- United States

- /

- Electric Utilities

- /

- NYSE:NRG

A Fresh Look at NRG Energy (NRG) Valuation After New Data Center Push and Analyst Upgrades

Reviewed by Kshitija Bhandaru

NRG Energy announced fresh debt financing on October 8, supporting its ongoing expansion plans and a recently unveiled strategic agreement with LandBridge Company LLC to develop a large natural gas facility for future data center use.

See our latest analysis for NRG Energy.

NRG Energy’s share price momentum has been hard to ignore, with an 81.96% year-to-date price return and a stellar 90.28% total shareholder return over the past 12 months. The mix of upgraded analyst ratings and earnings estimates, along with strategic moves like the LandBridge partnership, has fueled renewed optimism among investors, positioning the stock as a clear outperformer both in its sector and on the broader market.

If NRG’s fast-paced moves caught your attention, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With NRG Energy’s shares surging amid analyst upgrades and strategic expansion, investors are left with a key question: does the current price reflect all that future growth, or is there still a real buying opportunity here?

Most Popular Narrative: 12.1% Undervalued

With NRG Energy’s widely-followed narrative placing fair value at $191.95, well above the latest closing price, the gap between projections and the market is drawing real attention. This setup spotlights a bold vision for forward growth, as bullish and bearish analysts debate the true scale and trajectory of the company’s long-term earnings power.

Disciplined capital allocation is shown by strong share repurchases, focus on debt reduction, and strategic asset purchases. This directly supports higher EPS and sustained shareholder value creation given NRG's robust free cash flow generation.

Want the inside story on what drives this aggressive upside? The narrative hinges on a profit leap and a multiple usually seen in hotter growth sectors. What financial projections and bold assumptions power these estimates? Unlock the full breakdown behind the headline figure.

Result: Fair Value of $191.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, such as NRG's increased reliance on natural gas and challenges related to executing new smart home and virtual power plant integrations.

Find out about the key risks to this NRG Energy narrative.

Another View: Looking at Valuation Multiples

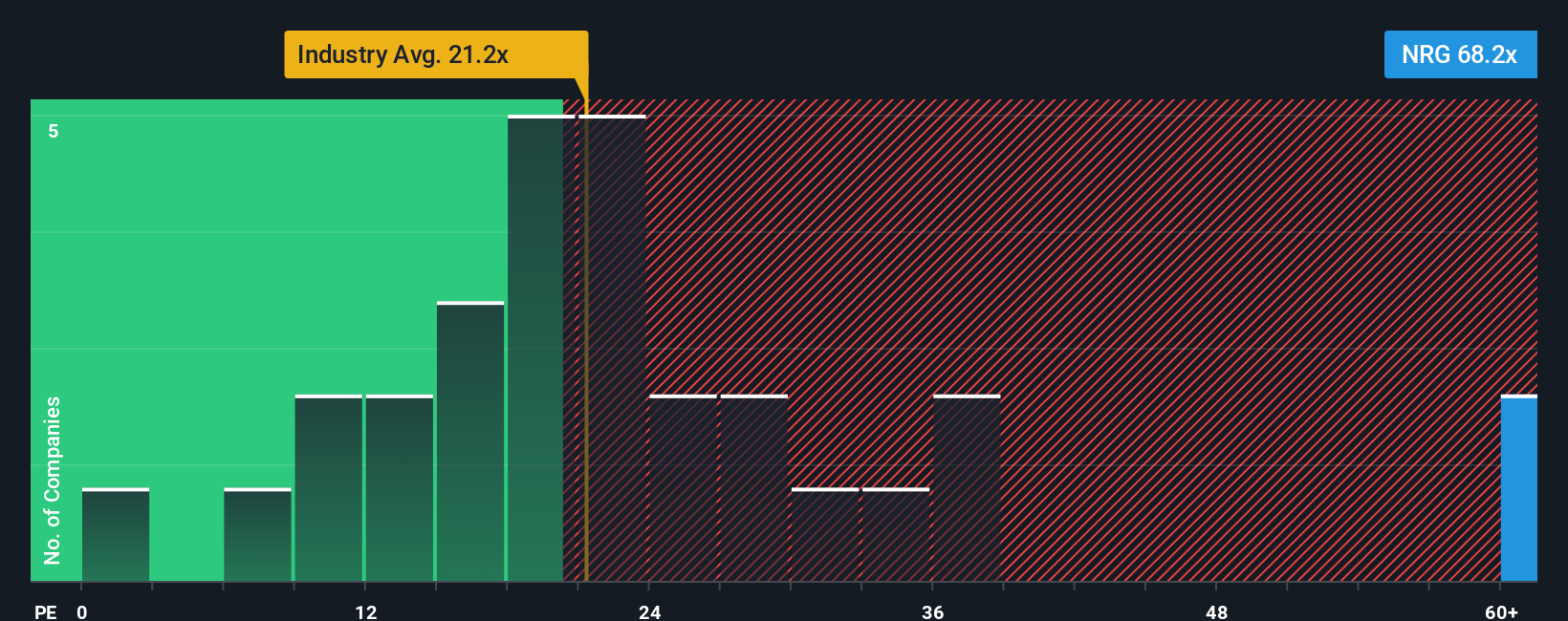

Taking a closer look at earnings-based valuation, NRG Energy trades at a price-to-earnings ratio of 71.7x. This is much higher than the US Electric Utilities average of 21.3x and the peer average of 23.6x. Compared to a fair ratio of 38.4x, this could mean investors are paying a steep premium. Does the market see something others do not, or does this suggest valuation risks ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NRG Energy Narrative

If you have a different outlook or want to dig into the numbers yourself, you can shape your own perspective in just minutes. So why not Do it your way?

A great starting point for your NRG Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Great investors do not just stick to one story. They stay ahead by comparing strategies, uncovering hidden gems, and capitalizing on powerful trends across the market. Leverage these handpicked screens to maximize your edge.

- Capture big yields and consistent income streams by reviewing these 18 dividend stocks with yields > 3% offering strong returns above 3%.

- Spot early movers in artificial intelligence with these 25 AI penny stocks making bold advances in machine learning and automation.

- Take advantage of growth that the market has not fully priced in using these 881 undervalued stocks based on cash flows for serious value hunters.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives