- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Assessing Valuation After a Recent Pullback in the Share Price

Reviewed by Simply Wall St

Duke Energy (DUK) has quietly pulled back about 6% over the past month, even as its year to date return is still positive. That divergence may be of interest to long term dividend investors considering an entry point.

See our latest analysis for Duke Energy.

That recent 30 day share price return of about negative 6 percent looks more like a breather than a breakdown, given Duke Energy’s solid year to date share price gains and healthy multi year total shareholder returns that suggest steady, income led momentum rather than a speculative spike.

If Duke’s move has you reassessing utilities’ role in your portfolio, it might also be worth scanning other dependable healthcare stocks that can deliver resilience alongside long term growth potential.

With earnings growing, a solid dividend, and the share price still below Wall Street’s targets, Duke Energy looks reasonably valued but not obviously cheap, leaving investors to ask whether there is a buying opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 15.3% Undervalued

With Duke Energy last closing at $115.30 against a narrative fair value near $136, the current pullback is framed as a potential mispricing, not a structural break.

Significant infrastructure and grid modernization investment (e.g., over $4 billion incremental CapEx in Florida) is positioned to capitalize on growing needs for digitalization and grid resilience, enabling Duke to enhance operational efficiency and reliability, which benefits both net margins and future rate base growth.

Want to see how steady growth assumptions can support a premium multiple for a regulated utility, while still calling it undervalued? The narrative quietly stacks optimistic revenue, margin, and earnings trajectories into a long term compounding story that is not obvious from the headline numbers. Curious which forward profit multiple and discount rate are doing the heavy lifting in that fair value math? Read on to unpack the full valuation playbook behind this call.

Result: Fair Value of $136.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster distributed energy adoption or tighter regulatory outcomes could dent long term load growth, pressure returns, and ultimately challenge that upbeat valuation path.

Find out about the key risks to this Duke Energy narrative.

Another Lens on Value

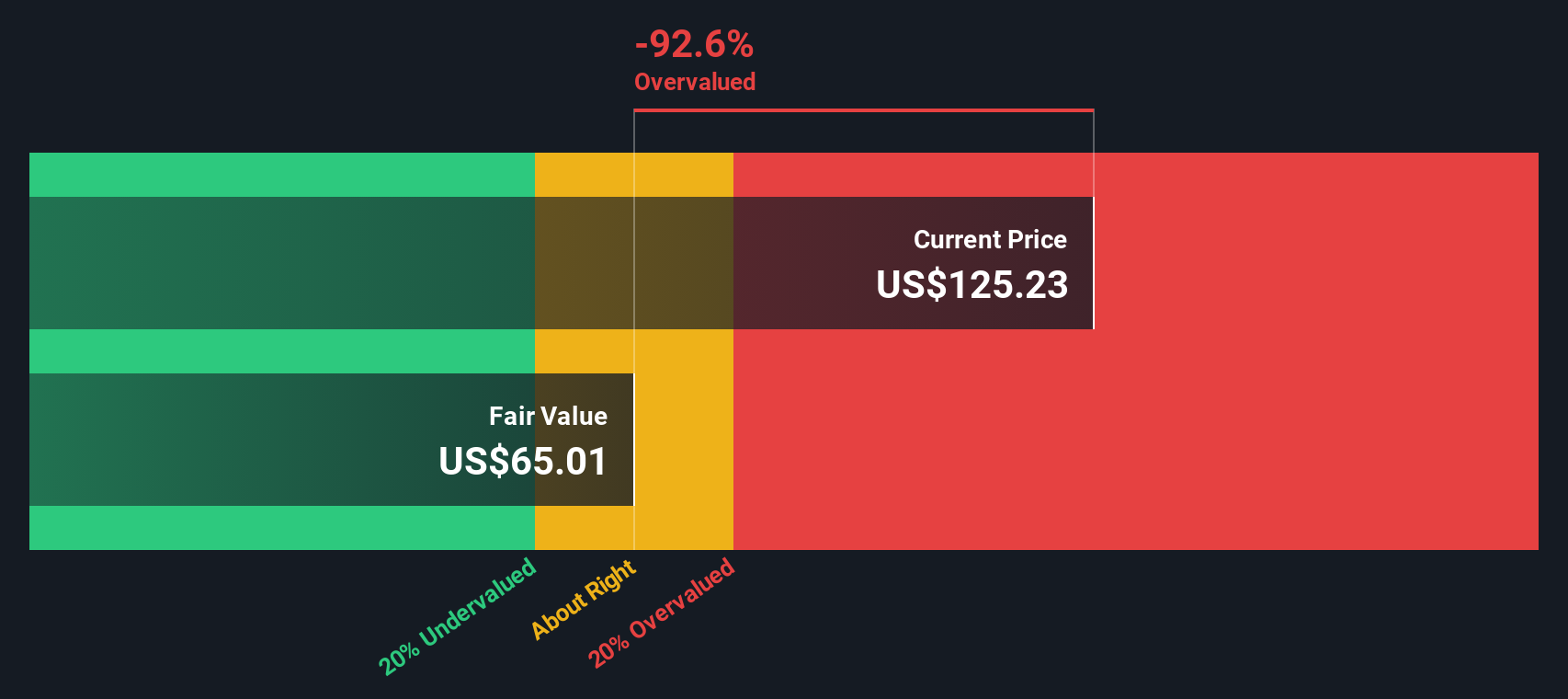

Our DCF model paints a much tougher picture than the narrative fair value. On SWS DCF assumptions, Duke Energy screens as overvalued around $115 versus an estimated fair value near $63, raising the question: are today’s buyers leaning too hard on optimistic growth and rate assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by using the Simply Wall Street Screener to uncover high conviction opportunities that could reshape your portfolio’s long term returns.

- Strengthen your income stream with reliable payers by targeting these 13 dividend stocks with yields > 3% that can help anchor your portfolio through different market cycles.

- Position for the next wave of innovation by focusing on these 27 quantum computing stocks shaping breakthroughs in computing power and real world problem solving.

- Tap into mispriced opportunities by scanning these 908 undervalued stocks based on cash flows where current market pessimism may not match the underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)