- United States

- /

- Electric Utilities

- /

- NYSE:NRG

Is NRG Energy’s 100% Gain in 2024 Justified After Announcing AI Data Center Power Deals?

Reviewed by Bailey Pemberton

If you have been watching NRG Energy’s stock chart recently, you already know it is not the quiet, utility-like story many might expect. In the last year alone, shares have surged by over 100.7%, and the gains go even deeper with the stock up 497.0% over the last five years. Even this year, NRG has kept up the pace, delivering an impressive 83.2% return year to date. Short-term moves have been a bit steadier, with gains of 1.0% in the past week and 3.5% over the last month. These eye-catching returns have a lot of people wondering if the growth still has legs or if the market’s appetite is starting to shift, especially as the company pivots toward consumer-centric energy solutions and navigates emerging competitive risks.

What’s driving all this action? Some of it ties back to broader market excitement around power and electrification themes, which have put a spotlight on many U.S. energy names. NRG appears to be riding that wave, but recent price momentum could also reflect shifts in how investors are pricing risk for companies like NRG amid a changing energy landscape. But does all this buzz make NRG a bargain, or is it flashing signs of overheating? Using a valuation score that measures six key factors, NRG currently gets a 2, meaning it looks undervalued in just two of those checks. That’s a decent start, but not a slam dunk.

In the next section, we will break down how the main valuation approaches stack up for NRG Energy, where the numbers point to opportunity or caution, and hint at a more nuanced way to judge value that often escapes the headlines.

NRG Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NRG Energy Discounted Cash Flow (DCF) Analysis

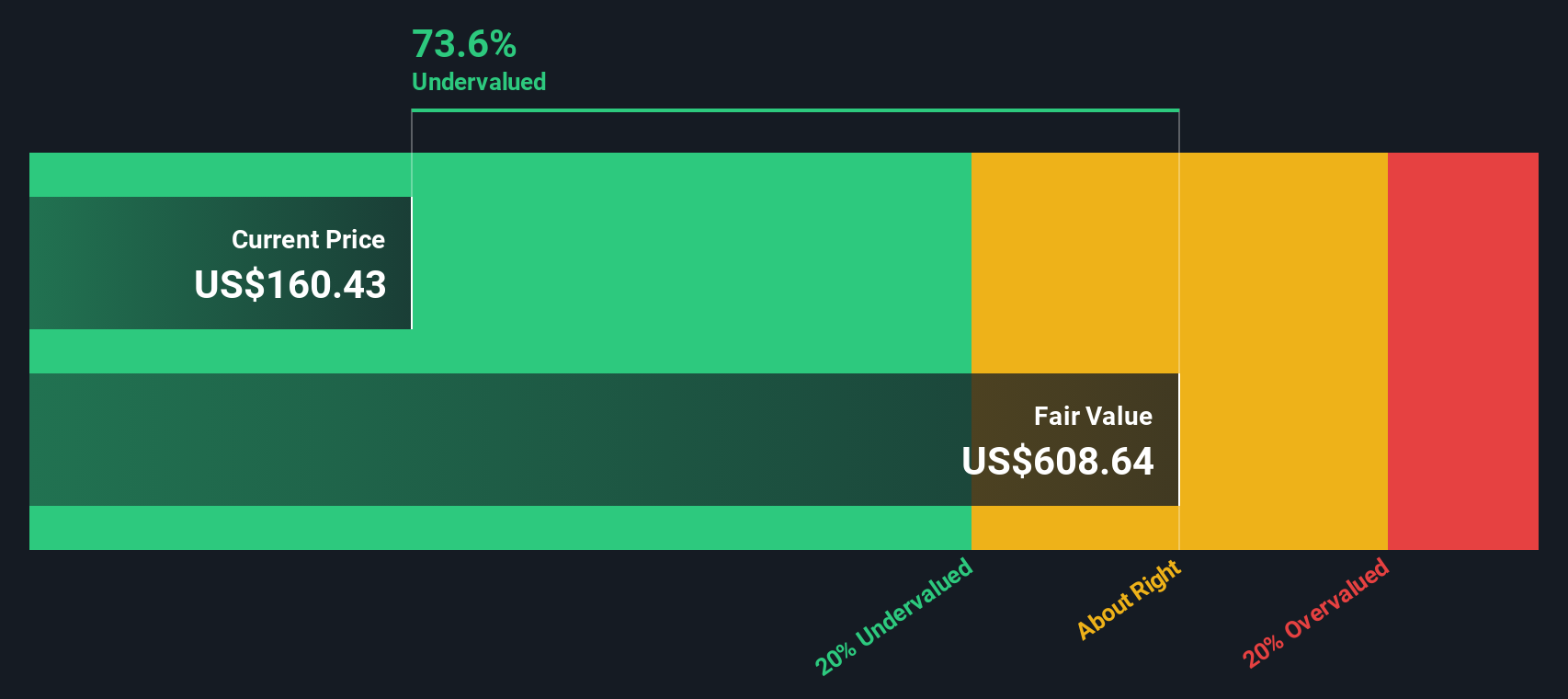

A Discounted Cash Flow (DCF) model estimates what a company’s shares should be worth by projecting its future cash flows and then discounting those projections back to today’s value. For NRG Energy, the DCF uses the 2 Stage Free Cash Flow to Equity approach. It starts with actual Free Cash Flow (FCF), and then incorporates analyst forecasts and longer-term projections.

NRG Energy currently generates Free Cash Flow of $1.65 billion, and analysts estimate that annual FCF will grow to over $4.24 billion by 2029. Beyond analyst estimates, Simply Wall St extrapolates FCF through 2035, with incremental growth each year. All projections and cash flows are denominated in US dollars.

Based on these long-term cash flow forecasts and after applying the discounting process, the DCF model produces an intrinsic fair value for NRG Energy of $522.01 per share. Compared to the stock’s current market price, this implies the shares are trading at a steep 67.4% discount, signaling significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NRG Energy is undervalued by 67.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: NRG Energy Price vs Earnings (PE)

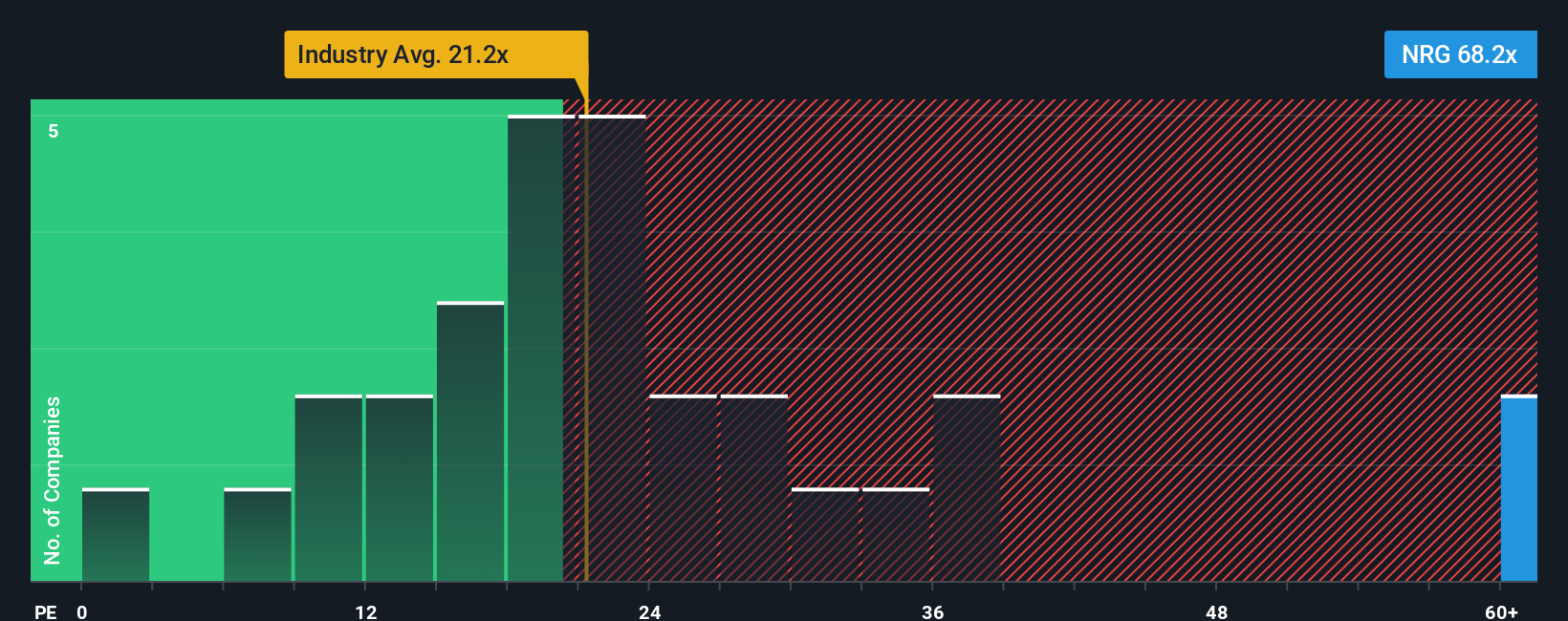

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it quickly shows how much investors are paying for each dollar of earnings. For established businesses like NRG Energy, the PE ratio puts current profits into perspective and allows easy comparisons to both industry standards and peer performance.

Of course, what counts as a “fair” PE ratio depends on more than just today’s profits. Higher growth expectations, stronger balance sheets, and lower perceived risks all justify a loftier ratio. In contrast, lower growth or heightened risks usually bring the number down, reflecting a market premium or discount for a company’s future prospects.

NRG Energy is currently trading at a PE ratio of 72.24x, which stands out from the electric utilities industry average of 21.25x and a peer average of 23.73x. Simply Wall St’s proprietary "Fair Ratio," which factors in NRG's unique earnings growth prospects, market cap, profitability, and risk profile, calculates a fair PE for NRG to be 36.05x. Unlike standard benchmarking, the Fair Ratio holistically considers not just competitive context but also company-specific fundamentals, allowing for a more tailored assessment of value.

Comparing NRG’s actual PE to its Fair Ratio, the stock is trading well above what its growth and risk profile would justify. This implies potential overvaluation by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NRG Energy Narrative

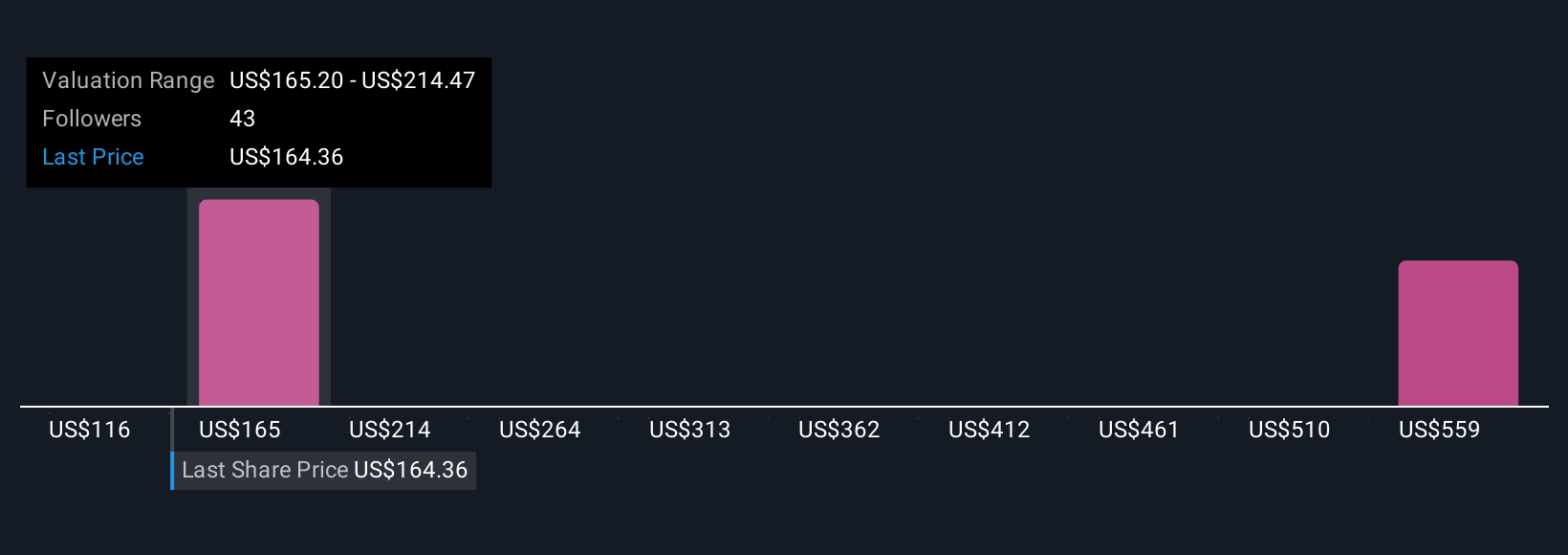

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Unlike traditional metrics, a Narrative connects your perspective on a company’s opportunities and risks directly to a clear financial forecast and fair value. Essentially, it’s how you tell the story behind the numbers.

On Simply Wall St’s Community page, millions of investors build and share Narratives by selecting or adjusting their own assumptions for NRG Energy’s future revenue, earnings growth, and profit margins. Narratives help investors make smarter decisions by showing a personalized Fair Value estimate right next to today’s share price, highlighting exactly when their story says to buy, hold, or sell.

What makes Narratives powerful is their dynamic nature. When fresh news or earnings come in, key numbers and projected outcomes update instantly, offering a living reflection of both your viewpoint and new market realities.

For example, the most optimistic Narrative for NRG Energy might assume rapid adoption of data center power agreements and significant earnings growth, arriving at a fair value of $203 per share; meanwhile, the most cautious investor could focus on regulatory risks and shrinking margins, justifying a much lower fair value of $92 per share.

Do you think there's more to the story for NRG Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)