- United States

- /

- Gas Utilities

- /

- NYSE:NWN

How a 70th Straight Dividend Hike at Northwest Natural (NWN) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In October 2025, Northwest Natural Holding Company’s Board of Directors increased the quarterly dividend to $0.4925 per share, with payment scheduled for November 14 to shareholders of record as of October 31.

- This latest dividend raise marks the company’s 70th consecutive annual increase, underscoring a lengthy record of reliable shareholder returns amid changing industry conditions.

- Building on the 70-year dividend growth streak, we’ll explore how this move impacts Northwest Natural Holding’s earnings and stability narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Northwest Natural Holding Investment Narrative Recap

To be a shareholder in Northwest Natural Holding, you need confidence in its ability to deliver stable, long-term growth driven by regulated utility earnings and customer expansion in Texas, while managing exposure to decarbonization policies and regulatory risk. The recent dividend increase reinforces the company’s image as a reliable income provider, but it isn't likely to significantly impact short-term catalysts such as ongoing Texas growth or address the most immediate risks around regulatory challenges and energy transition pressures.

Among recent company updates, the planned release of third quarter earnings on November 5 stands out, as it will give investors more insight into how dividend increases align with the latest financial performance. This earnings announcement will be closely watched by those weighing whether customer and meter growth in expanding markets is keeping pace with regulatory risks and higher operating costs.

However, it’s just as important for investors to be aware that, despite rising dividends, regulatory approval for cost recovery and capital spending continues to pose...

Read the full narrative on Northwest Natural Holding (it's free!)

Northwest Natural Holding's outlook anticipates $1.6 billion in revenue and $153.7 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.5% and an increase in earnings of $50.4 million from current earnings of $103.3 million.

Uncover how Northwest Natural Holding's forecasts yield a $52.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

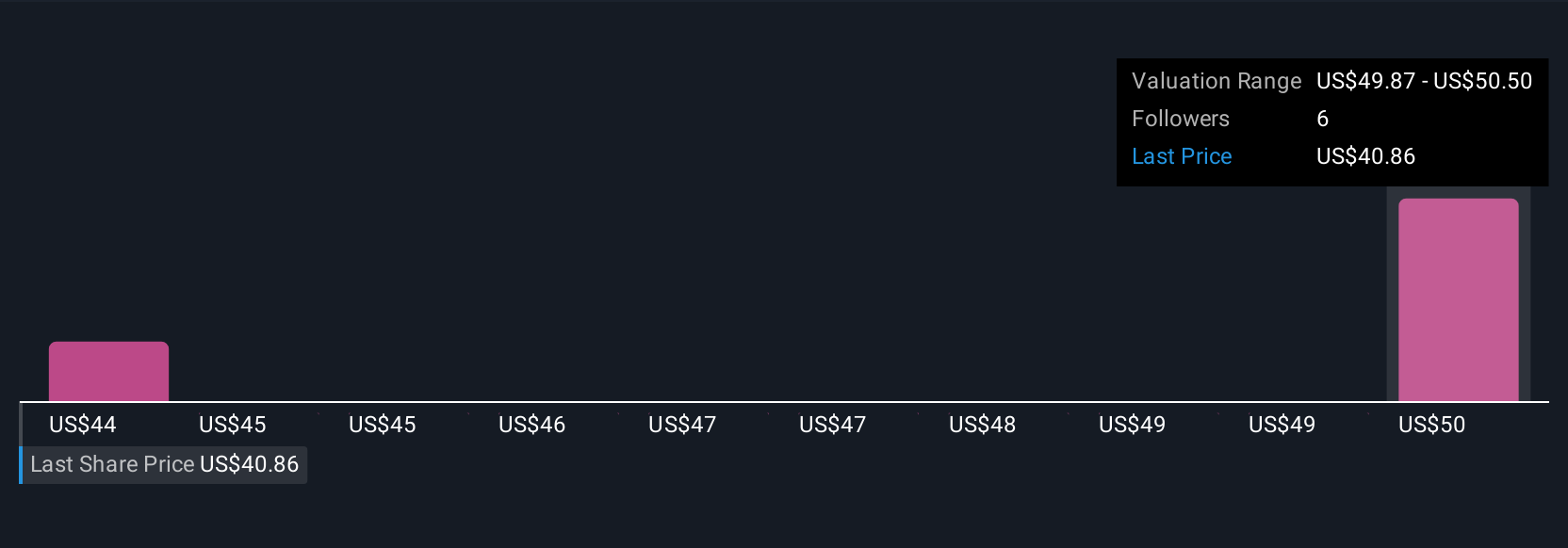

Fair value estimates from the Simply Wall St Community range from US$41.57 to US$52 across two contributors. While many see stable returns, continued execution on Texas customer growth remains a key driver that could influence future outcomes for Northwest Natural Holding.

Explore 2 other fair value estimates on Northwest Natural Holding - why the stock might be worth 7% less than the current price!

Build Your Own Northwest Natural Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Natural Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Natural Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Natural Holding's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives