- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Does NextEra Energy Still Offer Upside After Its 2025 Renewables Expansion Push?

Reviewed by Bailey Pemberton

- Wondering if NextEra Energy is still a smart buy at around $81 a share, or if the easy gains are already behind it? Let us unpack whether the current price leaves any real upside on the table.

- Over the last week the stock has edged up 2.1%, but it is still down 3.1% over the past month, even though it is up 13.6% year to date and 16.0% over the last year, and 23.7% over five years. This pattern hints at a steady long term compounding story rather than a speculative spike.

- Recent headlines have focused on NextEra Energy's continued build out of renewables and grid infrastructure, as the company positions itself as a key player in the transition toward cleaner power. At the same time, shifting interest rate expectations and changing investor sentiment toward utilities have been driving many of the short term moves across the sector.

- On our framework the stock earns a valuation score of 1 out of 6, which means it only screens as undervalued on one of six checks. Next we will walk through those different valuation lenses and, toward the end of the article, explore an even better way to make sense of what the market is really pricing in.

NextEra Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NextEra Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting future dividend payments and discounting them back to today, asking whether the current price is justified by the income stream.

For NextEra Energy, the model starts with the current annual dividend of about $2.55 per share and assumes earnings grow fast enough to support that payout. With a return on equity of roughly 9.5% and a payout ratio of about 61%, the implied long term dividend growth rate is capped at 3.26%, slightly below the model’s raw 3.71% estimate to keep assumptions conservative. Expected earnings growth of about 3.7% supports this outlook.

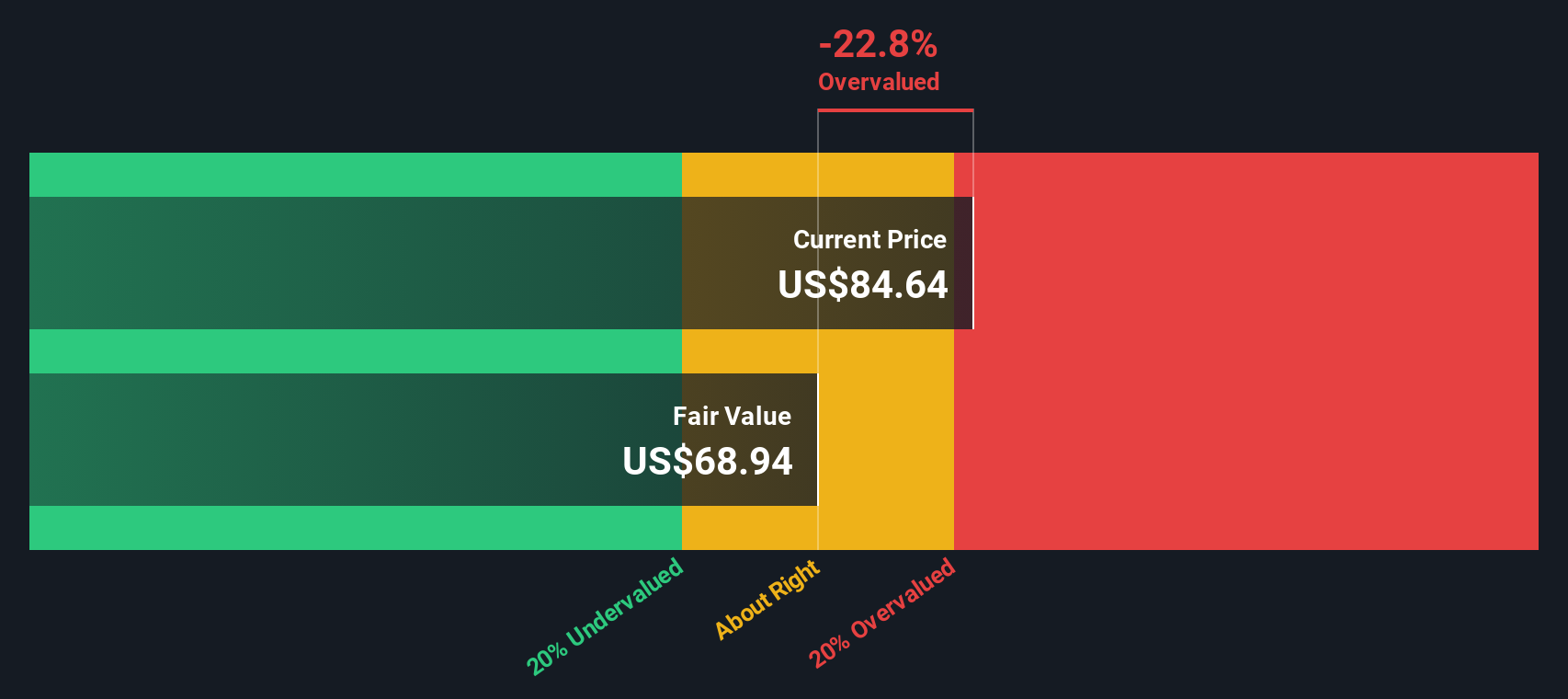

Using these inputs in the DDM framework produces an intrinsic value of roughly $68.92 per share. Compared with a current market price around $81, the model suggests NextEra Energy is about 18.0% overvalued, indicating that investors may be paying a premium for its dividend and growth profile.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests NextEra Energy may be overvalued by 18.0%. Discover 915 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NextEra Energy Price vs Earnings

For profitable companies like NextEra Energy, the price to earnings ratio is often the cleanest way to judge valuation because it directly links what investors pay today to the profits the business is currently generating. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty call for a lower, more conservative multiple.

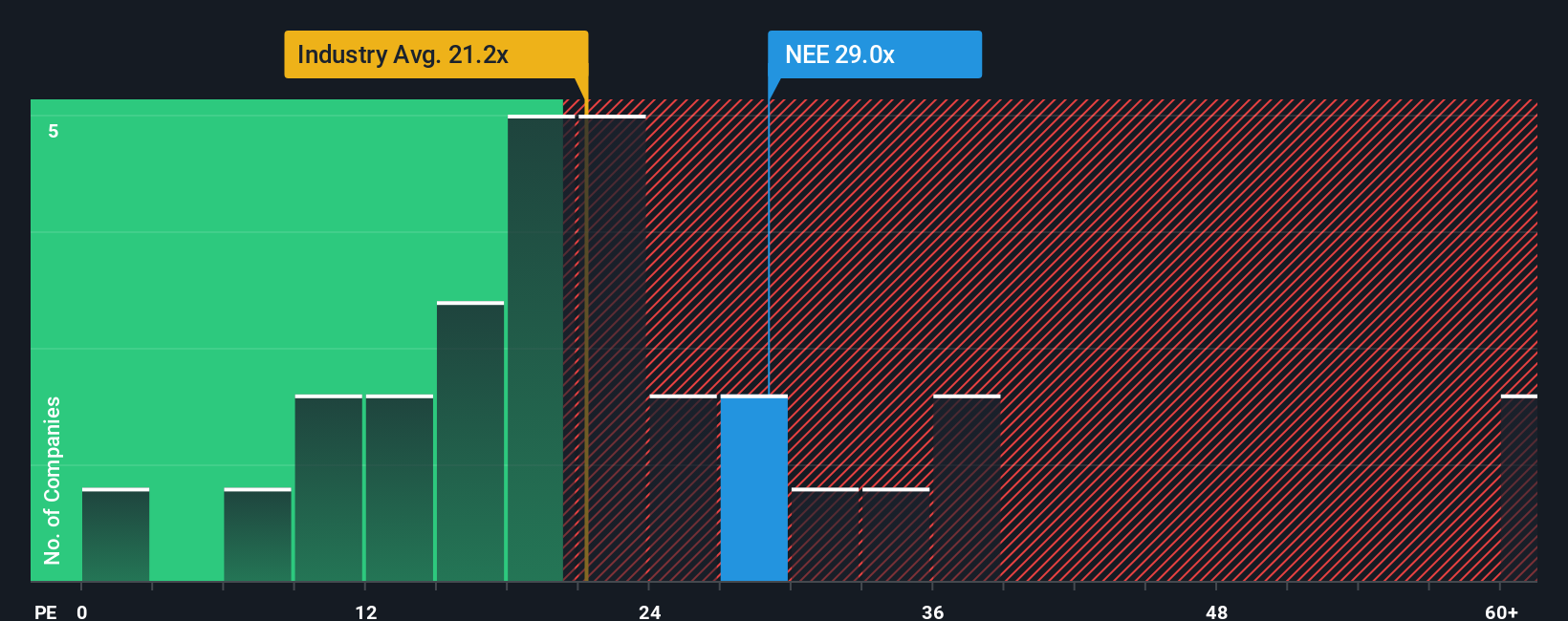

NextEra Energy currently trades at about 26.0x earnings, above the broader Electric Utilities industry average of roughly 19.5x and modestly above a peer group average near 24.5x. On the surface this suggests the stock carries a quality or growth premium compared with typical utility names.

Simply Wall St’s Fair Ratio framework refines this view by estimating what PE multiple would be reasonable given NextEra Energy’s earnings growth outlook, profitability, industry, size and risk profile. In this framework, the stock’s Fair Ratio comes out higher, around 29.7x. This indicates the market is actually assigning a discount relative to what those fundamentals might support. Because the current PE sits below the Fair Ratio, the multiple-based lens points to a stock that still looks attractively priced for long term investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NextEra Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you connect your view of a company’s story with the numbers behind its future revenue, earnings, margins and fair value. A Narrative is your investment story written in financial terms, linking what you believe about NextEra Energy’s business drivers, like long term clean power demand or policy risk, to a concrete forecast and then to a fair value that you can compare with today’s share price to decide whether to buy, hold or sell. Narratives on Simply Wall St are easy to create and explore within the Community page, where millions of investors express their perspectives and the platform dynamically updates fair values when new information like earnings reports or major news hits the market. For example, some investors currently anchor on a more cautious fair value near $52, while others see the long term setup supporting upside closer to $103. Narratives make those different assumptions transparent so you can choose or adapt the story that best fits your own view of NextEra Energy.

Do you think there's more to the story for NextEra Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)