- United States

- /

- Electric Utilities

- /

- NYSE:FE

FirstEnergy (NYSE:FE) Faces Activist Push On Lobbying Disclosure Ahead Of May 21 Meeting

Reviewed by Simply Wall St

FirstEnergy (NYSE:FE) saw a 4% price move over the past month, a period marked by rising investor activism and broader market volatility. The shareholder proposals submitted by John Chevedden, urging increased transparency on lobbying activities, were countered by the board's recommendation to vote against them. This ongoing governance debate coincides with a landscape of steep market declines, as major indexes entered correction territory following tariff announcements from the Trump administration. Despite the market downturn, FirstEnergy reaffirmed its commitment to shareholders with a planned dividend increase, contributing to its relatively positive monthly performance amidst the broader drop.

Be aware that FirstEnergy is showing 2 possible red flags in our investment analysis.

FirstEnergy's total shareholder returns over the last five years amounted to 13.47%. During this period, the company focused heavily on infrastructure investments, exemplified by its Energize365 program, which underscores a commitment to improving infrastructure reliability with a US$28 billion investment through 2029. Despite facing challenges such as regulatory uncertainties and rising financing costs, FirstEnergy has maintained its credit quality and diversified funding, aiming to sustain earnings growth.

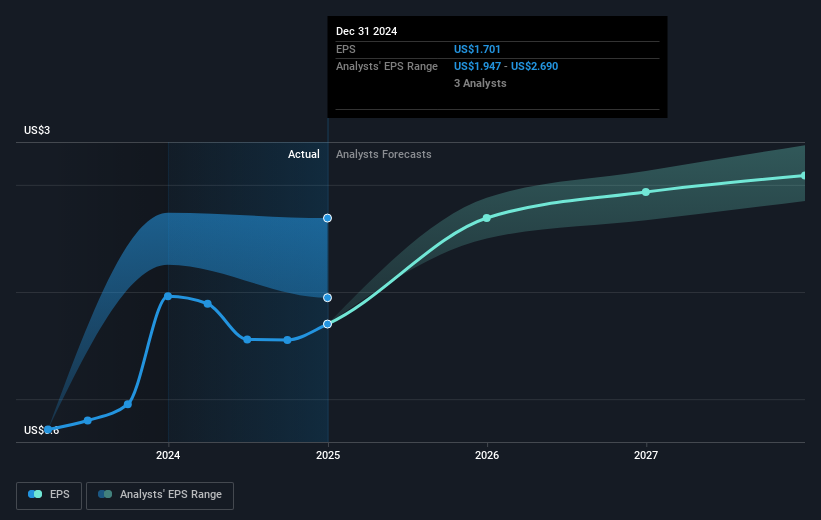

Amidst these developments, the company witnessed fluctuations in earnings and margins; for example, 2024 saw a reduction in net income to US$978 million and earnings per share to US$1.70, contributing to its underperformance relative to the broader US market and the Electric Utilities industry over the past year. Nevertheless, FirstEnergy continued to prioritize shareholder value, reflected in its recent dividend increase and guidance for 2025, supporting its commitment to reliable service and growth.

Examine FirstEnergy's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Second-rate dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives