- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Does the Recent Grid Modernization Push Make Duke Energy a Smart Pick for 2025?

Reviewed by Bailey Pemberton

If you are keeping a close eye on Duke Energy and debating whether now is the right time to make a move, you are definitely not alone. Over the past year, the stock has displayed a steady upward path, with a 19.3% gain so far this year and a 69.4% total return over the past five years. That is an impressive climb for a company known for its stability, especially given the market shifts we have seen recently.

Much of this positive momentum seems to be fueled by investor confidence in utilities as a relatively safe harbor, particularly as interest rate expectations have started to shift and investors reconsider the appeal of dividend-paying stocks. While Duke Energy's short-term performance, including a 2.7% gain over the last week and 5.1% over the past month, might grab your attention, the real story is how rising demand for energy and ongoing infrastructure investments are being priced into the stock.

But is it still undervalued after such a solid run? Based on six widely used valuation checks, Duke Energy earns a value score of 3, meaning it looks undervalued in half of those measures. That leaves room for discussion, and the real answer depends on how you size up different valuation approaches. Let’s break down what each check reveals. Later, I will share an even smarter way to think about what Duke Energy is actually worth now.

Why Duke Energy is lagging behind its peers

Approach 1: Duke Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation approach that estimates a stock's intrinsic value based on its future dividend payouts, assuming those dividends are the primary source of returns. This model works well for established, dividend-paying companies like Duke Energy because it lets investors weigh the sustainability and expected growth of those dividends over time.

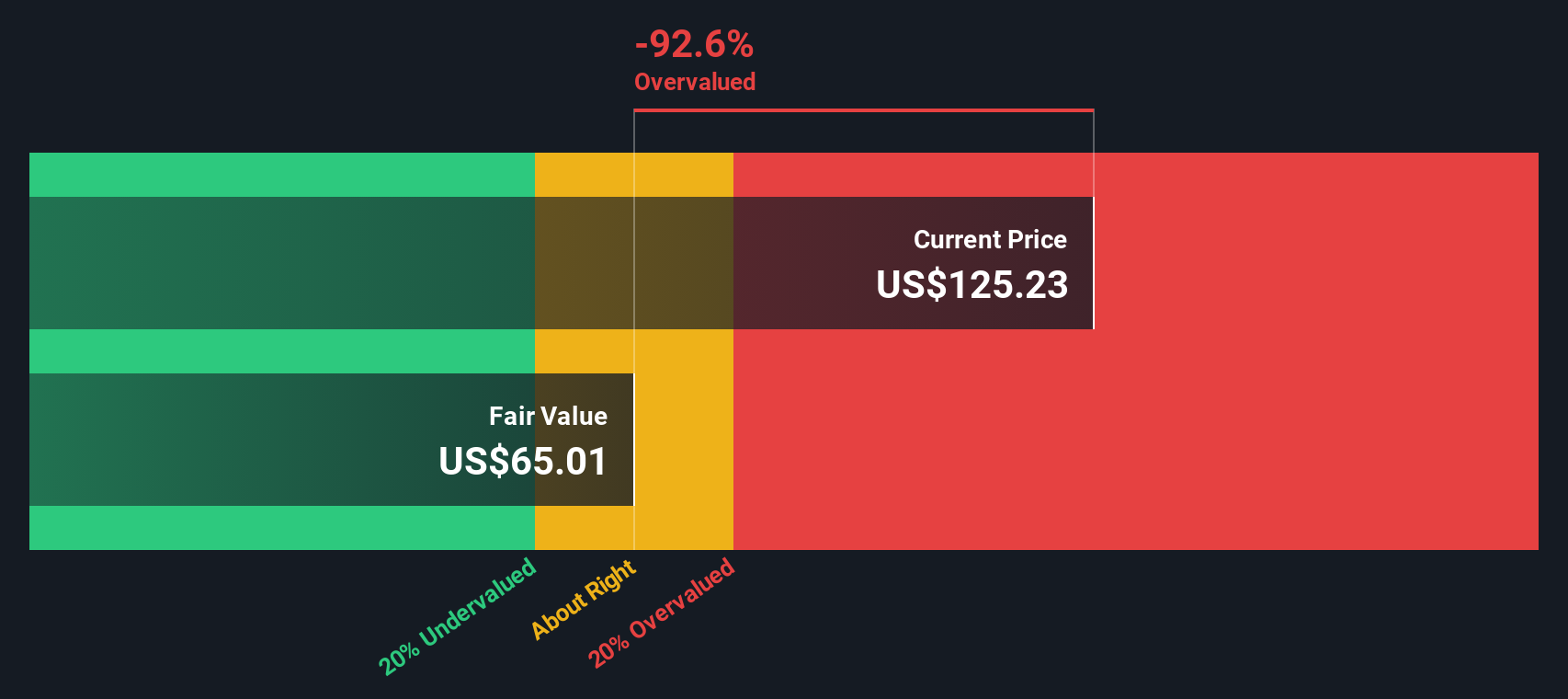

Looking at Duke Energy, the company currently pays an annual dividend per share (DPS) of $4.51. Notably, its payout ratio sits at 101.89%, meaning Duke is paying out nearly all of its earnings as dividends, or even a bit more. The calculated return on equity (ROE) stands at 8.48%. However, when applying the DDM formula, which multiplies the retained earnings ratio by ROE, we land at a projected long-term dividend growth rate of -0.16%. This suggests that, based on current fundamentals, dividend growth is expected to be slightly negative going forward.

Using these factors, the DDM estimates Duke Energy’s fair value at $65.01 per share. By comparison, the current market price is roughly 97.9% higher than this estimate, implying the stock is significantly overvalued according to this model.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Duke Energy may be overvalued by 97.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Duke Energy Price vs Earnings

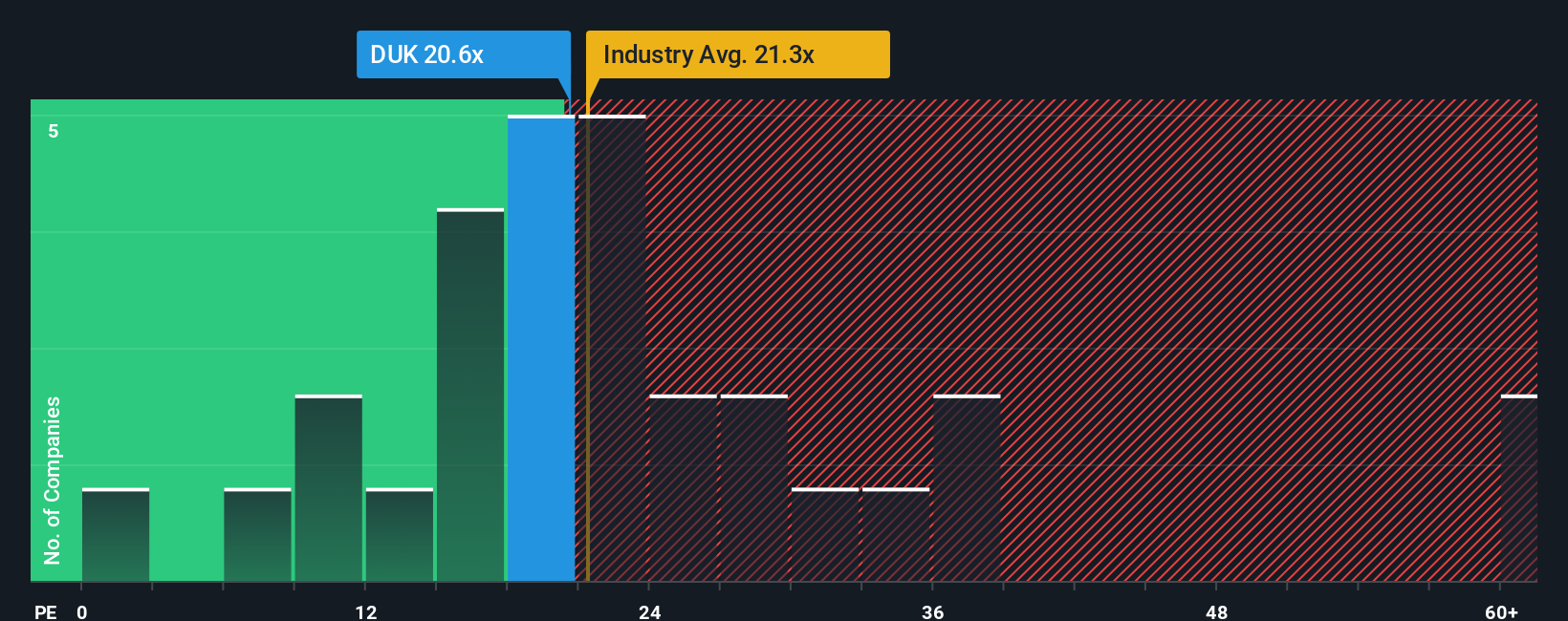

For profitable companies like Duke Energy, the Price-to-Earnings (PE) ratio is a widely accepted metric to assess whether a stock is fairly valued. The PE ratio tells investors how much they are paying for each dollar of earnings, making it especially relevant for established firms with consistent profit streams.

What qualifies as a "normal" or "fair" PE ratio depends on the growth prospects and risks of a business. Strong earnings growth or low risk typically justify a higher PE ratio, while slower growth or greater uncertainties may lead to a lower multiple.

Currently, Duke Energy trades at a PE ratio of 21.15x. This is quite close to the Electric Utilities industry average of 21.42x and is below the peer average of 28.69x. While comparing to industry and peer averages gives helpful context, these benchmarks do not consider all of the unique factors affecting Duke Energy’s valuation.

This is where the “Fair Ratio” comes in. This proprietary metric by Simply Wall St estimates a PE multiple tailored to a company’s future earnings outlook, industry, risk, profitability, and market cap. For Duke Energy, the Fair Ratio is calculated at 22.15x, suggesting what investors should reasonably expect given its profile. This approach provides a more nuanced picture than a blunt comparison to industry and peer averages.

Since Duke Energy’s current PE of 21.15x is just about in line with its Fair Ratio, it appears that the stock is fairly valued based on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Duke Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story underpinning a company's financial future. It is where you connect your perspective on a business with real numbers, including your own assumptions for fair value, future revenues, earnings, and margins. Narratives link Duke Energy’s business strengths, risks, and market forces to a financial forecast, then synthesize it all into a clear, actionable fair value estimate.

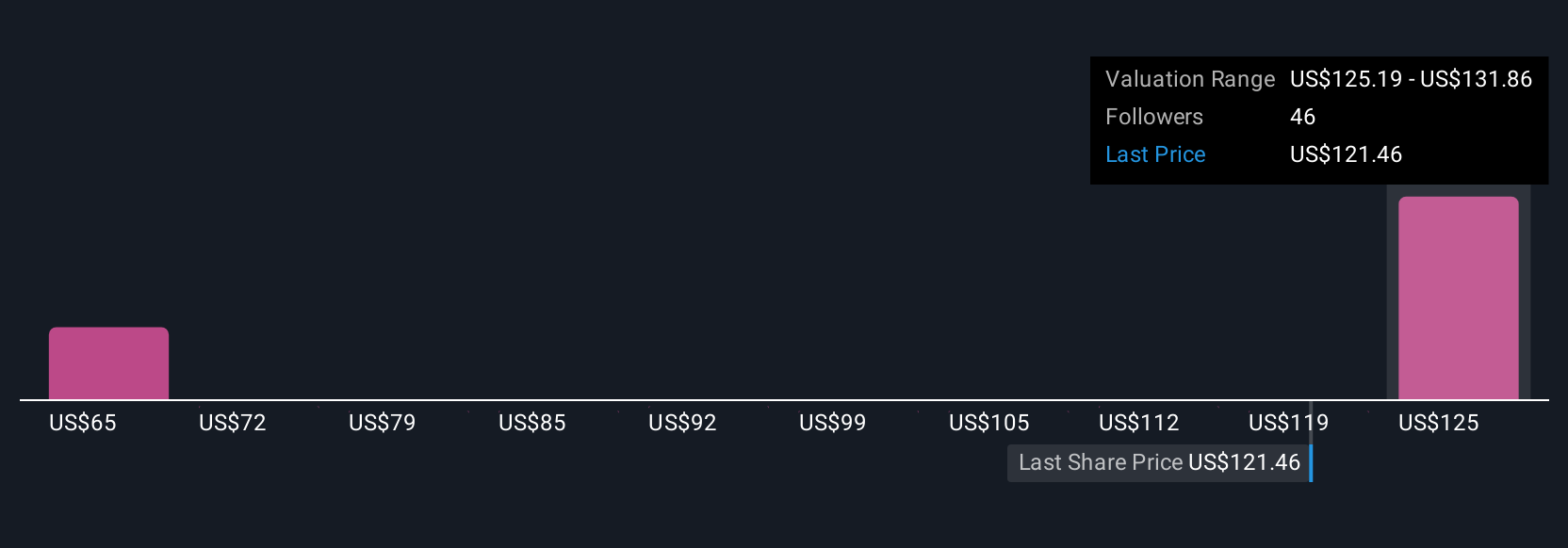

This approach is easy to access via the Community page on Simply Wall St, where millions of investors share and update their Narratives as new information comes in, like earnings or news developments. By building a Narrative, you can instantly see whether your view of Duke’s fair value makes the current price look attractive or stretched, giving you clarity on when to buy or sell. For example, some investors believe Duke’s grid modernization and regulatory support justify a fair value above $133 per share, while others see risks around capital needs or future demand, resulting in estimates under $120. Narratives empower you to neatly link the story behind the stock to your investment call and adjust quickly as the facts change.

Do you think there's more to the story for Duke Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)