- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Does NextEra’s Recent 18% Rally Still Make Sense Amid Funding Uncertainty?

Reviewed by Bailey Pemberton

If you are watching NextEra Energy right now and wondering whether it is the right moment to jump in or hold your shares, you are not alone. The stock has been on the move. Over the past month, it gained an impressive 18.1%, and it is now up by 18.2% for the year to date. Even if you zoom out, the stock’s five-year return sits at 27.6%. After a relatively modest gain of 5.4% over the past year, this renewed momentum has caught the eye of investors refocusing on the renewables space.

Part of this recent optimism seems rooted in shifting sentiment around clean energy. Despite headlines about potential federal cuts to clean energy funding and regulatory pauses on offshore wind, NextEra’s core business continues to attract attention. Investors seem to believe the long-term opportunity is still robust, even if the political winds sometimes blow in new directions. To put things in context, analysts like those at Mizuho have been raising their price targets, reflecting new perspectives on growth and risk for the company, even as debate swirls in the broader energy sector.

But with these gains comes a crucial question: is NextEra Energy undervalued, fully valued, or overvalued? Based on the common valuation checks, the company currently scores a 0 out of 6, meaning it does not appear undervalued by any of the usual measures. So how should we interpret this, and what do these valuation approaches really tell us? Before jumping to conclusions, let’s take a closer look at how each method evaluates the company. There may be an even better way to judge its true worth coming up at the end of this article.

NextEra Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NextEra Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates the fair value of a company by forecasting future dividends and discounting them back to present value, accounting for growth and risk. This approach is most useful for firms with steady, predictable dividend payments like those found in the utility sector.

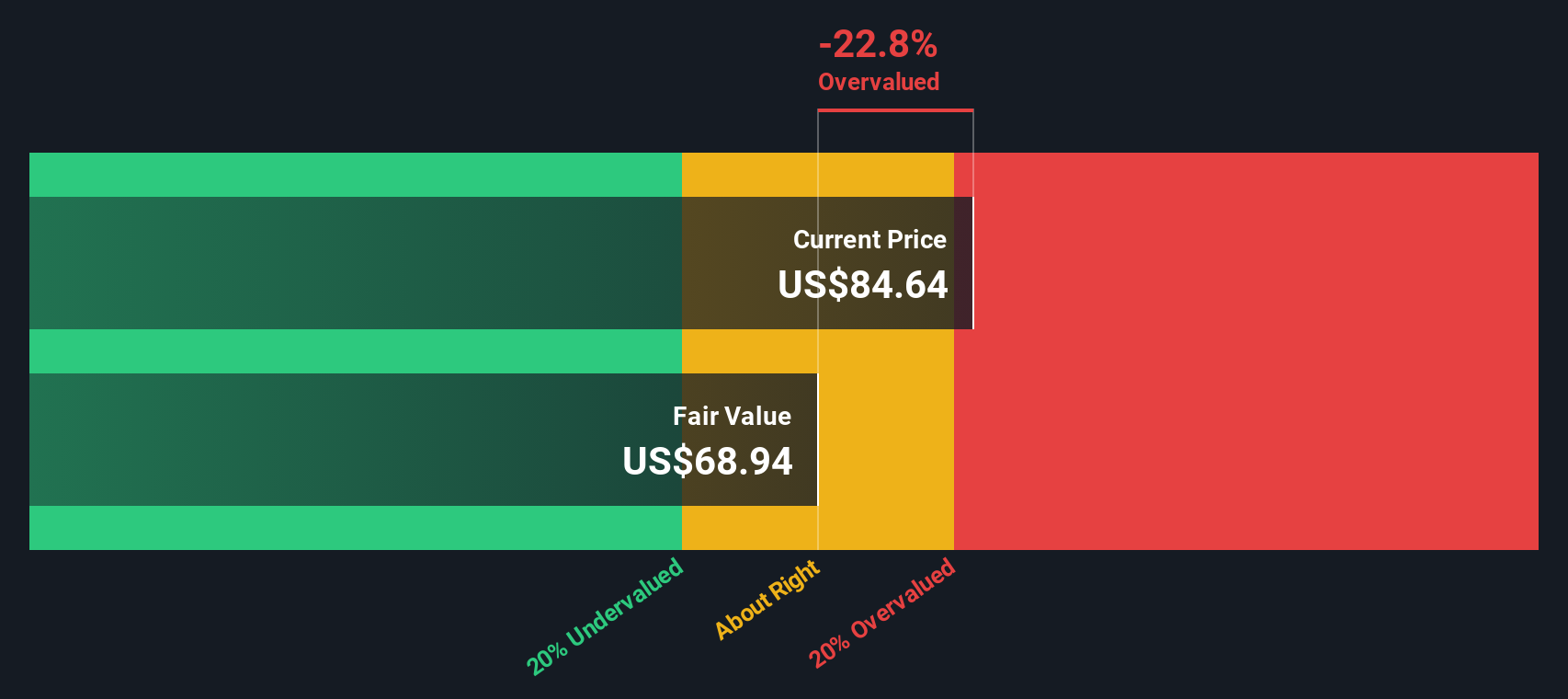

For NextEra Energy, the latest DDM valuation uses an annual dividend per share (DPS) of $2.55, a return on equity (ROE) of 9.5%, and an expected payout ratio of 61%. The model assumes dividend growth will settle at 3.08% per year, slightly under longer-term expectations to reflect a more conservative outlook.

Using these inputs, the DDM calculates an intrinsic value of $69.07 per share. Compared to the current market price, this figure suggests NextEra Energy stock is 22.6% overvalued according to the model’s assumptions about growth and dividend sustainability.

Investors should recognize that DDM results can be sensitive to both growth forecasts and the stability of payouts. In this case, the data indicates the market price may be factoring in faster growth or lower risk than the model allows for.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests NextEra Energy may be overvalued by 22.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NextEra Energy Price vs Earnings

For profitable companies like NextEra Energy, the Price-to-Earnings (PE) ratio is one of the most common ways to assess value. The PE ratio measures how much investors are willing to pay for each dollar of earnings, making it an intuitive benchmark for companies with steady profits.

The “right” PE ratio for a company varies depending on expectations for growth and perceptions of risk. Companies with faster projected earnings growth typically warrant higher multiples, while those facing uncertainty or slower growth tend to trade at lower ratios.

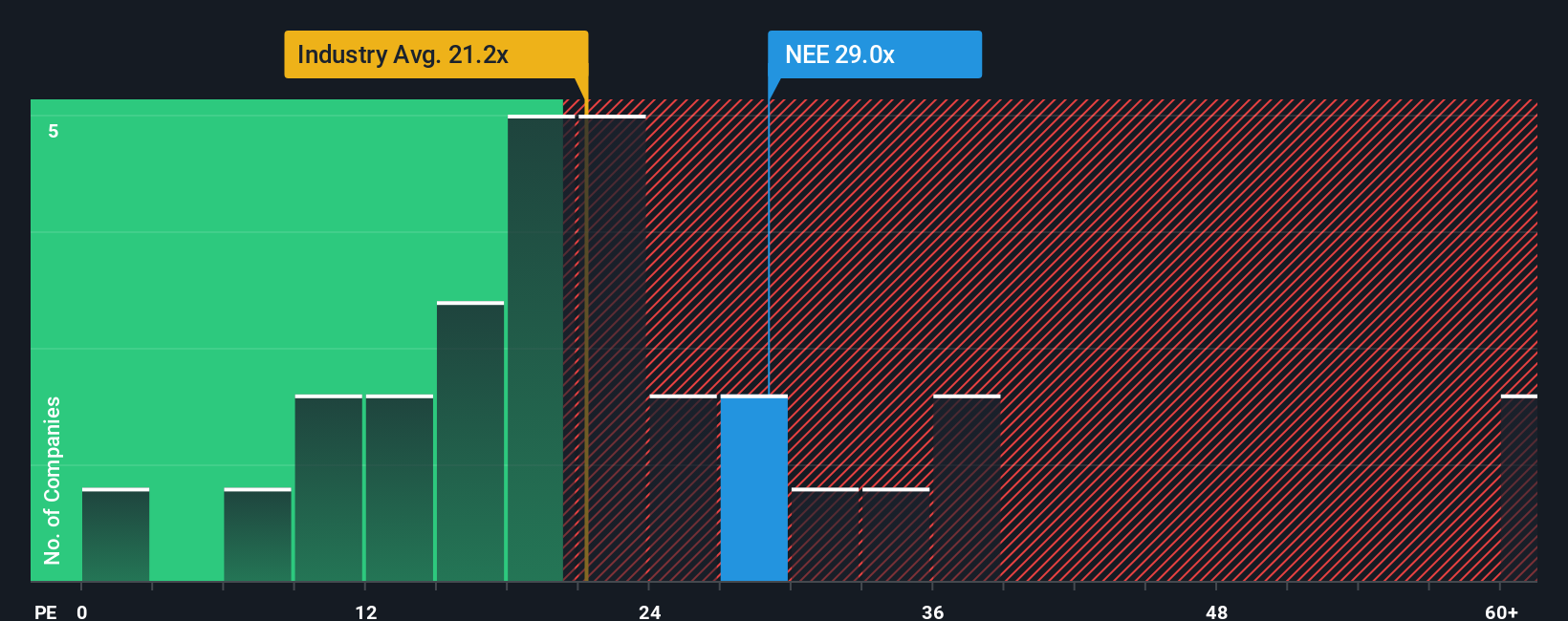

NextEra Energy’s current PE ratio stands at 29.5x. This is noticeably higher than both the Electric Utilities industry average of 21.3x and the peer group average of 26.1x. On the surface, this suggests the stock is priced at a premium relative to its sector.

However, Simply Wall St’s Fair Ratio, calculated using a proprietary approach that considers not only industry and peer multiples but also factors like growth, risk, profit margins, and market cap, places NextEra Energy’s fair PE at 28.9x. This makes it a more tailored and holistic benchmark than basic sector comparisons, capturing nuances that a simple average might overlook.

When we compare the Fair Ratio to the actual PE, the difference is just 0.6x. This proximity indicates the market has NextEra Energy priced almost exactly as expected based on its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NextEra Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible way for you to give context and your story behind the numbers, linking your own outlook on NextEra Energy’s business, such as expected revenue, earnings, or margins, directly to a financial forecast and an estimated fair value.

This approach helps you bridge the gap between what the company does and what it is worth, allowing you to tie together your analysis of industry trends, company catalysts, or risks with your expectations for future performance. Narratives make investing more personal and actionable by showing how your perspective stacks up against current prices, so you can quickly decide if and when to buy or sell.

Millions of investors on Simply Wall St use Narratives, found on each company’s Community page, to share their reasoning and regularly check their views against new information, as every Narrative updates automatically when fresh news, results, or guidance is released.

For example, on NextEra Energy, one investor’s Narrative assumes strong tailwinds from AI and renewables and values the company at $103 per share, while another focuses on regulatory and market risks and sees fair value at only $52. This demonstrates just how powerful your own story can be to clarify your confidence and guide your decisions.

For NextEra Energy, here are previews of two leading NextEra Energy Narratives:

Fair Value: $103.00

Current Price vs Fair Value: 17.8% undervalued

Expected Revenue Growth: 15.7%

- Foresees accelerated decarbonization, grid digitalization, and strategic nuclear initiatives driving above-consensus revenue and margin growth through 2029 and beyond.

- Unique asset scale and aggressive investment strategy position NextEra for significant market share gains and premium pricing power in a rapidly electrifying US economy.

- Assumes bullish 2028 forecasts, including $40.1B revenue, $10.7B earnings, and a 24.2x PE ratio, supported by continuous margin expansion and premium returns.

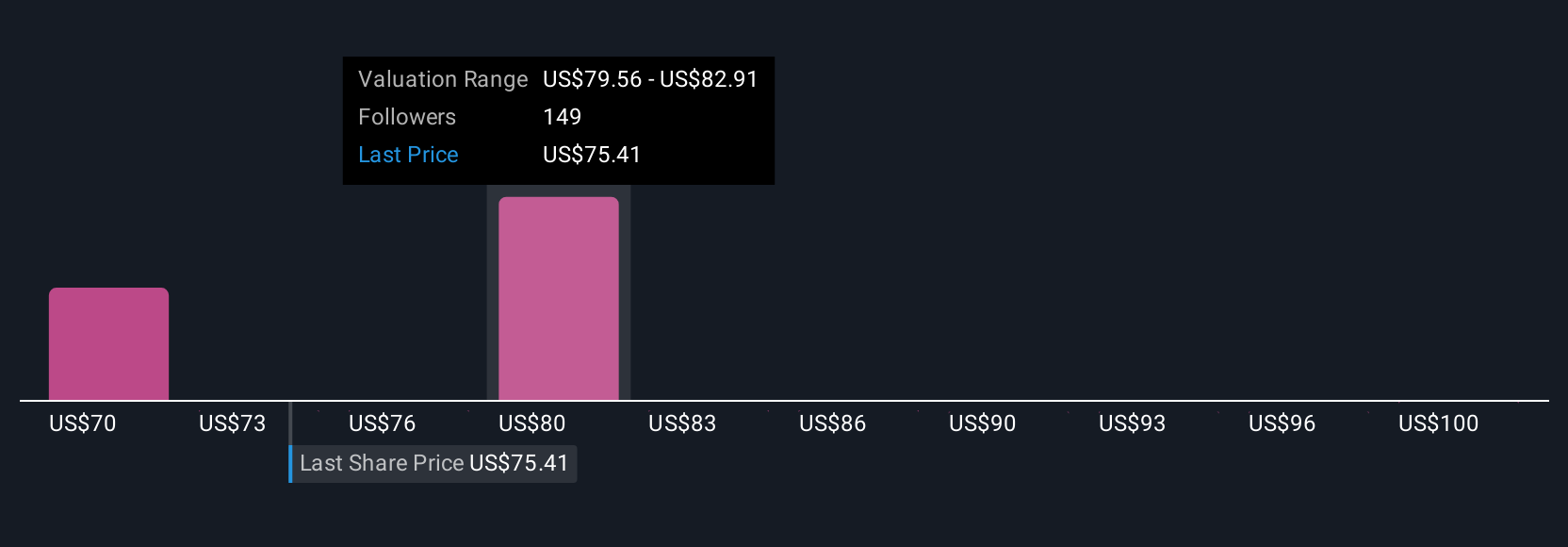

Fair Value: $83.59

Current Price vs Fair Value: 1.3% overvalued

Expected Revenue Growth: 11.3%

- Highlights strong demand from AI and electrification but cautions that moderating policy support, higher financing costs, and intensified competition could constrain long-term upside.

- Points to robust project backlog and stable utility investments contributing to predictable earnings, but emphasizes regulatory risks and headwinds from phasedown of incentives.

- Projects consensus 2028 estimates including $35.9B revenue, $9.4B earnings, and a 22.3x PE ratio, resulting in a fair value near today’s price, indicating a fairly valued or slightly overvalued stock.

Do you think there's more to the story for NextEra Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives