- United States

- /

- Electric Utilities

- /

- NYSE:ES

What Recent Grid Modernization News Means for Eversource Energy’s Stock Outlook in 2025

Reviewed by Bailey Pemberton

If you are wondering whether now is the right moment to reconsider your stance on Eversource Energy stock, you are definitely not alone. With a share price that has climbed 10.3% in the past month and notched a robust 26.0% year to date, there is a growing buzz about Eversource’s potential. That said, it is worth noting the stock saw a mild dip of 1.7% last week, offering a reality check and maybe even an opportunity for keen-eyed investors. Over the past year, shares are up a healthy 15.3%, though the longer-term 5-year return sits at a less impressive -5.4%, a reminder of this market’s cyclical nature and shifting investor sentiment.

Much of the recent movement appears rooted in ongoing conversations about infrastructure investment and renewable energy policy, which can drive revaluations across the utility sector. For Eversource, these macro forces are mixing with heightened market attention, sparking debates over whether the company is now bargain-priced or still waiting for a true catalyst.

From a valuation standpoint, Eversource scores a 3 out of 6 on our value check system. In other words, it comes up as undervalued in half of the key measures we analyze, signaling there might be some overlooked upside or areas for caution depending on your perspective.

Let’s dive deeper into those valuation approaches to see what is really driving that score and stick around for an even smarter way to think about valuation strategies as we wrap up the analysis.

Why Eversource Energy is lagging behind its peers

Approach 1: Eversource Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them to today’s dollars. This offers an objective approach to long-term valuation and helps investors see what a company may realistically be worth based on its ability to generate cash.

Eversource Energy’s current Free Cash Flow (FCF) over the last twelve months is negative at -$1.18 Billion, reflecting recent investments or capital expenditures. Looking ahead, analyst and internal estimates forecast a significant turnaround in cash generation, with FCF projected to reach $2.72 Billion in 2035. These projections are based on a 2 Stage Free Cash Flow to Equity model, which uses analysts’ data for the first five years and then extrapolates further using historical performance and industry trends.

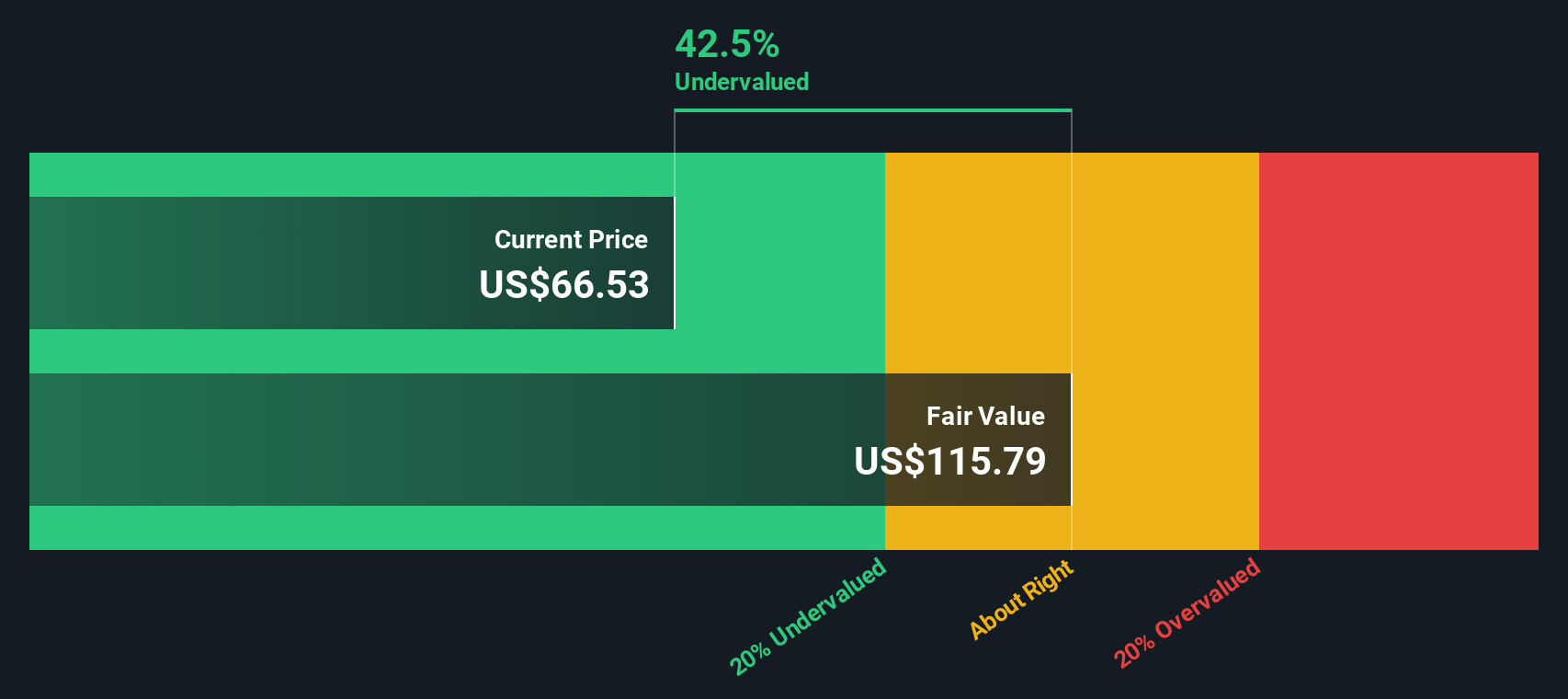

When these projected cash flows are discounted back to present value, the DCF model estimates Eversource Energy’s intrinsic value at $116.68 per share. According to the DCF model, the stock is trading at a 38.1% discount, which suggests that Eversource Energy may be undervalued compared to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eversource Energy is undervalued by 38.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Eversource Energy Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a core tool for valuing profitable companies like Eversource Energy, because it links a company’s market price to its actual earnings, giving investors a sense of how much they are paying for every dollar of profit. A higher PE usually reflects the market’s expectations for higher growth or lower risk, while a lower PE can mean the opposite. Context is key when making these comparisons.

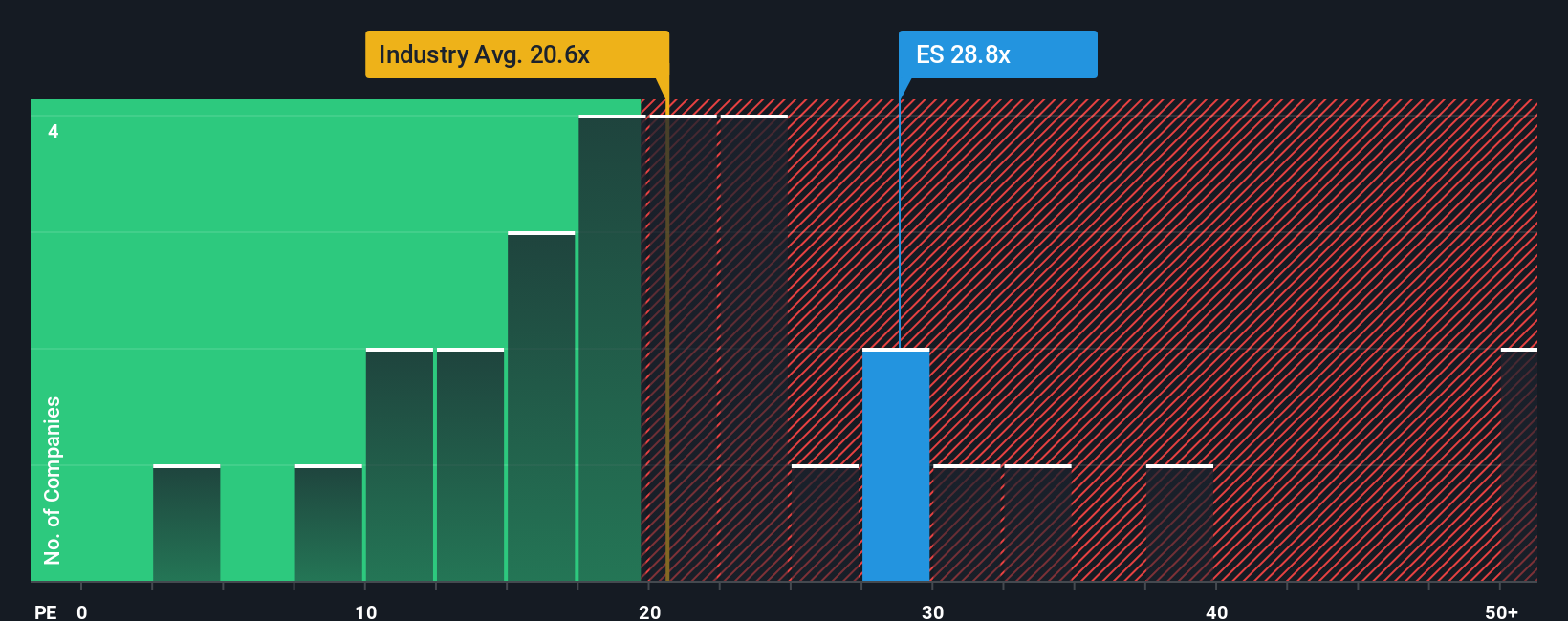

Currently, Eversource Energy trades at a PE ratio of 31.2x. This is slightly below the peer group average of 32.7x, but considerably above the broader electric utilities industry average of 21.4x. On the surface, this might suggest the stock is valued higher than most utilities, possibly due to market expectations for better earnings growth or stability.

To provide a more tailored benchmark, Simply Wall St’s "Fair Ratio" takes into account factors like Eversource’s projected earnings growth, its industry and market cap, as well as company-specific risks and profit margins. In Eversource’s case, the Fair Ratio stands at 25.4x, which is notably below both its current valuation and its peers. This approach offers a clearer lens than industry or peer comparisons alone because it aligns valuation expectations with fundamentals unique to the company.

Given that Eversource’s current PE ratio (31.2x) is well above its Fair Ratio (25.4x), the evidence suggests the stock is trading at a premium relative to what its earnings profile would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eversource Energy Narrative

Earlier we mentioned a better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your own investment story for a stock—how you see Eversource Energy’s business, what you expect for its future revenues and margins, and what you believe is a fair value. Narratives bridge the gap between facts and forecasts by linking your perspective on the company’s future to a clear financial outlook and actionable fair value estimate. They are easy to use on Simply Wall St’s platform, where millions of investors build and share Narratives on the Community page. This enables anyone to bundle their reasoning, assumptions, and forecasts in one accessible view.

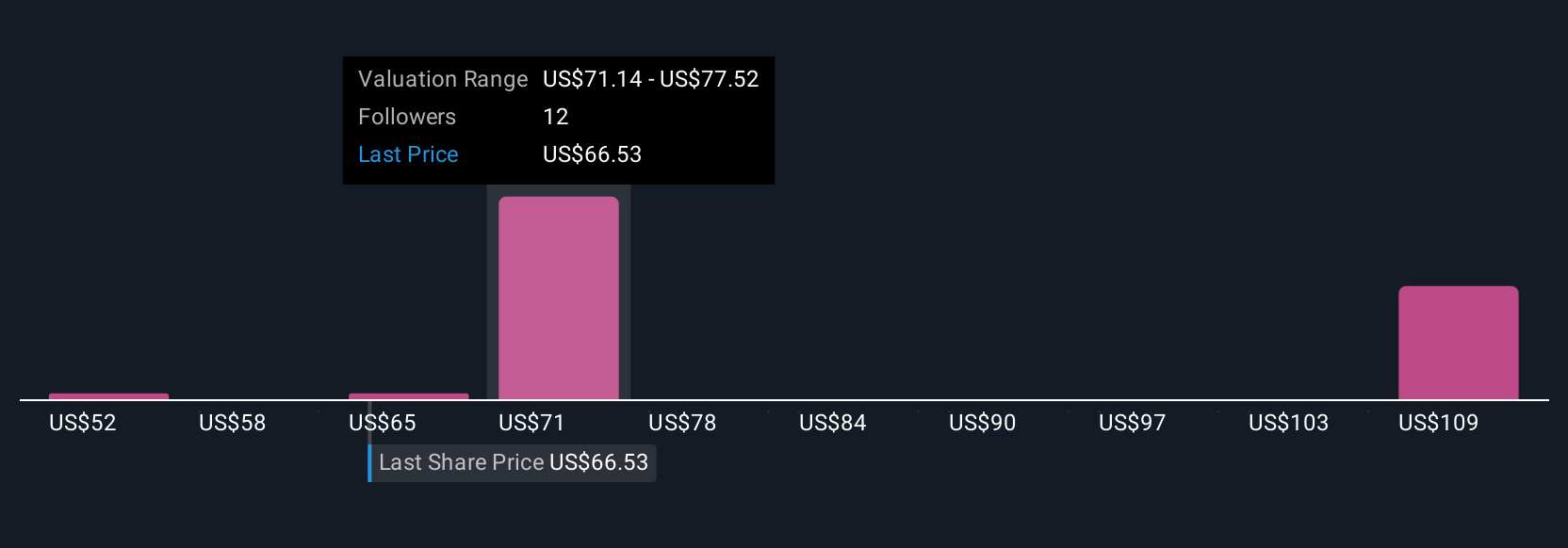

Narratives help investors make clear buy or sell decisions by comparing their fair value with the current price, dynamically updating when news or earnings change the outlook. For example, some investors might be optimistic that grid modernization and regulatory support will drive significant earnings growth, leading to a high fair value for Eversource Energy. Others, who are more cautious about regulatory risks and financing pressures, may set a much lower fair value. No matter your outlook, Narratives turn complex information into a simple roadmap for smarter investing.

Do you think there's more to the story for Eversource Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)