- United States

- /

- Gas Utilities

- /

- NYSE:NFG

National Fuel Gas (NFG): Assessing Valuation After Scotiabank Downgrade Triggers Stock Pullback

Reviewed by Kshitija Bhandaru

National Fuel Gas (NFG) shares dropped 4% after Scotiabank downgraded the stock, which drew fresh attention from investors. The downgrade appears to have sparked the latest wave of trading activity in the name.

See our latest analysis for National Fuel Gas.

Beyond today’s dip driven by the downgrade, National Fuel Gas has actually been showing some impressive momentum. Its share price is up nearly 40% so far this year, and long-term investors have seen a 47% total shareholder return over the past year. The combination of outsized recent gains and a steady longer-term track record suggests the market has been warming to the company, but perceptions can shift quickly as new events unfold.

If this move has you wondering what else is catching attention right now, it might be time to broaden your search and discover fast growing stocks with high insider ownership

Now that the stock has pulled back despite strong year-to-date gains, the big question is whether National Fuel Gas remains undervalued or if the market has already accounted for all its future growth potential. Is this a buying opportunity, or is everything already priced in?

Most Popular Narrative: 12.4% Undervalued

National Fuel Gas’s most widely followed narrative sets a fair value of $98 per share, about 12% above its last close of $85.81. This gap between price and target is attributed to a combination of growth expectations and efficiency gains, which keeps market watchers attentive for the next major catalyst. Here is one of the main drivers behind this optimistic outlook:

Accelerating natural gas demand for baseload power generation, including new data centers, electrification of heating and transportation, and structural shifts in state energy policies, is expected to drive higher and more stable demand for National Fuel Gas's pipeline and utility segments. This underpins predictable revenue and margin growth over the long term.

Just how ambitious are the financial projections behind this 12% upside target? The narrative suggests sustained double-digit growth rates, profit margin improvements, and a future earnings multiple that is uncommon in the utilities sector. If you want to see which estimates form the basis of this bold fair value, this is where you find out.

Result: Fair Value of $98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising decarbonization policies or unexpected costs for new regulations could put pressure on National Fuel Gas’s margins and challenge its long-term growth story.

Find out about the key risks to this National Fuel Gas narrative.

Another View: Valuation Based on Earnings Multiples

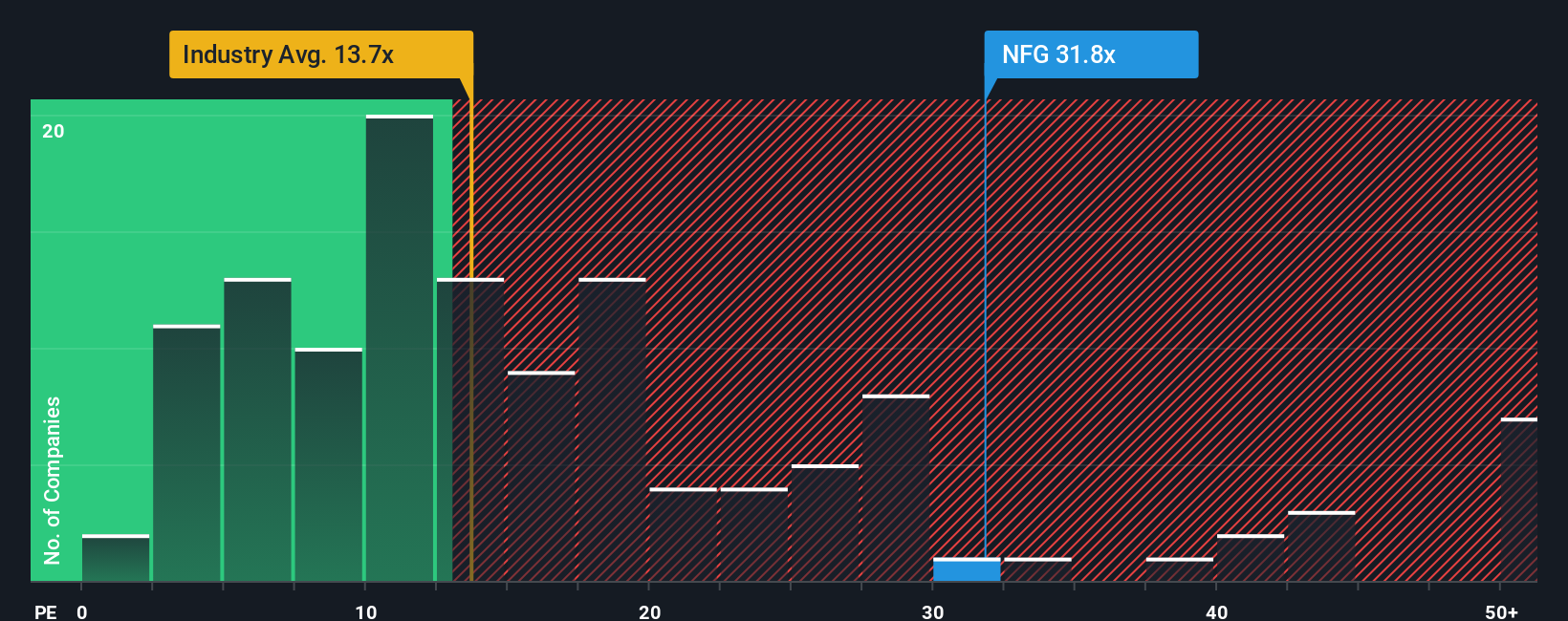

Looking from another angle, National Fuel Gas’s current price-to-earnings ratio stands at 31.8x, considerably higher than both its peers (20.9x) and the broader global gas utilities industry (13.4x). While this premium may reflect high growth expectations, it also introduces the risk that the stock could re-rate lower if results disappoint or sector sentiment shifts. Could the market eventually move closer to its fair ratio of 49.1x, or is a pullback more likely if the outlook changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Fuel Gas Narrative

If you think the current outlook does not quite fit, or want to dive deeper on your own, you can craft your own view in just a few minutes, so why not Do it your way

A great starting point for your National Fuel Gas research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investment horizons with fresh opportunities the market is buzzing about and be the first among your friends to act on overlooked trends.

- Supercharge your portfolio’s income potential by targeting steady payers and fast growers through these 18 dividend stocks with yields > 3%, which offers robust yields over 3%.

- Accelerate your growth strategy with these 25 AI penny stocks, featuring companies that are pioneering tomorrow’s AI breakthroughs across multiple industries.

- Secure the advantage on undervalued gems with these 891 undervalued stocks based on cash flows, which is based on real cash flow metrics before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

High growth potential average dividend payer.

Market Insights

Community Narratives