- United States

- /

- Gas Utilities

- /

- NYSE:NJR

New Senior Note Sale Could Be a Game Changer for New Jersey Resources (NJR)

Reviewed by Simply Wall St

- On August 21, 2025, New Jersey Resources announced it had sold US$200 million in senior notes to institutional investors, with proceeds earmarked for general corporate purposes, including debt refinancing and capital expenditures.

- This move provides the company with additional liquidity and indicates a focus on maintaining operational flexibility by proactively managing its balance sheet.

- We'll now explore how this recent senior note issuance could influence New Jersey Resources' ability to fund growth initiatives and manage risk.

Find companies with promising cash flow potential yet trading below their fair value.

New Jersey Resources Investment Narrative Recap

The key consideration for New Jersey Resources shareholders is belief in the long-term role of natural gas utilities amid growing clean energy investment and tightening energy policies. The recent US$200 million senior note sale modestly strengthens short-term liquidity, supporting ongoing project funding; however, it does not materially alter the most pressing catalyst, which remains regulatory approval for capital projects, or the central risk, potential policy shifts affecting future rate recovery and gas demand.

Among recent updates, the company raised its fiscal 2025 net financial earnings per share guidance from $3.15-$3.30 to $3.20-$3.30, citing robust Energy Services segment performance. This is particularly relevant given that proceeds from the senior notes are earmarked for debt refinancing and capital expenditure, linking short-term financial flexibility to NJR’s ability to meet its updated earnings targets and fund growth initiatives.

Yet, if regulatory priorities evolve and reduce support for natural gas infrastructure, investors should be aware that…

Read the full narrative on New Jersey Resources (it's free!)

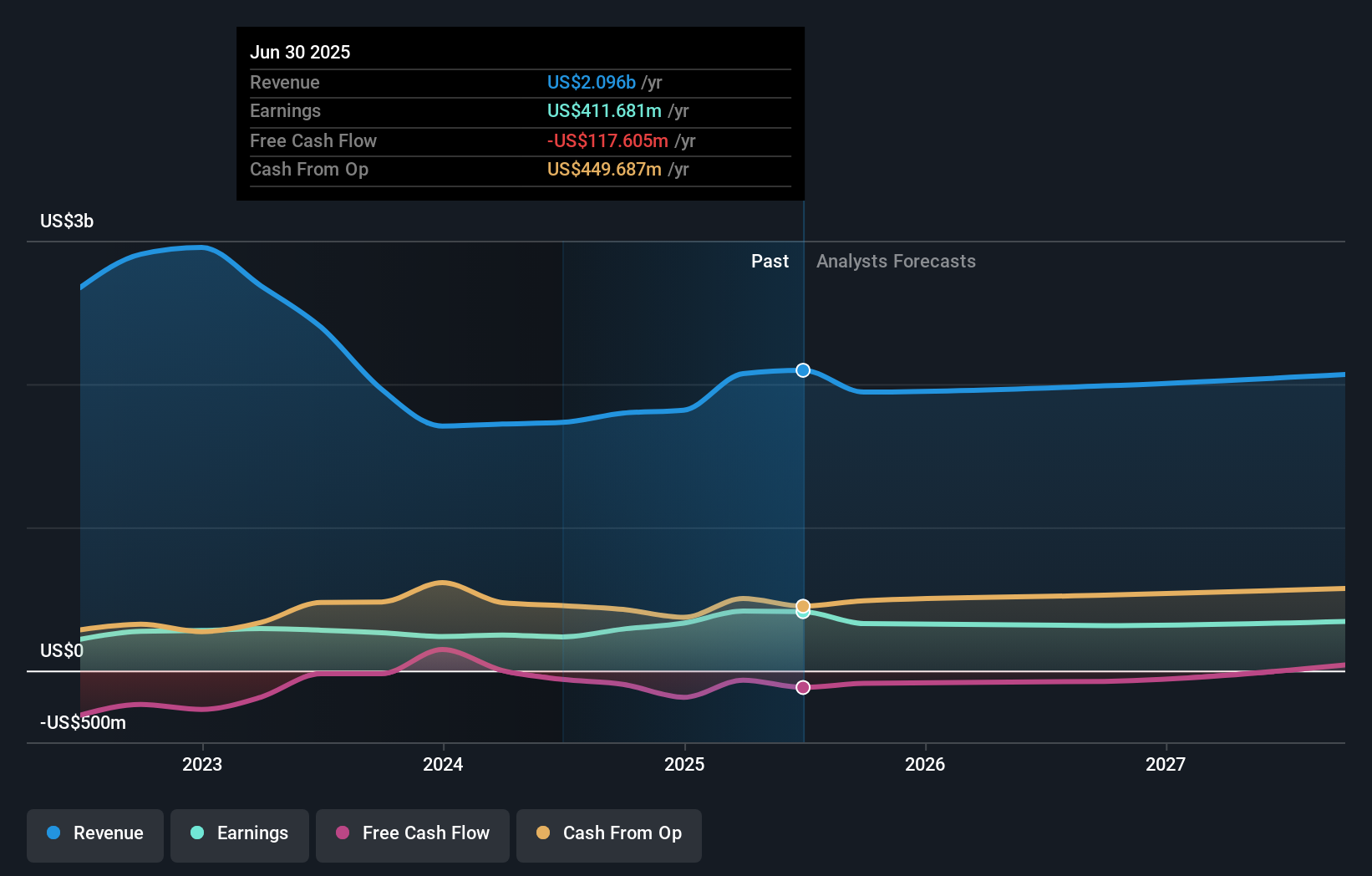

New Jersey Resources is projected to reach $2.1 billion in revenue and $399.3 million in earnings by 2028. This outlook is based on a modest annual revenue decline of 0.1% and a decrease in earnings of $12.4 million from the current $411.7 million.

Uncover how New Jersey Resources' forecasts yield a $53.57 fair value, a 12% upside to its current price.

Exploring Other Perspectives

All ten community members from Simply Wall St assigned an identical fair value of US$53.57 per share. While investor sentiment shows strong consensus, upcoming regulatory decisions could still significantly influence NJR’s revenue growth and project approvals, explore the full range of viewpoints to see how opinions may evolve.

Explore another fair value estimate on New Jersey Resources - why the stock might be worth just $53.57!

Build Your Own New Jersey Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Jersey Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Jersey Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Jersey Resources' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Jersey Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NJR

New Jersey Resources

An energy services holding company, distributes natural gas.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives