric Utilities industry. Key factors contributing to this result include Oklo's strategic alliances and regulatory engagements. Noteworthy developments such as the Memorandum of Understanding with Lightbridge Corporation in January 2025 and the Memorandum of Agreement with the U.S. Department of Energy in March 2025 have positioned Oklo as a significant player in nuclear technology advancement. These partnerships signal strong industry collaborations and potential future growth in the sector.

The appointments of industry veterans Daniel Poneman and Michael Thompson to Oklo's Board in March 2025 reinforced its leadership capabilities, particularly in nuclear technology and financial oversight. These executive shifts, combined with proactive regulatory actions like the Pre-Application Readiness Assessment with the NRC, underline Oklo's commitment to navigating regulatory processes efficiently while enhancing its strategic partnerships and leadership structure.

Examine Oklo's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oklo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives