- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NEE): Examining Valuation After Point Beach Nuclear Plant License Extension Approval

Reviewed by Kshitija Bhandaru

The U.S. Nuclear Regulatory Commission has granted NextEra Energy (NYSE:NEE) approval to extend the licenses for its Point Beach Nuclear Plant Units 1 and 2 in Wisconsin for roughly another two decades. This regulatory milestone reinforces the company’s commitment to reliable and diversified energy for the region.

See our latest analysis for NextEra Energy.

NextEra Energy’s steady expansion, including the recent license extension for Point Beach and an active pipeline of renewable projects, has helped the stock gain momentum, especially after sector-shaping events like the reported AES Corp. buyout bid. While the latest 1-year total shareholder return is just shy of flat, longer-term holders have enjoyed a nearly 20% total return over five years, underlining the company’s durable appeal in the utility space even as investor sentiment ebbs and flows.

If you’re looking to widen your search for opportunities beyond established leaders, now is a good time to explore fast growing stocks with high insider ownership.

Yet with NextEra Energy trading near analysts’ price targets and at a premium to sector multiples, investors are left wondering if the stock is undervalued after this rally or if the market has already priced in its future growth.

Most Popular Narrative: 4.2% Undervalued

With NextEra Energy last closing at $80.06 and the most-followed narrative placing fair value at $83.59, the current price falls below consensus estimates, hinting at modest undervaluation in relation to projected business performance and market drivers.

*Recently enacted federal legislation (OBBB) and safe harbor provisions provide multi-year tax and regulatory visibility through at least 2029 for wind, solar, and storage projects. Combined with a large existing project backlog and strong balance sheet, these factors allow NextEra to secure project returns, support dividend growth, and maintain healthy net margins despite broader policy uncertainty.*

Want to see what powers this valuation? The narrative builds its case on ambitious revenue and profit forecasts, with a profit multiple that stands out in the utilities sector. Curious which bold financial assumptions are fueling this potential upside? Discover the numbers and forecasts behind the fair value call.

Result: Fair Value of $83.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and rising project financing costs could challenge NextEra Energy’s growth momentum and put pressure on its future profit margins.

Find out about the key risks to this NextEra Energy narrative.

Another View: Market Ratios Raise Caution

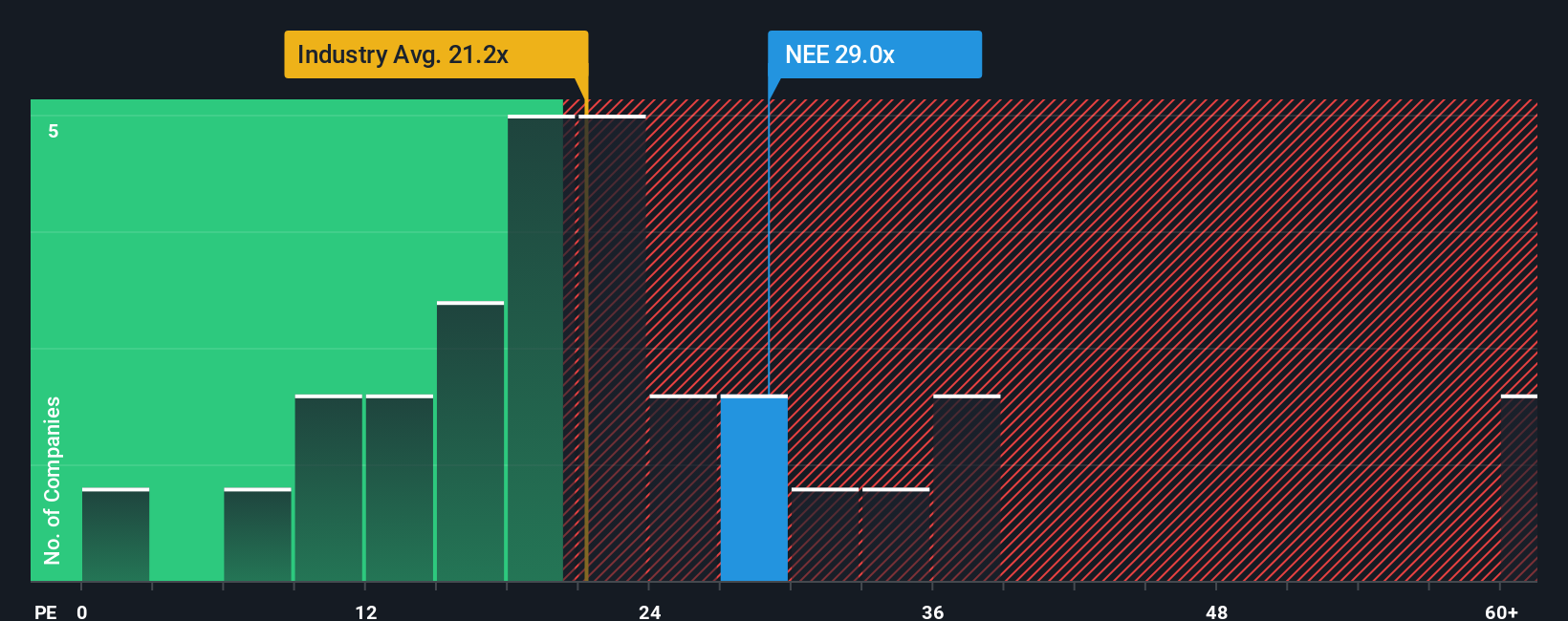

Looking at market ratios, NextEra Energy’s price-to-earnings sits at 27.9x. This is notably higher than both the peer average of 24.7x and the U.S. electric utilities sector average of 21.1x. Even compared to its fair ratio of 28.8x, the shares look expensive, which amplifies valuation risk if growth falls short. Is the market overconfident, or will fundamentals catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextEra Energy Narrative

If this view doesn't quite fit your perspective, you can dig into the full data and build your own take on NextEra Energy in just a few minutes with our easy tools. Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t miss your chance to spot stand-out investment opportunities others may overlook. Put the Simply Wall Street Screener to work and move ahead of the market crowd with these unique ideas:

- Boost your portfolio’s income with reliable picks by reviewing these 19 dividend stocks with yields > 3% that consistently deliver yields over 3%.

- Tap into the rapid advances in machine learning by checking out these 24 AI penny stocks poised for growth in the AI revolution.

- Uncover potential bargains hidden in plain sight by assessing these 896 undervalued stocks based on cash flows trading well below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives