- United States

- /

- Electric Utilities

- /

- NYSE:NEE

How Analyst Optimism and Renewables Expansion at NextEra Energy (NEE) Has Changed Its Investment Story

Reviewed by Simply Wall St

- In the past week, NextEra Energy drew investor attention with analyst optimism around its operational performance, positive earnings projections, and the addition of 3.2 gigawatts to its renewables and storage backlog.

- This expansion in clean energy infrastructure and an upcoming earnings release have reinforced market confidence in NextEra’s growth trajectory and leadership in clean energy deployment.

- We'll explore how expanding renewables capacity and robust analyst sentiment are influencing NextEra Energy's investment outlook moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NextEra Energy Investment Narrative Recap

To be a shareholder in NextEra Energy today, you’ll want to believe that accelerating demand for clean electricity, combined with the company’s unmatched renewables pipeline, gives it staying power as clean energy expands. The latest news highlighting upbeat analyst sentiment around earnings and renewables growth reinforces this story, but doesn’t substantially reduce concerns about higher project financing costs, which remain the most significant short-term risk facing NextEra amid ongoing capital investment needs.

Among recent updates, the addition of 3.2 gigawatts to NextEra’s renewables and storage backlog stands out. This milestone directly supports the main catalyst: expanding clean energy capacity and long-term visibility into future earnings, as the company continues to lead in securing new projects and capturing growth in green infrastructure.

But on the other hand, investors should pay close attention to the risks that could arise if financing costs remain elevated...

Read the full narrative on NextEra Energy (it's free!)

NextEra Energy's narrative projects $35.9 billion revenue and $9.4 billion earnings by 2028. This requires 11.5% yearly revenue growth and a $3.5 billion increase in earnings from the current $5.9 billion.

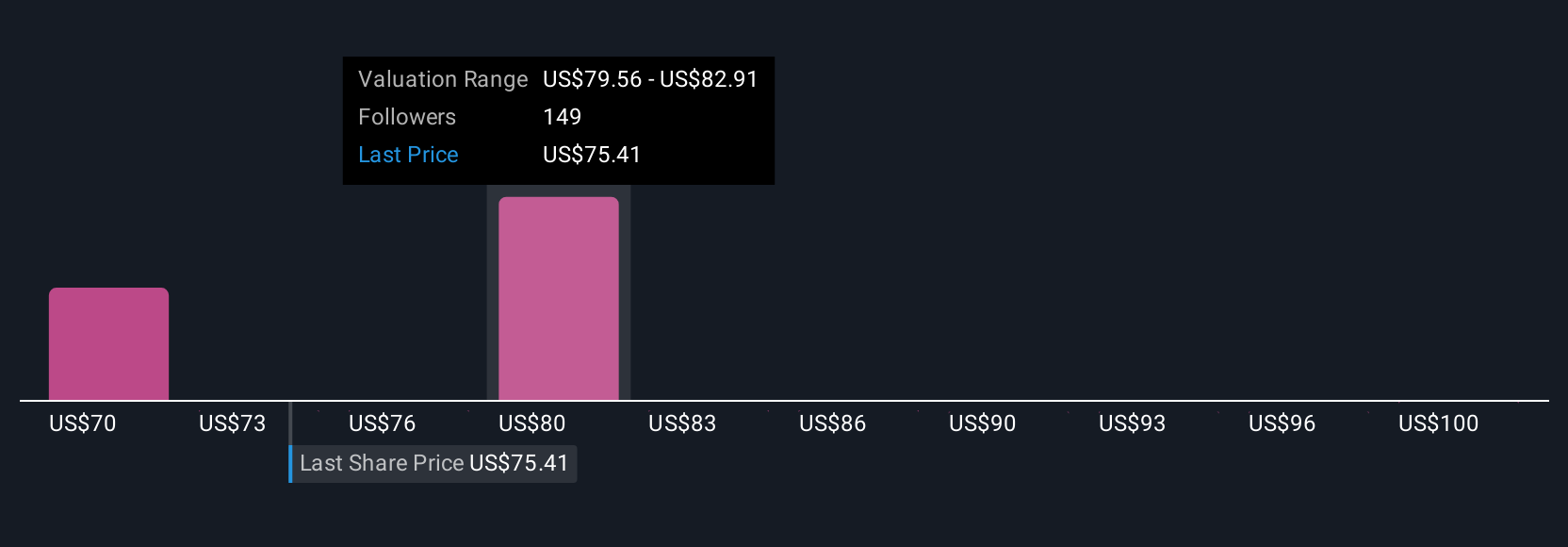

Uncover how NextEra Energy's forecasts yield a $82.29 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were expecting NextEra’s annual revenue to reach US$40.1 billion by 2028, supported by its advanced grid assets and accelerated electrification. These bullish forecasts point to much faster earnings growth than consensus expects, highlighting that opinions differ widely and may shift as new data emerges. You may want to explore these views if you’re weighing how new developments could reshape what’s possible for NextEra’s future.

Explore 9 other fair value estimates on NextEra Energy - why the stock might be worth as much as 42% more than the current price!

Build Your Own NextEra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NextEra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextEra Energy's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives