- United States

- /

- Electric Utilities

- /

- NYSE:ES

Eversource Energy's Valuation in Focus as US Weighs Clean Energy Funding Cuts and Offshore Wind Exit

Reviewed by Kshitija Bhandaru

The U.S. administration is weighing a $12 billion cut to clean energy funding, which injects added uncertainty for Eversource Energy (ES) and peers, especially as it adapts after leaving its offshore wind partnership.

See our latest analysis for Eversource Energy.

Shares of Eversource Energy have rebounded, with a 13% 1-month share price return and a 26% gain year-to-date, as investors weigh both policy headwinds and the company’s recent shift away from offshore wind. However, the 1-year total shareholder return sits at 19%, signaling steady but not runaway momentum. This comes as clean energy funding uncertainty continues to shape sentiment.

If you’re interested in exploring what else is energizing the market, now’s the perfect chance to discover fast growing stocks with high insider ownership

With shares rebounding and policy headwinds looming, investors are now faced with a key question: Is Eversource Energy undervalued at current levels, or is the market already anticipating the company's forward growth prospects?

Most Popular Narrative: 2% Overvalued

Compared to the last close price of $72.35, the most widely followed narrative pegs Eversource Energy’s fair value only slightly lower at $70.77. This suggests the stock is trading just above what analysts see as justified. This small premium creates tension in how sustainable the recent rebound really is.

Positive legislative and regulatory developments, such as the passage of Senate Bill 4 in Connecticut and constructive rate case outcomes in both New Hampshire and Massachusetts, are enhancing visibility for cost recovery and capital deployment and supporting long-term earnings and cash flow stability.

Is Eversource’s fair value really just a matter of regulatory wins and infrastructure plans? The full narrative exposes bold analyst assumptions about growth, margins, and future earnings. Only a deep dive reveals which financial gears could push the value much higher or hold it back. Don’t miss what’s lurking beneath the surface.

Result: Fair Value of $70.77 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in asset sales or unexpected regulatory setbacks could quickly shift projections and cast doubt on Eversource’s current outlook for earnings growth.

Find out about the key risks to this Eversource Energy narrative.

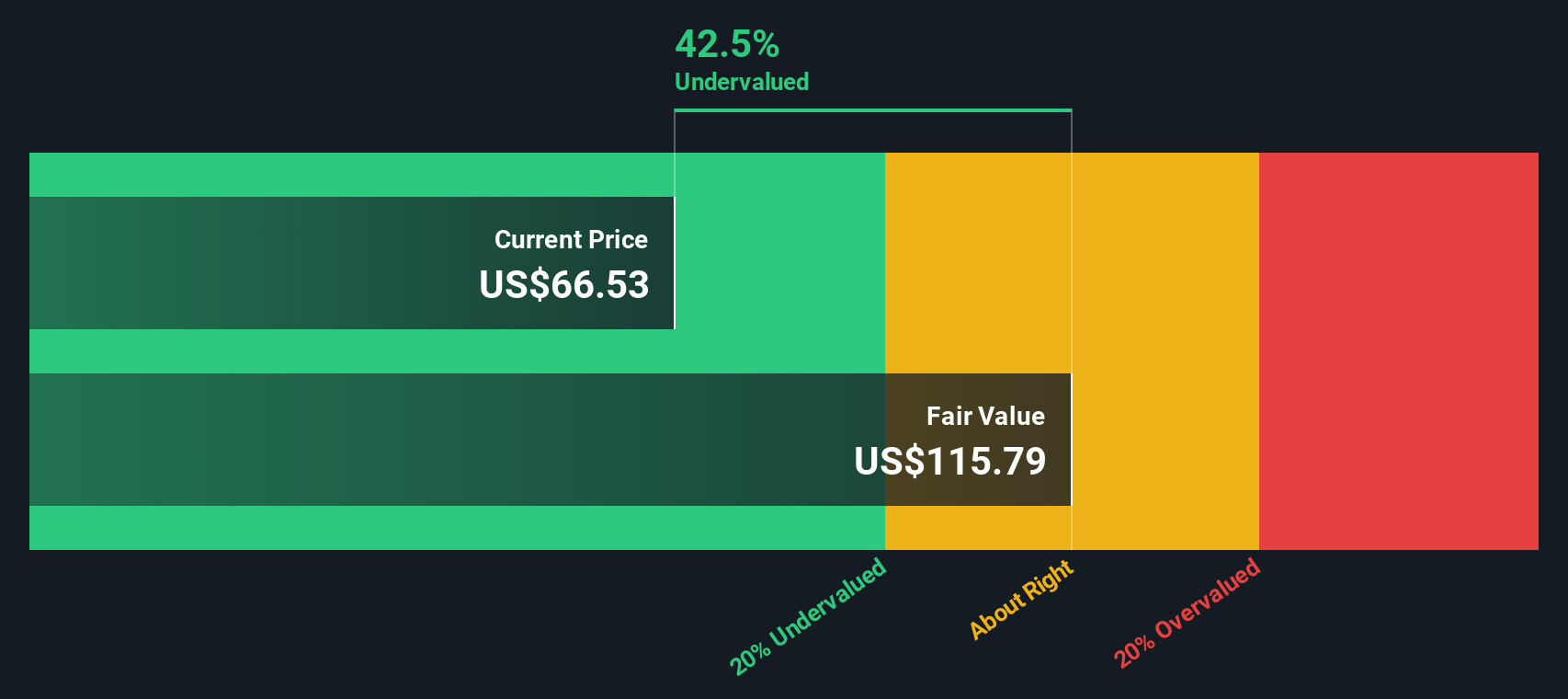

Another Perspective: Discounted Cash Flow Model Says “Undervalued”

While analysts call Eversource Energy slightly overvalued based on future earnings, the SWS DCF model paints a very different picture. According to our DCF analysis, Eversource's shares are actually trading well below estimated fair value. This is a significant disconnect. Could the market be missing something deeper in the company’s cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eversource Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eversource Energy Narrative

If you want to dig into the numbers yourself or see a different story in the data, you can build your own perspective in under three minutes with Do it your way.

A great starting point for your Eversource Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t let great opportunities slip past you. Expand your portfolio by seeking out stocks primed for growth, strong income, or emerging innovation in today’s market.

- Accelerate your returns and tap into a world of low-priced stocks showing exceptional balance sheets by starting with these 3583 penny stocks with strong financials.

- Unlock passive income streams by zeroing in on businesses offering robust yields above 3% with these 19 dividend stocks with yields > 3%.

- Spot companies at the forefront of artificial intelligence innovation by using these 24 AI penny stocks to find those defining the next wave of tech-driven change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)