- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy (DTE) Valuation Check as Oracle–OpenAI Data Center Sparks Regulatory Scrutiny and Shifts in Market Sentiment

Reviewed by Simply Wall St

DTE Energy (DTE) is in the spotlight as Michigan regulators weigh its request to fast-track power contracts for a massive Oracle and OpenAI backed data center, a project reshaping both demand expectations and investor sentiment.

See our latest analysis for DTE Energy.

Despite the short term pullback in DTE’s share price, with a 7 day share price return of negative 4.23 percent as investors digest the noisy data center headlines and fresh dividend announcement, the stock still shows solid underlying momentum. It has an 11.59 percent 1 year total shareholder return and a steady multi year track record, suggesting the market is gradually rewarding its regulated growth story.

If this kind of AI driven power demand has your attention, it is worth exploring other utility adjacent names sitting alongside high growth tech, including high growth tech and AI stocks.

With DTE trading at a modest discount to analyst targets and boasting double digit earnings growth, the key question is whether the AI data center upside is still underappreciated or if the market is already pricing in that future growth.

Most Popular Narrative: 12.7% Undervalued

With the narrative fair value sitting at about $150.31 versus DTE Energy’s last close at $131.23, the valuation case leans in favor of upside.

A major upcoming catalyst for DTE is the rapid expansion in electricity demand being driven by hyperscale data centers, with 3 gigawatts of advanced negotiations and an additional 4 gigawatts in the pipeline. These loads, operating at nearly 90% capacity factors, may materially increase revenues and provide headroom for rate growth while improving overall system load factor and grid utilization.

Want to see how steady grid demand, rising profit margins, and richer future earnings multiples all intersect in this story? The narrative presents them together as a way to reconsider how to view a regulated utility’s potential growth ceiling.

Result: Fair Value of $150.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major grid investment execution risks and potential regulatory pushback on data center related rate cases could still derail those optimistic earnings and valuation assumptions.

Find out about the key risks to this DTE Energy narrative.

Another Lens on Valuation

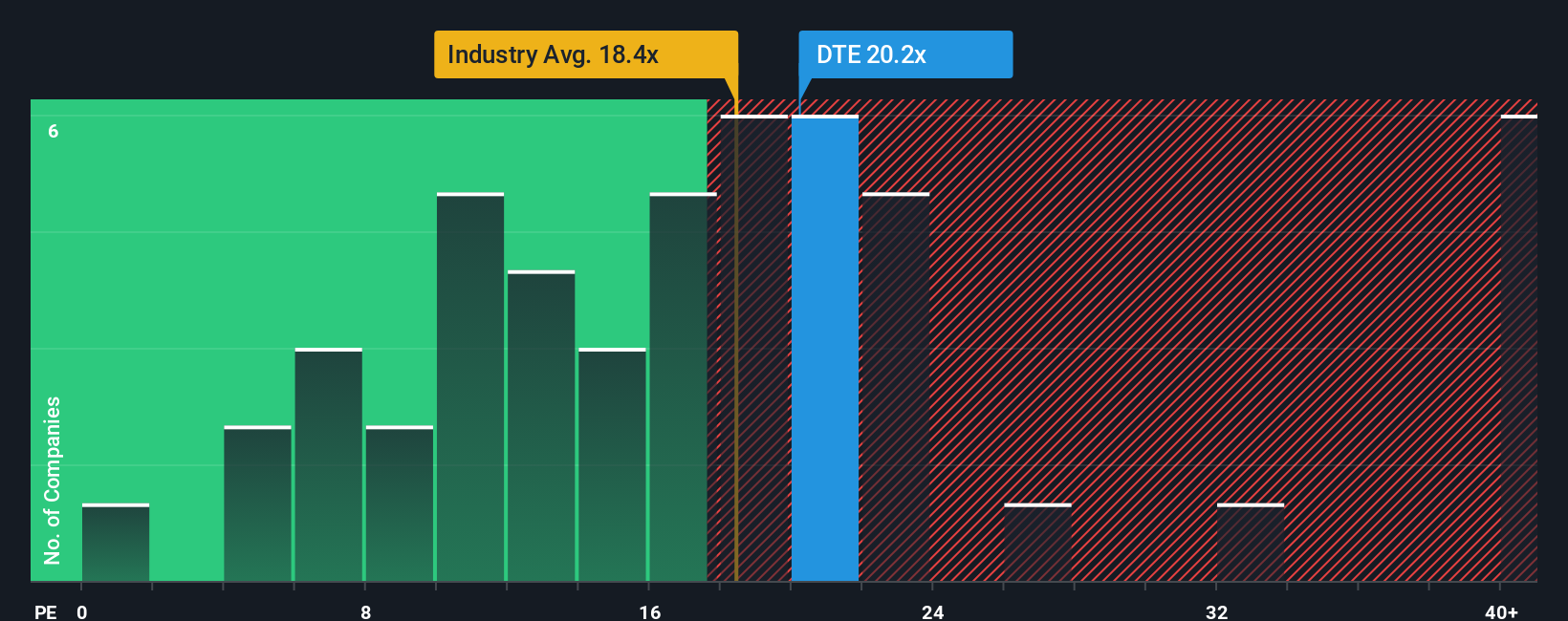

On a simple price to earnings view, DTE trades at 19.7 times earnings, richer than the global integrated utilities average of 17.8 times yet cheaper than its peer group at 21.1 times and below a 22.9 times fair ratio. This leaves investors to judge whether this premium is earned or fragile.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DTE Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your DTE Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Before you move on, put Simply Wall Street’s Screener to work and build a watchlist of high conviction ideas that the market may be overlooking.

- Explore potential mispricings by targeting companies trading below intrinsic value through these 908 undervalued stocks based on cash flows, built from daily refreshed cash flow models.

- Focus on the growth of automation and machine learning by identifying next wave innovators using these 26 AI penny stocks, tailored to fast growing tech.

- Strengthen your income stream by filtering for reliable payers with attractive yields via these 15 dividend stocks with yields > 3%, so your capital keeps working even in sideways markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026