- United States

- /

- Electric Utilities

- /

- NYSE:NEE

A Look at NextEra Energy's Valuation Following Nuclear License Extension Approval

Reviewed by Kshitija Bhandaru

The U.S. Nuclear Regulatory Commission has just greenlit license extensions for NextEra Energy (NEE) at the Point Beach Nuclear Plant, securing clean, reliable power for Wisconsin into the middle of the century. This regulatory breakthrough is a clear signal of confidence in the company’s long-term energy strategy.

See our latest analysis for NextEra Energy.

The landmark nuclear license extensions arrived as NextEra Energy’s share price surged 17.3% over the past month, building strong momentum and pushing its stock to $83.35. While the 1-year total shareholder return stands at a moderate 5%, the company’s mix of utility stability and clean energy growth ambitions continues to draw market attention. With a steady pipeline of renewable projects and continued investor optimism, both short-term and long-term performance trends indicate positive sentiment is building around NextEra’s future potential.

If these developments have you rethinking your energy portfolio, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With its strong rally and major regulatory wins, is NextEra Energy truly undervalued based on future growth prospects, or has the recent surge already included most of the upside for would-be buyers?

Most Popular Narrative: 30% Undervalued

With NextEra Energy’s narrative fair value at $83.59, almost identical to its last close, current sentiment from the most popular perspective sees more potential upside than the recent rally suggests. The number crunchers behind this view are betting that future growth drivers still have further to run, not just short-term momentum.

Declining costs and rapid deployment timelines of renewables (solar, wind, and especially battery storage), along with NextEra's unrivaled supply chain and perpetual construction capabilities, allow the company to extract significant pricing and operational advantages over competitors, helping to expand margins and accelerate earnings as cost pressures mount elsewhere in the sector.

Curious about the math powering this ambitious outlook? Key assumptions center on robust gains in revenue, climbing profit margins, and a future earnings multiple that could rival growth stocks. Hungry for the exact projections and the boldest bets built into this valuation? Go beyond the headline to see what most are missing.

Result: Fair Value of $83.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting regulatory policies and higher financing costs remain key risks that could challenge NextEra’s ambitious growth outlook in the coming years.

Find out about the key risks to this NextEra Energy narrative.

Another View: Are Multiples Sending a Warning?

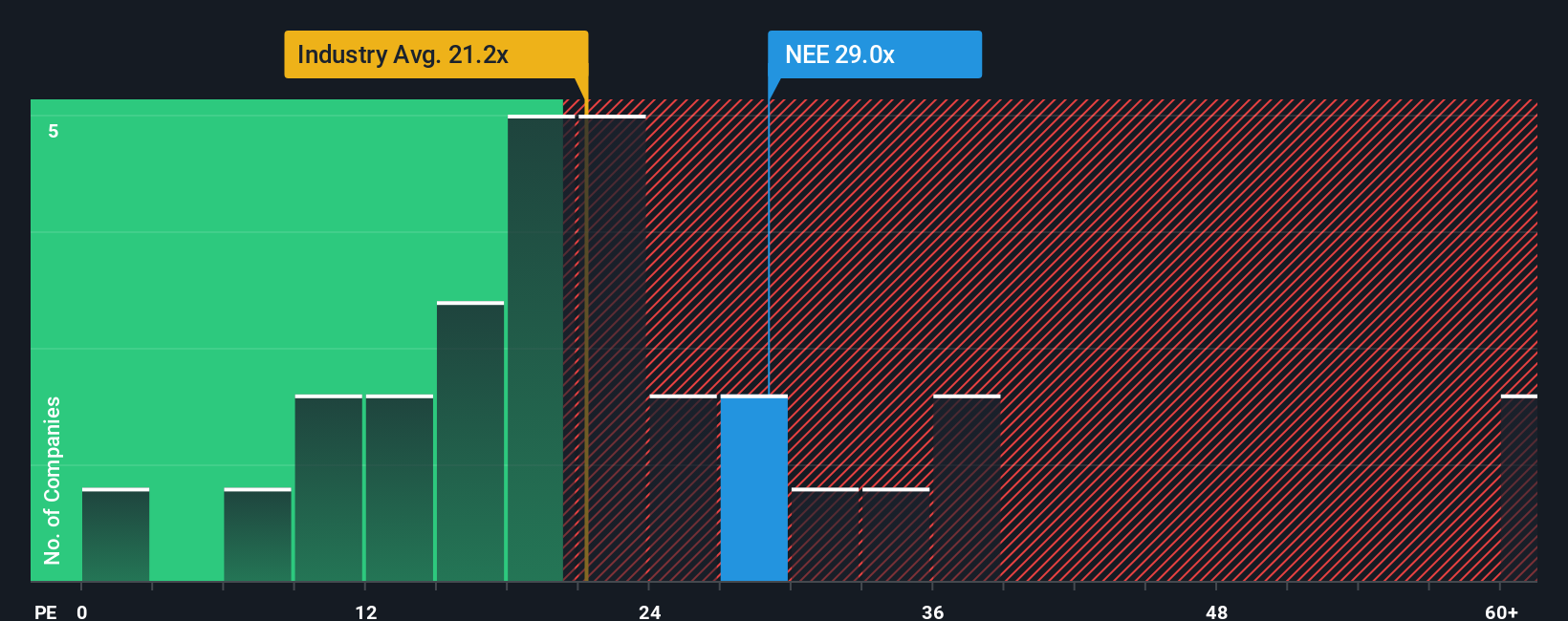

Looking from another angle, NextEra Energy’s price-to-earnings ratio stands at 29x. This is noticeably higher than both its peer average of 25.4x and the US Electric Utilities industry average of 21.2x. Although the current fair ratio is pegged at 29x, these higher numbers suggest investors might be paying a premium that leaves little margin for error. Is the market underestimating the risks of buying at these elevated levels, or could growth still justify the mark-up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextEra Energy Narrative

If you see the story unfolding differently, or want to dive into the numbers firsthand, you can craft your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t stand on the sidelines while others seize promising opportunities. You could be missing out on stocks set to outperform. Let Simply Wall Street’s top screeners guide your next big move.

- Tap into fresh potential and boost your gains by targeting these 899 undervalued stocks based on cash flows backed by strong fundamentals and attractive valuations.

- Spot tomorrow's innovators early in these 24 AI penny stocks, focused on real companies driving breakthroughs in artificial intelligence and automation.

- Secure steady income streams by choosing these 19 dividend stocks with yields > 3% earning more than 3% annual yields from established, shareholder-friendly businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives