- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Should You Rethink Entergy After Its 26% Surge and Clean Energy Momentum in 2025?

Reviewed by Bailey Pemberton

If you are trying to figure out whether Entergy’s stock still has room to run or if the best gains are behind it, you’re not alone. Investors have watched this utility company’s share price surge an impressive 26.3% so far this year, outpacing much of the broader market. Over the past twelve months, the return stands at a remarkable 50.2%, while the three- and five-year marks show total returns of 113.6% and 115.2%, respectively. That’s not just solid performance for a utility; it may signal shifting expectations around Entergy’s growth and risk profile.

Zooming in, last month alone saw the stock climb 7.7%, though it’s basically flat in the past week. Some recent market optimism around the utility sector’s role in the clean energy transition and resilience against economic headwinds may be fueling new interest. Yet, the big question lingers: at a closing price of $95.26, is Entergy still a bargain, or is much of the upside already priced in?

Our valuation score, a quick tally out of 6 different yardsticks for undervaluation, gives Entergy a 2 this time. That means it only passes 2 out of 6 major checks, suggesting it may not be as under-the-radar as before. But traditional valuation metrics are only one part of the story. Next, we will break down these approaches, and later in the article, I’ll share an even more insightful way to judge the true value of Entergy’s stock.

Entergy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Entergy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model, or DDM, estimates a company’s intrinsic value by projecting future dividend payments and discounting them back to the present. This approach is especially relevant for utility companies like Entergy, where dividends are a core part of shareholder returns.

For Entergy, recent data show an annual dividend per share of $2.64 with a payout ratio of 64.5%. The company’s return on equity stands at 10.7%, suggesting it maintains a reasonable level of profitability while still distributing a substantial chunk of earnings to investors. Importantly, analysts and modelers have capped long-term dividend growth at 3.08%, a slight downward adjustment from previous assumptions of 3.79%, reflecting a cautious approach to future increases.

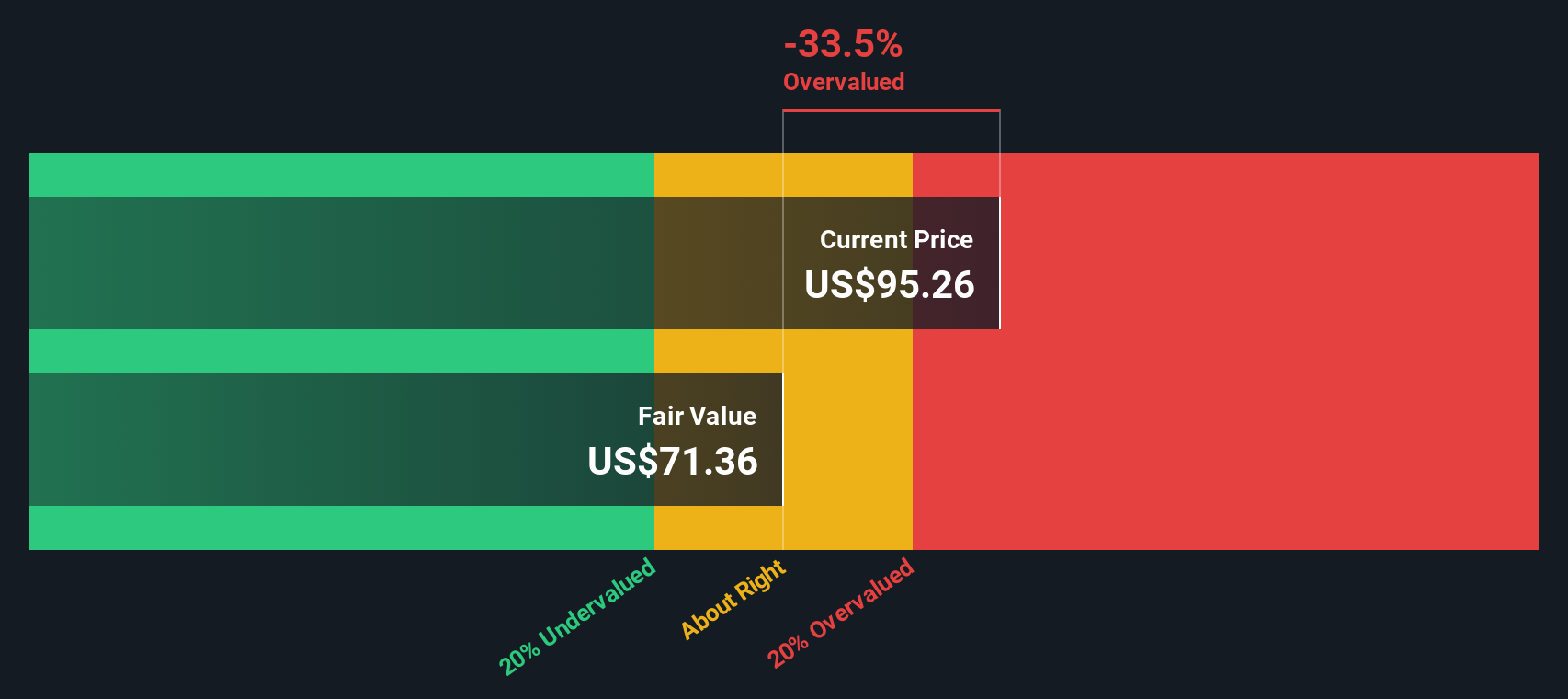

Based on these assumptions, the DDM calculates Entergy’s intrinsic value at $71.36 per share. Since the current share price sits at $95.26, the model signals the stock is about 33.5% overvalued according to this method. This suggests much of Entergy’s future dividend growth could be already priced in, so new investors may want to approach with caution.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Entergy may be overvalued by 33.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Entergy Price vs Earnings

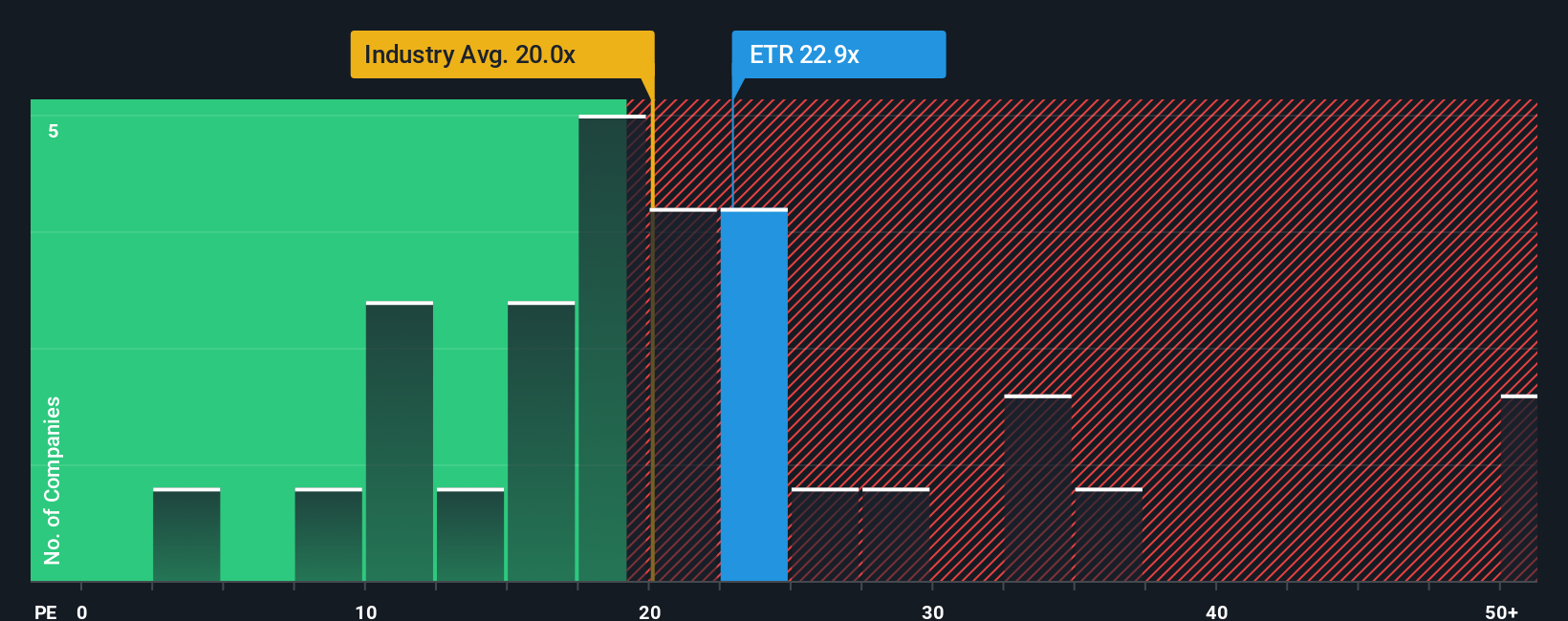

The price-to-earnings (PE) ratio is a widely used valuation method for profitable companies like Entergy, since it shows how much investors are willing to pay for each dollar of earnings. This metric helps gauge whether the stock price reflects the company's current and expected profitability.

Growth prospects and risk play a key role in what counts as a “fair” PE ratio. High-growth, stable companies can usually justify a higher PE, while slower-growing or riskier firms tend to trade on lower multiples. Comparing Entergy’s PE ratio to those of its industry peers and the broader utilities sector provides some initial context for valuation.

Entergy currently trades at a PE ratio of 24.16x. This is above the electric utilities industry average of 21.14x, but below the peer group average of 31.01x. However, using comparisons alone does not always capture the full picture. That is where Simply Wall St’s Fair Ratio comes in, as it adjusts for Entergy's specific growth outlook, profitability, size, and risk, delivering a more customized benchmark. Entergy’s Fair Ratio is calculated at 24.50x, very close to where the stock currently trades.

Since the difference between Entergy’s actual PE and its Fair Ratio is minimal, this suggests the stock is valued about right relative to its earnings power and risk profile, even if simple peer comparisons might say otherwise.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Entergy Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story or perspective you have about a company like Entergy, reflecting the reasons and assumptions behind your fair value estimates, including forecasts for revenue, profit, and margins. Narratives are powerful because they connect Entergy’s unique story with your financial forecast and translate those views into a clear fair value that you can use for buy or sell decisions.

Narratives are easy to build and track on Simply Wall St’s Community page, which is used by millions of investors globally, and are updated automatically as fresh news and earnings are released. By comparing your Narrative’s fair value with the current market price, you can see at a glance whether you think Entergy is overvalued or undervalued, and adapt when circumstances change.

For example, some investors’ Narratives about Entergy are bullish, setting fair values as high as $109 based on expectations for rapid Gulf South infrastructure expansion and robust industrial demand. Others are more cautious, with fair values as low as $67 due to concerns about debt, regulatory risk, or climate vulnerability. With Narratives, you see both the numbers and the reasoning in one place, helping you make better, more confident decisions.

Do you think there's more to the story for Entergy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives