- United States

- /

- Other Utilities

- /

- NYSE:NI

Should GenCo's Approval to Serve Data Centers Prompt a Strategic Reassessment for NiSource (NI) Investors?

Reviewed by Sasha Jovanovic

- In September 2025, NiSource Inc. received approval from the Indiana Utility Regulatory Commission for its NIPSCO Generation LLC (GenCo) declination petition, allowing GenCo to own, build, and manage generation assets supporting the expanding data center sector in Northern Indiana.

- This decision creates a separate entity to shield existing retail customers from added costs while positioning NiSource to promptly meet surging power demand from large data center clients.

- Let's assess how GenCo's regulatory approval may strengthen NiSource's outlook by enabling dedicated energy solutions for major data center growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

NiSource Investment Narrative Recap

To be a NiSource shareholder, you need to believe in the company’s ability to capture accelerating electricity demand, particularly from large data center clients, while maintaining regulatory support to fund major capital investments. The approval of GenCo’s declination petition directly addresses a key short-term catalyst by unlocking a pathway to meet new load growth, though the risk of high capital expenditure still looms and could influence margins and future dividends. For now, the regulatory win may help support near-term outlook, but won’t eliminate longer-term headwinds around future gas demand or leverage.

Among recent announcements, the steady quarterly dividend declaration, US$0.28 per share in August, stands out because dividend sustainability is closely tied to cost management and regulatory clarity, both of which GenCo’s approval is designed to reinforce. How effectively GenCo delivers on its “financial stability” pillar will directly impact free cash flow and NiSource’s ability to balance growth investments with investor returns. In contrast, investors should be aware that substantial capital needs for GenCo and grid modernization may still constrain...

Read the full narrative on NiSource (it's free!)

NiSource's outlook anticipates $6.8 billion in revenue and $1.1 billion in earnings by 2028. This projection is based on a 3.5% annual revenue growth rate and represents an increase of $215.4 million in earnings from the current $884.6 million.

Uncover how NiSource's forecasts yield a $43.91 fair value, in line with its current price.

Exploring Other Perspectives

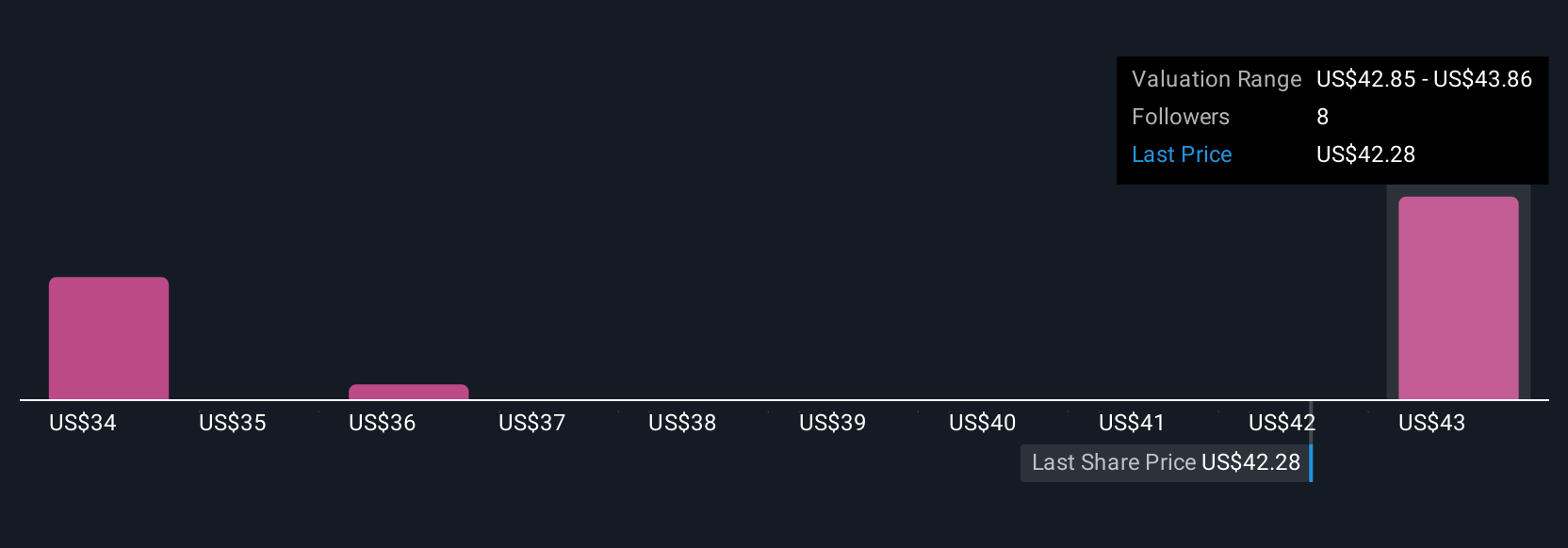

Simply Wall St Community members set fair value estimates for NiSource between US$33.54 and US$43.91 from three perspectives. While regulatory wins are supporting growth plans, ongoing capital needs could challenge the business, explore other viewpoints before forming your opinion.

Explore 3 other fair value estimates on NiSource - why the stock might be worth 24% less than the current price!

Build Your Own NiSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NiSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NiSource's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NiSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NI

NiSource

An energy holding company, operates as a regulated natural gas and electric utility company in the United States.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives