- United States

- /

- Electric Utilities

- /

- NYSE:ES

Eversource Energy (NYSE:ES) Urges Shareholders to Vote Against Independent Chairman Proposal

Reviewed by Simply Wall St

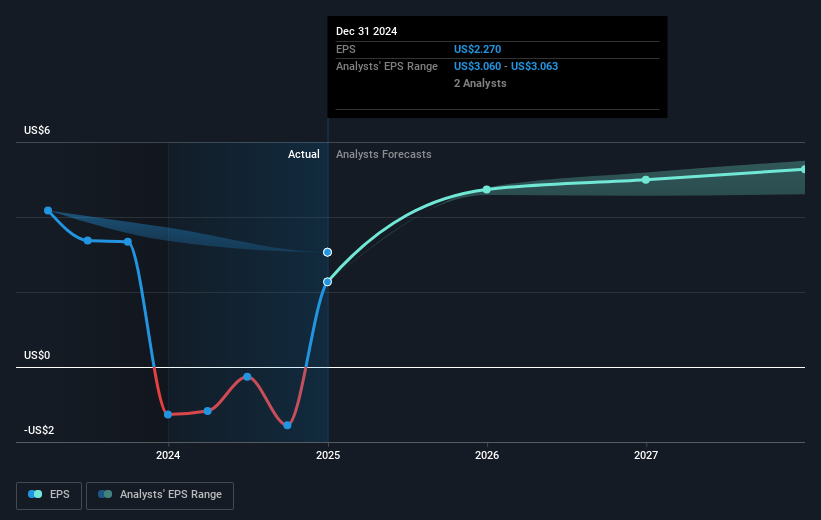

Eversource Energy (NYSE:ES) recently stirred investor interest with its firm opposition to proposals for an independent chairman, ahead of its annual meeting. This governance debate, coinciding with a quarterly share price increase of 8%, reveals the company’s strategic focus on leadership stability. Major financial results, such as a turnaround in net income to $72 million from a prior loss, further support this appreciation. Eversource's proactive shareholder engagement occurred amid a market decline influenced by broad tariff concerns that sent Dow Jones into correction territory, underscoring the company’s resilience against a backdrop of economic unease.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, Eversource Energy achieved a total return of 10.13%, including share price appreciation and dividends. Despite underperforming the broader US Electric Utilities industry, which recorded a 20.8% increase, key corporate developments may explain Eversource's performance. The sale of Aquarion Water for US$2.4 billion aided debt reduction, strengthening financial stability during this period. Also, significant capital commitment to infrastructure, exemplified by the groundbreaking of the Greater Cambridge Energy Program, underscored a focus on enhancing grid resilience.

Moreover, the company's engagement in investor relations included robust measures like the proxy statements opposing proposals to separate leadership roles, emphasizing governance continuity. These initiatives coincided with improved profitability, where net income shifted positively from a prior loss to US$811.65 million. Finally, enhanced shareholder returns were supported by dividend increases, reflecting a commitment to reward investors during a challenging market. All these aspects contributed to the company's financial performance over the year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives