- United States

- /

- Electric Utilities

- /

- NYSE:IDA

Did IDACORP’s (IDA) Capex Hike and Wind-to-Gas Shift Just Recast Its Investment Narrative?

Reviewed by Sasha Jovanovic

- IDACORP recently raised its 2025–2029 capital expenditure forecast by about 20% after cancelling the 300 MW Jackalope Wind project, replacing it with a planned 167 MW gas plant and other investments to meet capacity and energy needs.

- Alongside this higher spending outlook, the company reported third-quarter 2025 earnings that surpassed analyst expectations, underlining demand tied to projects such as Micron’s Fab 2 facility and reinforcing its role in supporting regional growth.

- We’ll now explore how IDACORP’s higher long-term capital spending plans could influence its previously outlined investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

IDACORP Investment Narrative Recap

To own IDACORP, you have to believe in steady utility-style earnings supported by rapid regional load growth, while accepting execution and regulatory risks tied to heavier capital spending. The 20% increase in 2025–2029 capex and shift from the Jackalope Wind project to gas and other resources does not appear to change the near term earnings catalyst, but it does sharpen the focus on cost recovery and balance sheet pressure.

The most relevant recent announcement is IDACORP’s updated 2025–2029 capital expenditure forecast, lifted by about 20% after terminating the 300 MW Jackalope Wind project and adding a 167 MW gas plant and related investments. This higher, more gas-weighted capex plan sits right at the heart of the key catalyst of serving projects like Micron’s Fab 2 facility, while increasing exposure to regulatory approval risk and potential shifts in the company’s long term resource mix.

But investors also need to be aware that higher, front loaded capex could test regulators’ willingness to allow full cost recovery and...

Read the full narrative on IDACORP (it's free!)

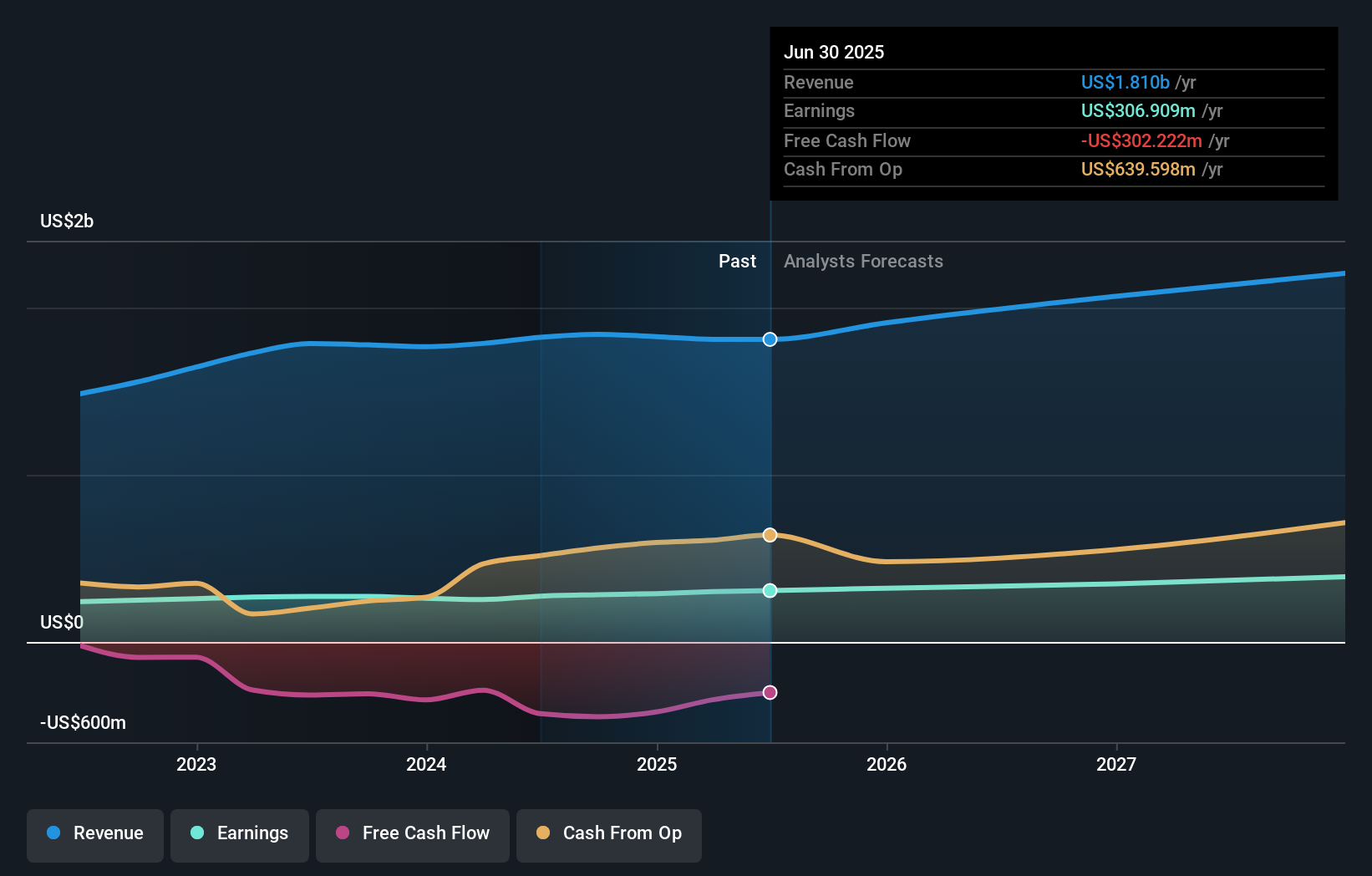

IDACORP's narrative projects $2.3 billion revenue and $441.8 million earnings by 2028.

Uncover how IDACORP's forecasts yield a $140.88 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$103 to US$141 per share, reflecting a wide spread of expectations. When you set those side by side with IDACORP’s rising long term capex needs and associated regulatory risk, it underlines why it can help to weigh several different views before deciding how this stock might fit in your portfolio.

Explore 3 other fair value estimates on IDACORP - why the stock might be worth as much as 10% more than the current price!

Build Your Own IDACORP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IDACORP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDACORP's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026