- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

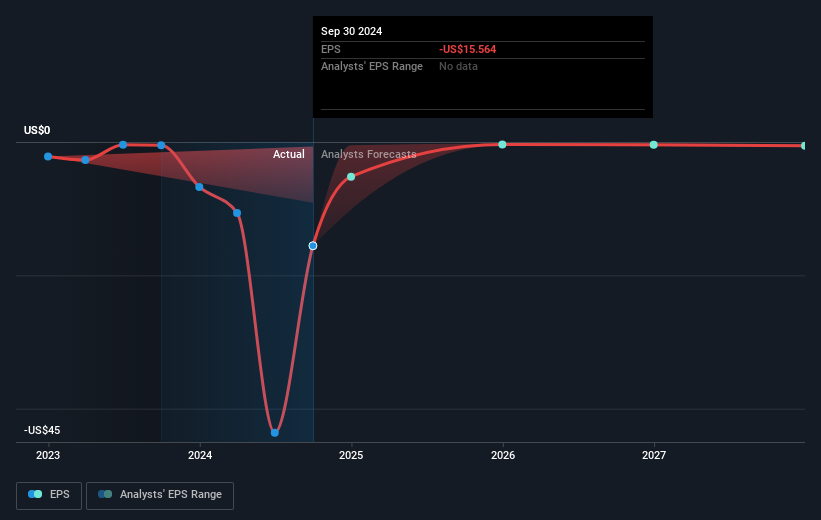

Oklo (NYSE:OKLO) Reports US$74 Million Loss but Benefits from 55% NRC Licensing Fee Cut

Reviewed by Simply Wall St

Recent developments for Oklo (NYSE:OKLO) have raised investor interest, likely impacting its 31% price increase over the last quarter. Despite posting a net loss of USD 74 million for 2024, Oklo's progress in regulatory engagements, like the Pre-Application Readiness Assessment with the Nuclear Regulatory Commission and strategic board appointments, potentially enhances its standing in the advanced nuclear sector. These actions coincide with broader market trends, as the S&P 500 and Nasdaq rebounded slightly amid easing tariff concerns, indicating improving investor confidence that could have also supported the company's upward price momentum.

Over the past three years, Oklo Inc.'s total shareholder return amounted to 215.73%, showcasing substantial growth despite its current unprofitability. This significant return reflects the company's strategic positioning within the advanced nuclear sector, distinctively surpassing the 1-year performance of the broader US Electric Utilities industry, which achieved a 20.5% return.

In 2024, Oklo's inclusion in the S&P Global BMI Index likely enhanced its market credibility, aiding its investor appeal. The December 2024 agreement with Switch for 12 gigawatts of Aurora Projects exemplifies a forward-thinking approach, focusing on future clean energy demands. The collaboration with the U.S. DOE and INL, culminating in an Environmental Compliance Permit by November 2024, signifies substantial environmental groundwork. Additionally, the January 2025 partnership with Lightbridge Corporation to study fuel recycling underscores Oklo's commitment to sustainable innovation. Together, these factors contribute to the company's resilient long-term performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives