- United States

- /

- Electric Utilities

- /

- NYSE:NRG

A Piece Of The Puzzle Missing From NRG Energy, Inc.'s (NYSE:NRG) 28% Share Price Climb

Despite an already strong run, NRG Energy, Inc. (NYSE:NRG) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 101% in the last year.

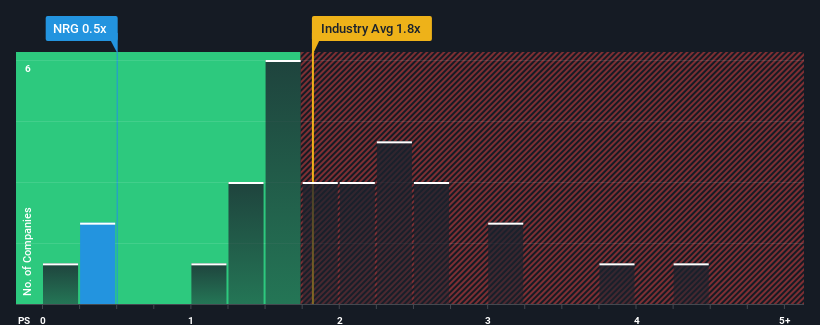

Even after such a large jump in price, given about half the companies operating in the United States' Electric Utilities industry have price-to-sales ratios (or "P/S") above 1.8x, you may still consider NRG Energy as an attractive investment with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for NRG Energy

How NRG Energy Has Been Performing

While the industry has experienced revenue growth lately, NRG Energy's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think NRG Energy's future stacks up against the industry? In that case, our free report is a great place to start.How Is NRG Energy's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as NRG Energy's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 8.6% decrease to the company's top line. Still, the latest three year period has seen an excellent 217% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 4.7% each year as estimated by the eight analysts watching the company. That's shaping up to be similar to the 4.4% per annum growth forecast for the broader industry.

In light of this, it's peculiar that NRG Energy's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift NRG Energy's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of NRG Energy's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for NRG Energy you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives