- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NEE): Revisiting Valuation After a 14% One-Year Shareholder Return

Reviewed by Simply Wall St

NextEra Energy (NEE) has quietly outperformed over the past year, climbing about 14% while the broader utilities space has lagged. That steady move higher is making investors revisit its valuation.

See our latest analysis for NextEra Energy.

With the share price now around $81.27, NextEra’s 90 day share price return of 13.44 percent and 1 year total shareholder return of 14.45 percent suggest momentum is rebuilding as investors warm back up to quality renewables growth stories.

If NextEra’s steady climb has you rethinking the utilities space, it could be a good moment to see what else is working and explore fast growing stocks with high insider ownership.

But with shares still trading at a modest discount to analyst targets and growth regaining pace, is NextEra quietly undervalued right now, or has the market already priced in the next leg of its clean energy expansion?

Most Popular Narrative Narrative: 10.7% Undervalued

With NextEra Energy closing at $81.27 versus a narrative fair value of $91, the current setup suggests the story is still playing catch up.

Declining costs and rapid deployment timelines of renewables (solar, wind, and especially battery storage), along with NextEra's unrivaled supply chain and perpetual construction capabilities, allow the company to extract significant pricing and operational advantages over competitors, helping to expand margins and accelerate earnings as cost pressures mount elsewhere in the sector.

Want to see what kind of revenue surge and margin lift those advantages are meant to produce, and what future earnings multiple that assumes? The full narrative unpacks the growth runway, profitability targets, and valuation math that push this fair value above today’s price.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on policy and execution, with tax credit phase downs and higher financing costs both capable of squeezing project returns and earnings power.

Find out about the key risks to this NextEra Energy narrative.

Another Angle on Valuation

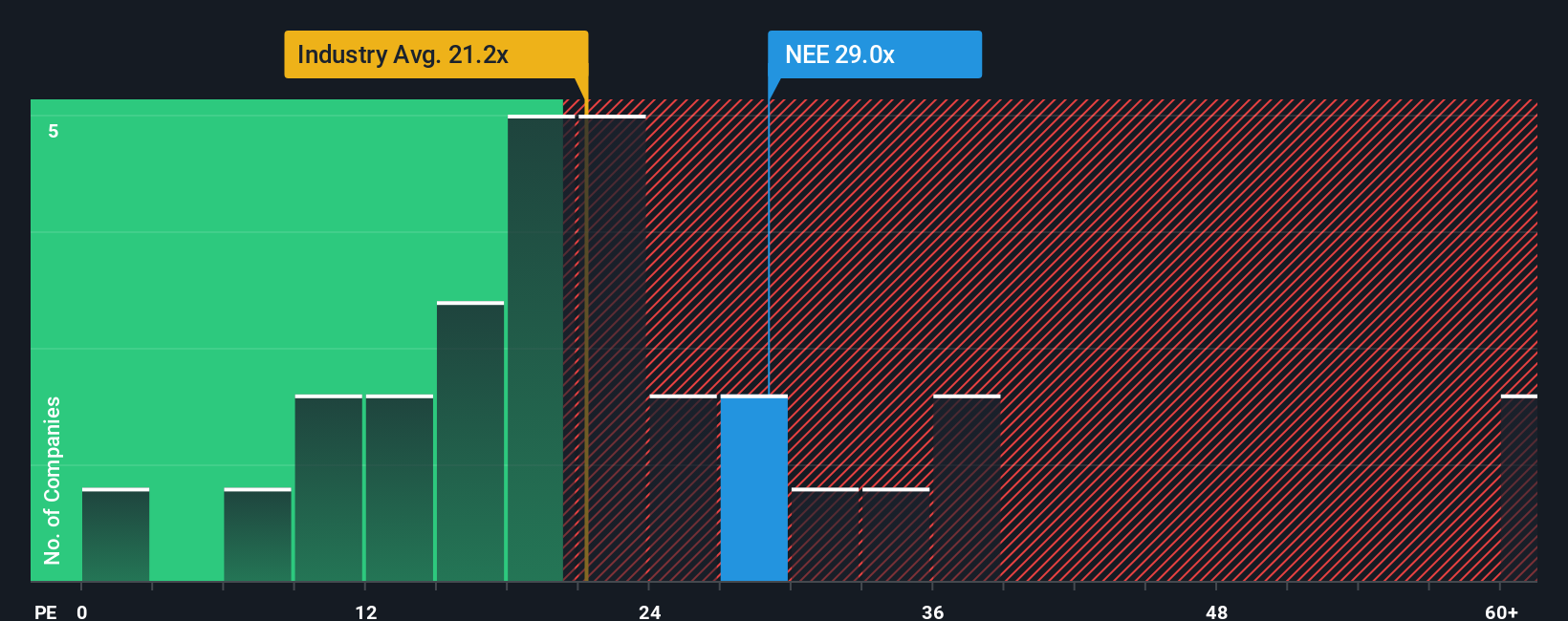

That 10.7% upside from the narrative fair value clashes with what the price to earnings ratio is signaling. At 26 times earnings, NextEra trades richer than both the US electric utilities sector at 19.9 times and its peer group at 24.2 times, yet below a fair ratio of 29.7 times that the market could drift toward.

This places investors in a gray zone, where the stock appears expensive relative to today’s market and sector, but still has room to rerate if growth delivers. The key question is whether this represents a margin of safety or a margin of error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextEra Energy Narrative

If this view does not fully line up with your own or you want to dive into the numbers yourself, you can quickly build a personalized take in just a few minutes, Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to explore a few more opportunities with targeted screeners on Simply Wall St so you are not leaving potential returns on the table.

- Scan these 906 undervalued stocks based on cash flows to identify companies that combine resilient cash flows with what may be attractive entry points.

- Explore these 26 AI penny stocks to find businesses that appear positioned to participate in the adoption of AI across different industries.

- Review these 12 dividend stocks with yields > 3% to focus on companies that may help enhance portfolio yield while maintaining solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion