- United States

- /

- Electric Utilities

- /

- NYSE:HE

Hawaiian Electric Industries (HE): Evaluating Valuation After Major Moves to Strengthen Balance Sheet and Liquidity

Reviewed by Simply Wall St

If you’re eyeing Hawaiian Electric Industries (HE) for your portfolio, the company’s latest wave of financial actions might already be on your radar. In early September, management announced expanded and extended revolving credit facilities for both HE and its main utility subsidiary, along with plans for a $400 million private placement of senior unsecured notes. These steps are not just routine refinancing; they mark a deliberate effort to bolster liquidity and equip the company with more flexibility for capital and operational demands.

This dual move lands at a time when the stock has seen an upswing of 27% year-to-date and a 13% rise over the past three months, even as returns over the last three and five years remain deep in the red. In the shorter term, momentum is clearly building. The fresh credit lines and new debt signal efforts to manage risk, optimize capital structure, and perhaps regain confidence that has wavered for longer-term investors who weathered those significant declines.

Now, with the liquidity runway extended and a rebound taking shape, is HE trading at a discount worth buying, or are investors already baking all this future growth into today’s price?

Most Popular Narrative: 5.2% Overvalued

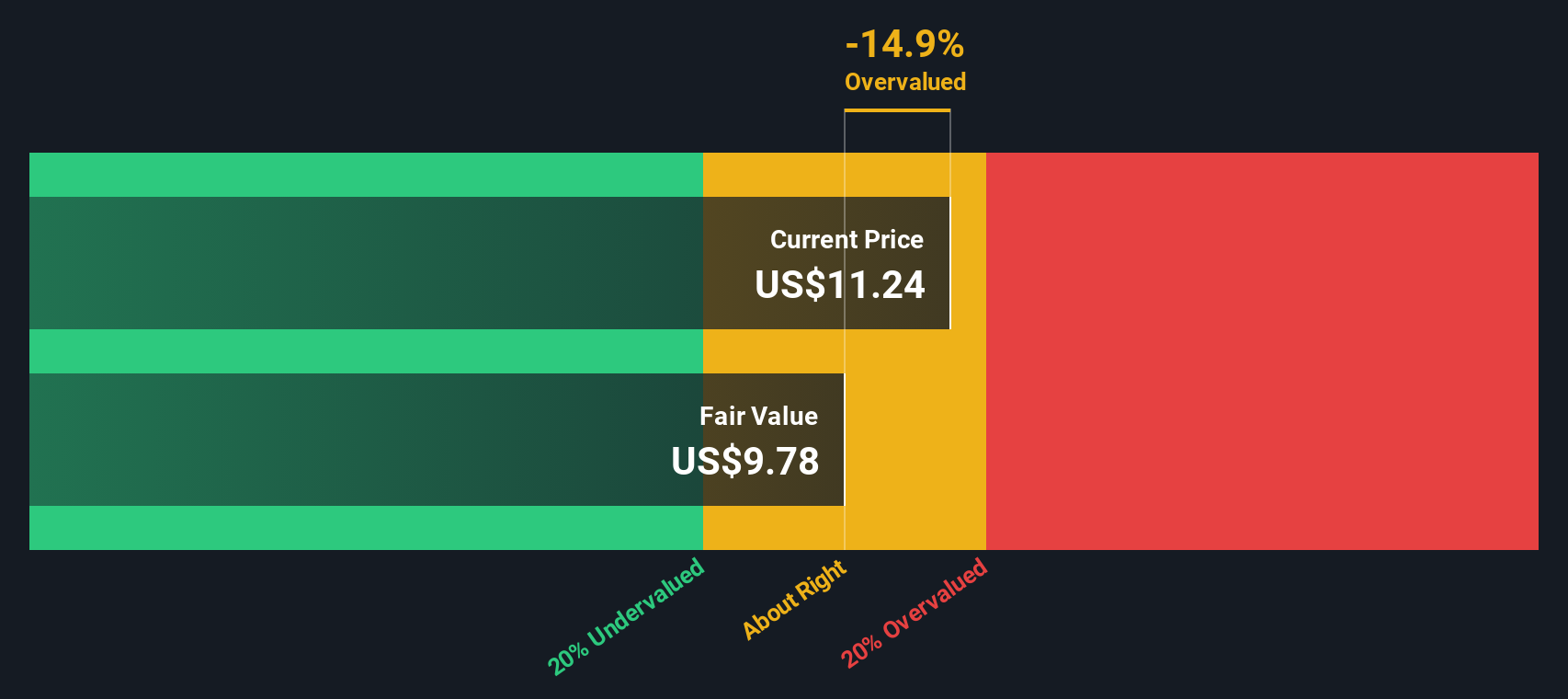

According to the narrative favored by most analysts, Hawaiian Electric Industries is currently priced slightly above its estimated fair value. The stock is seen as marginally overvalued when weighed against future earnings and other fundamental assumptions.

"Recent Hawaii legislation enabling wildfire liability caps, state funding for settlements, and securitization of wildfire safety investments significantly reduces legal and financial risk exposure while supporting large-scale infrastructure upgrades. This is likely to stabilize earnings and improve net margins."

Curious what’s driving this valuation call? The story is packed with ambitious growth projections and concrete financial milestones baked into the forecast. Want to see which game-changing numbers are setting the tone for the future? Dive in to uncover the key assumptions and the dramatic financial turnaround that analysts are expecting to fuel this price estimate.

Result: Fair Value of $11.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing wildfire liabilities and rising costs remain serious threats. These factors could potentially undermine earnings and delay any sustained turnaround for Hawaiian Electric Industries.

Find out about the key risks to this Hawaiian Electric Industries narrative.Another View: Our DCF Model Sees Value

Looking at the numbers through the lens of our DCF model tells a different story. Instead of overvaluation, this method places Hawaiian Electric Industries well below its fair value. Is the market missing something? Alternatively, are DCF assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hawaiian Electric Industries Narrative

If these perspectives don’t quite fit your investment playbook, you’re free to dive into the details and shape your own in just minutes. Do it your way

A great starting point for your Hawaiian Electric Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Unlock your next winning stock by searching beyond the usual suspects. There is a world of untapped potential that Simply Wall Street’s powerful screeners can help you access right now.

- Spot undervalued gems trading below their true worth, and get started right here with {undervalued stocks based on cash flows}.

- Access stable income options that offer yields above 3%, with a tailored search through {dividend stocks with yields > 3%}.

- Leap into tomorrow’s tech frontrunners by filtering for cutting-edge companies at the heart of artificial intelligence, notably with {AI penny stocks}.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hawaiian Electric Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HE

Hawaiian Electric Industries

Engages in the electric utility business in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives