- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Evaluating Valuation as Upgrades and Earnings Momentum Drive Investor Focus

Reviewed by Kshitija Bhandaru

Duke Energy is getting a lot of investor attention right now as the company prepares to release third-quarter earnings in early November. Analysts have been revising estimates upward, and recent activity such as the $2 billion shelf registration and sustained clean energy investments are supporting momentum in the stock.

See our latest analysis for Duke Energy.

Duke Energy’s share price has quietly built strong momentum this year, with a 17.81% gain year-to-date and a recent push supported by news of strategic investments, state policy tailwinds, and infrastructure upgrades. Total shareholder return also stands out, up 65% over three years, signaling that investors are rewarding the company’s long-term focus and reliable dividend in addition to near-term optimism.

If you’re looking to spot other companies showing this kind of steady momentum and growth focus, now’s a great chance to discover fast growing stocks with high insider ownership

But with shares near all-time highs and analysts lifting price targets, the key question for investors is whether Duke Energy remains undervalued, or if the market is already pricing in these growth drivers as fully as possible.

Most Popular Narrative: 4.9% Undervalued

Duke Energy’s most popular narrative values the company just above its latest closing price of $127.02, suggesting only a modest gap remains between market price and consensus fair value. This sets the stage for a focused debate on how much further the stock can run.

Major economic development wins (e.g., AWS's $10B data center in North Carolina), paired with accelerated migration and manufacturing demand in Duke's service territory, are expected to drive robust, multi-year load and volume growth. These factors support higher revenues and long-term EPS growth.

Want to know what’s fueling this bullish price target? Analysts are betting on rare growth dynamics and profit margins—the sort you do not usually see in utility stocks. Ready to see which headline numbers could surprise the market and what it would take for investors to agree with this forecast? Read on for the full playbook behind the valuation.

Result: Fair Value of $133.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating customer adoption of solar and batteries, or unexpected regulatory shifts, could quickly weaken Duke Energy's growth outlook and challenge its advantages in its core markets.

Find out about the key risks to this Duke Energy narrative.

Another View: What About the SWS DCF Model?

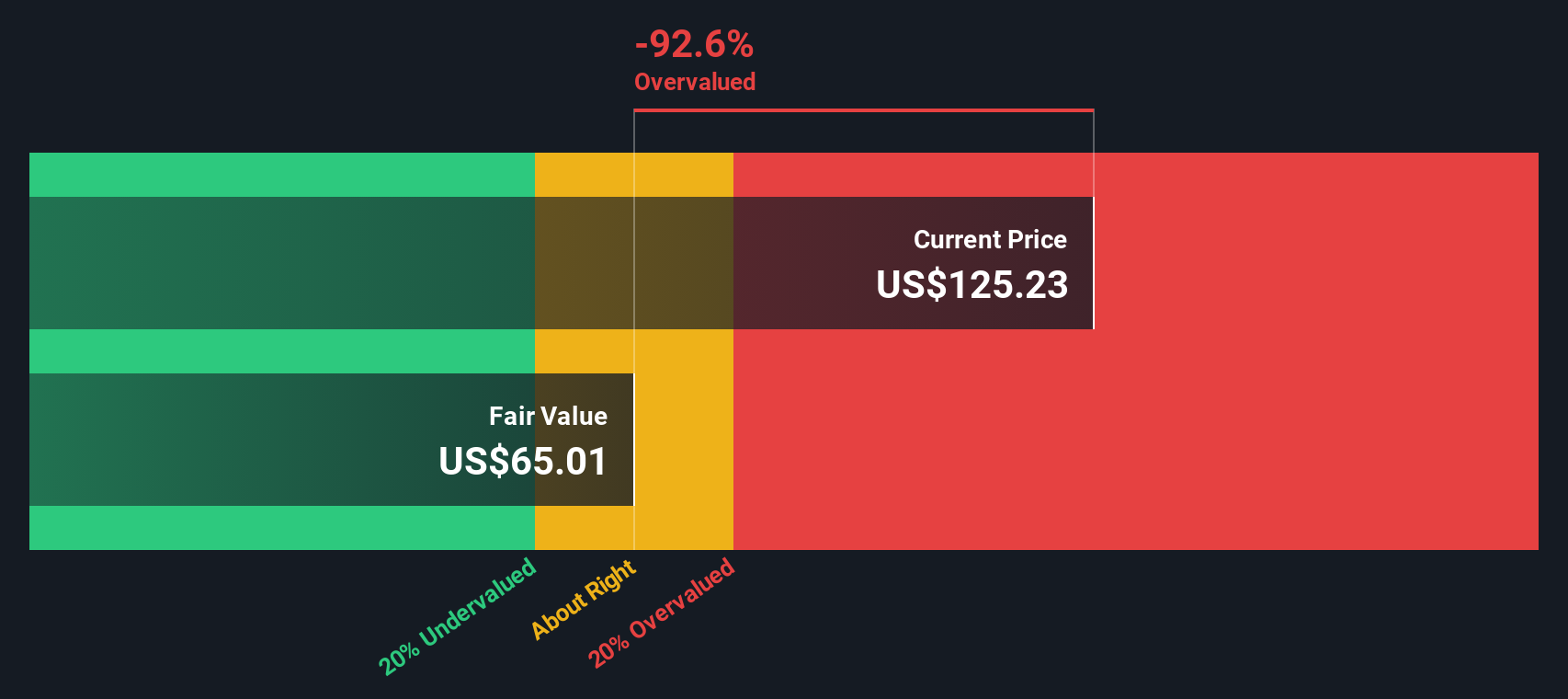

While the current consensus uses analyst forecasts and multiples, our DCF model tells a different story, estimating Duke’s fair value at $65.01, which is about half the current share price. This suggests analysts might be factoring in more optimism than the company’s future cash flows justify. Which outlook will markets trust moving forward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you have a different perspective or want to dive deeper into Duke Energy’s numbers yourself, it’s quick and easy to build a custom narrative in just a few minutes. Do it your way

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead in the market means knowing where the next big opportunity is coming from. Why limit yourself when smarter choices are a click away?

- Boost your portfolio's income potential by checking out these 19 dividend stocks with yields > 3%, which features stocks with attractive yields and stable performance histories.

- Spot emerging industry leaders when you review these 24 AI penny stocks, a resource focused on companies harnessing artificial intelligence for growth and innovation.

- Capitalize on future technologies by browsing these 26 quantum computing stocks, where high-growth quantum computing players are shaping the next tech transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives