- United States

- /

- Electric Utilities

- /

- NYSE:EIX

Edison International (NYSE:EIX) Announces Annual Earnings Growth Offers 2025 EPS Guidance Declares US$1 Dividend

Reviewed by Simply Wall St

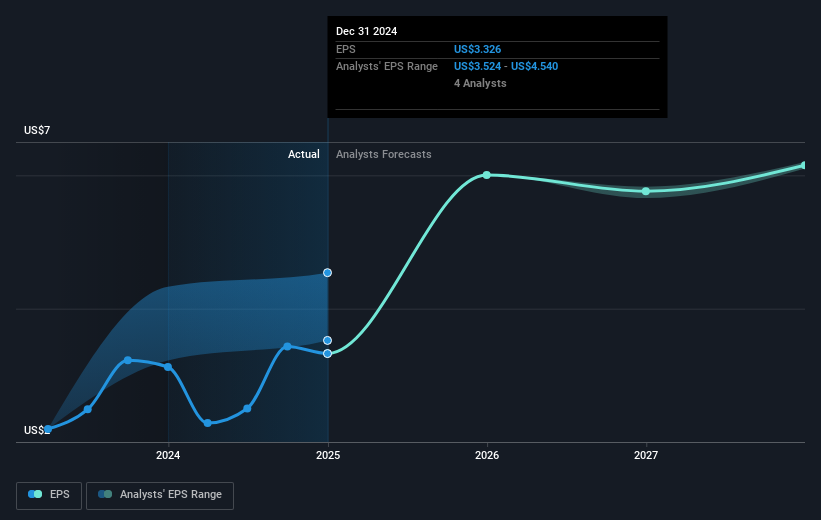

Edison International (NYSE:EIX) experienced a 1% decline in its share price last week, despite announcing positive earnings results for 2024, with sales increasing to $17,599 million from $16,338 million in the previous year. The company's net income rose to $1,284 million, and its earnings per share also showed growth. A quarterly dividend declaration of $0.83 per share underscores its commitment to shareholder value. However, broader market trends, including a 4.8% decline, may have influenced its performance. Investors faced an uncertain economic backdrop characterized by volatile market conditions and potential tariff impacts. While major indexes like the S&P 500, Dow, and Nasdaq were set to close the month with losses, the easing of inflation eased some concerns. These factors, along with the company's stable 2025 EPS guidance, could contribute to the nuanced picture of Edison’s recent performance amid market fluctuations.

Click here and access our complete analysis report to understand the dynamics of Edison International.

The last 5 years have seen Edison International's total shareholder return fall 7.26%. During this period, the company's performance was affected by various factors. A significant one-off loss of US$912 million significantly impacted the financial results for the year ending September 2024. Additionally, Edison faced legal challenges with lawsuits involving wildfire risks, which may have contributed to shareholder concerns. In the same timeframe, earnings growth slowed, leading to performance below the growth rate of the broader US market and the Electric Utilities industry. Though the company trades at a good valuation compared to peers, these factors likely influenced the overall return.

Despite challenges, Edison achieved annual earnings growth of 10.4% over the past five years, showcasing some resilience. Its dividend policy also remained robust, with an increase to US$0.8275 per share in January 2025. However, these positive aspects were overshadowed by underperforming returns compared to the 16.9% rise in the US market and a 29.6% increase in the Electric Utilities industry over the past year.

- Learn how Edison International's intrinsic value compares to its market price with our detailed valuation report.

- Uncover the uncertainties that could impact Edison International's future growth—read our risk evaluation here.

- Already own Edison International? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edison International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EIX

Edison International

Through its subsidiaries, engages in the generation and distribution of electric power.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives