- United States

- /

- Other Utilities

- /

- NYSE:ED

Consolidated Edison (ED): Assessing Valuation After Quarterly Revenue and Earnings Beat Expectations

Reviewed by Simply Wall St

If you’re weighing what to do with Consolidated Edison stock today, you’re not alone. The utility giant just posted quarterly results that beat investor expectations on nearly every front. Electric revenue rose 8.9%, gas surged by 22%, and steam jumped more than 20%. Net income for the period climbed almost 22% year-over-year to $246 million, well ahead of usual forecasts. Yet, despite these strong numbers across all its core business lines, shares actually dipped following the announcement, leaving many long-time holders and prospective buyers scratching their heads.

This curious reaction comes after a mixed period for Consolidated Edison. While shares have delivered a respectable 9% gain so far this year, the stock is still down roughly 3% over the past year. Longer-term, ED has quietly outperformed, with a return of 58% over five years. Compared to several quarters with more modest top-line growth, this latest report seemed like the kind of catalyst that could spark renewed optimism. However, for a slow and steady name like Consolidated Edison, recent price action suggests investors remain cautious.

So after a solid recent run and a standout quarter, should investors treat the dip as a buying opportunity, or is the market already factoring in all of Consolidated Edison’s future growth?

Price-to-Earnings of 18.2x: Is it justified?

Consolidated Edison is currently valued at a Price-to-Earnings (P/E) ratio of 18.2x, which is below the average for its peers but above the average for the broader industry. This suggests that, compared to similar companies, investors may see the stock as offering better value on an earnings basis. However, it does trade at a slight premium to the global integrated utilities sector.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. For a major utility like Consolidated Edison, which offers reliable but moderate earnings growth, the P/E ratio is a key benchmark for assessing whether the stock is fairly priced relative to both its sector and the broader market.

Given Consolidated Edison's consistent earnings and recent growth outperformance versus peers, the lower P/E ratio compared to the peer average could indicate an attractive entry point for value-focused investors. At the same time, the fact that its multiple is above the wider industry's average means expectations are still relatively high for steady future performance.

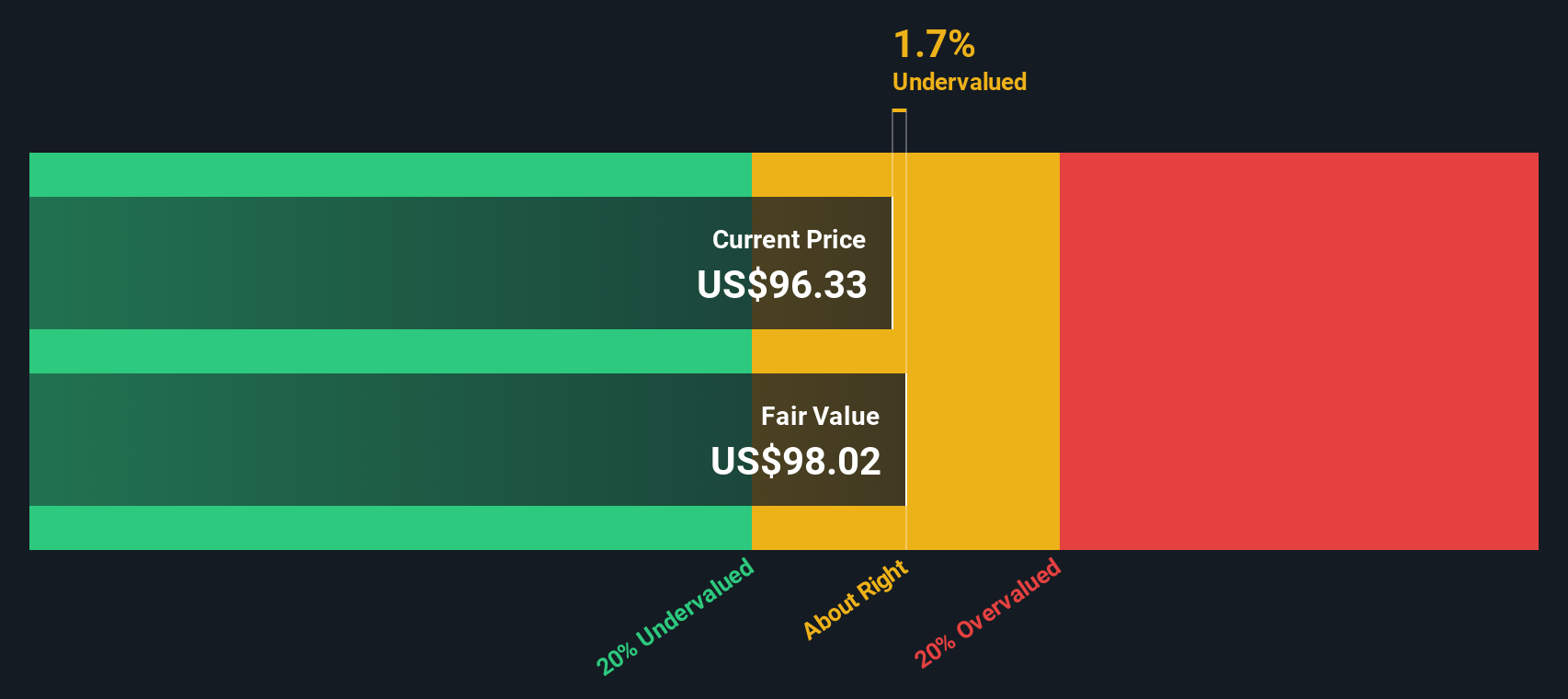

Result: Fair Value of $98.02 (ABOUT RIGHT)

See our latest analysis for Consolidated Edison.However, slower annual revenue growth and recent negative price momentum could dampen optimism. This situation reminds investors that strong fundamentals do not guarantee near-term gains.

Find out about the key risks to this Consolidated Edison narrative.Another View: Our DCF Model’s Take

Looking at our SWS DCF model, the result closely aligns with the first valuation. This reinforces the idea that the current price is fair, rather than deeply undervalued or overvalued. However, could something be missing from both approaches?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Consolidated Edison Narrative

If you see things differently or want to investigate further, you can easily develop your own take backed by the latest numbers in just minutes. Do it your way

A great starting point for your Consolidated Edison research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more standout investment ideas?

Smart investors are always one step ahead. If you want fresh opportunities beyond Consolidated Edison, check out these unique market themes right now and put your capital to work where it matters most.

- Uncover high-potential value plays that could be undervalued today by following our picks for undervalued stocks based on cash flows.

- Fuel your portfolio’s long-term income with handpicked companies offering dividend stocks with yields > 3% and reliable payout records.

- Ride the innovation wave as artificial intelligence transforms industries and back the trailblazers behind AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives