- United States

- /

- Gas Utilities

- /

- NYSE:MDU

MDU Resources Group (MDU) Is Up 5.8% After Prolonged Revenue Decline Raises Demand Concerns – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

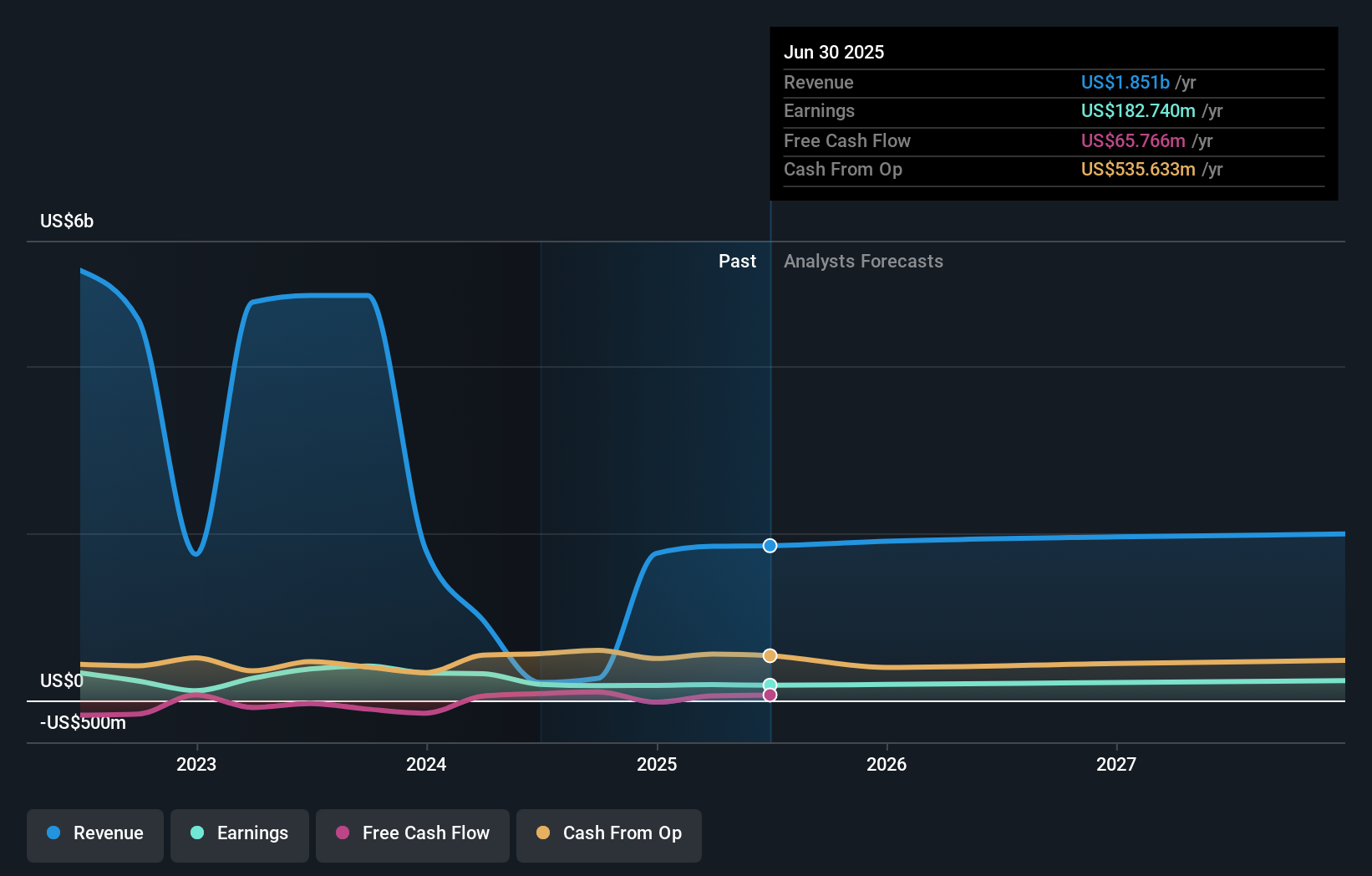

- In recent days, MDU Resources Group reported a 37.6% annual revenue decline over five years after customers postponed purchases of its products and services.

- This significant contraction highlights ongoing operational and demand headwinds that have persisted, raising concerns about the company's ability to sustain growth amid shifting customer behaviors.

- We'll examine how this extended decline in customer demand influences the outlook presented in the company's prior investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MDU Resources Group Investment Narrative Recap

To be a shareholder in MDU Resources Group, you need to believe in the resilience of its regulated energy delivery and infrastructure strategy, despite significant headwinds. The reported 37.6% revenue decline over five years signals that shifting customer behavior has become a material, near-term challenge, especially as it weighs on MDU’s biggest catalyst: benefiting from US infrastructure investment. This same demand weakness has amplified the most pressing risk to the business, persistent margin and earnings pressure if operational costs rise faster than revenues, potentially overshadowing incremental growth opportunities in the short run.

Against this backdrop, MDU’s decision to file for a US$400 million follow-on equity offering, announced in August 2025, stands out as particularly relevant. Raising new equity at a time of prolonged revenue contraction may influence both near-term catalysts (capital flexibility for infrastructure projects) and risks (the threat of shareholder dilution), especially as the funds could be directed toward costly but required upgrades or investments to maintain service levels and compliance.

However, with revenue volatility persisting and operating expenses rising beyond recoverable rates, the impact of further dilution is something investors should be aware of if...

Read the full narrative on MDU Resources Group (it's free!)

MDU Resources Group's outlook points to $2.0 billion revenue and $233.0 million earnings by 2028. Achieving this would require 3.0% annual revenue growth and a $50.3 million increase in earnings from the current $182.7 million.

Uncover how MDU Resources Group's forecasts yield a $20.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range widely, with targets set at US$1.13 and US$20. As you weigh these varied perspectives, persistent customer demand shifts and earnings contraction remain key risks for those following MDU’s evolving story.

Explore 2 other fair value estimates on MDU Resources Group - why the stock might be worth as much as 7% more than the current price!

Build Your Own MDU Resources Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDU Resources Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free MDU Resources Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDU Resources Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDU

MDU Resources Group

Engages in the regulated energy delivery businesses in the United States.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives