- United States

- /

- Water Utilities

- /

- NYSE:CWT

Hawaii Rate Hike Approval Might Change the Case for Investing in California Water Service Group (CWT)

Reviewed by Sasha Jovanovic

- Hawaii Water Service, a subsidiary of California Water Service Group, recently received approval from the Hawaii Public Utilities Commission to raise annual revenue by US$4.7 million across the Waikoloa service area, with corresponding adjustments to water and wastewater rates reflecting infrastructure investments and higher operating costs.

- This regulatory approval comes as California Water Service Group continues to pursue revenue growth, capital investments, and special dividends, highlighting robust activity across both its core and expanding markets.

- We'll explore how the successful rate increase for the Hawaii subsidiary could reinforce confidence in California Water Service Group's infrastructure-driven growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

California Water Service Group Investment Narrative Recap

For shareholders, the core belief in California Water Service Group hinges on the company's ability to steadily grow its regulated rate base through infrastructure investments and secure timely regulatory approvals for rate increases. While the Hawaii Water Service rate hike showcases progress in non-California markets, the most important catalyst, the pending resolution of the California General Rate Case, remains unaffected by this latest development. The main risk continues to be regulatory delays or unfavorable outcomes that could diminish future revenue and earnings growth.

Among recent announcements, continued capital deployment stands out, particularly the launch of a major wastewater project in San Bernardino County. This signals California Water Service Group’s commitment to expanding its operational footprint and investing in essential infrastructure, which remains important as the company seeks stable, recurring cash flows. However, as rate cases progress at different speeds across regions, investor attention is likely to stay on regulatory signals in California.

Yet, against these infrastructure wins, investors should also consider the unresolved questions around California’s General Rate Case and how...

Read the full narrative on California Water Service Group (it's free!)

California Water Service Group's outlook projects $1.1 billion revenue and $187.9 million earnings by 2028. This is based on an expected 3.9% annual revenue growth rate and a $52.1 million earnings increase from the current $135.8 million.

Uncover how California Water Service Group's forecasts yield a $55.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

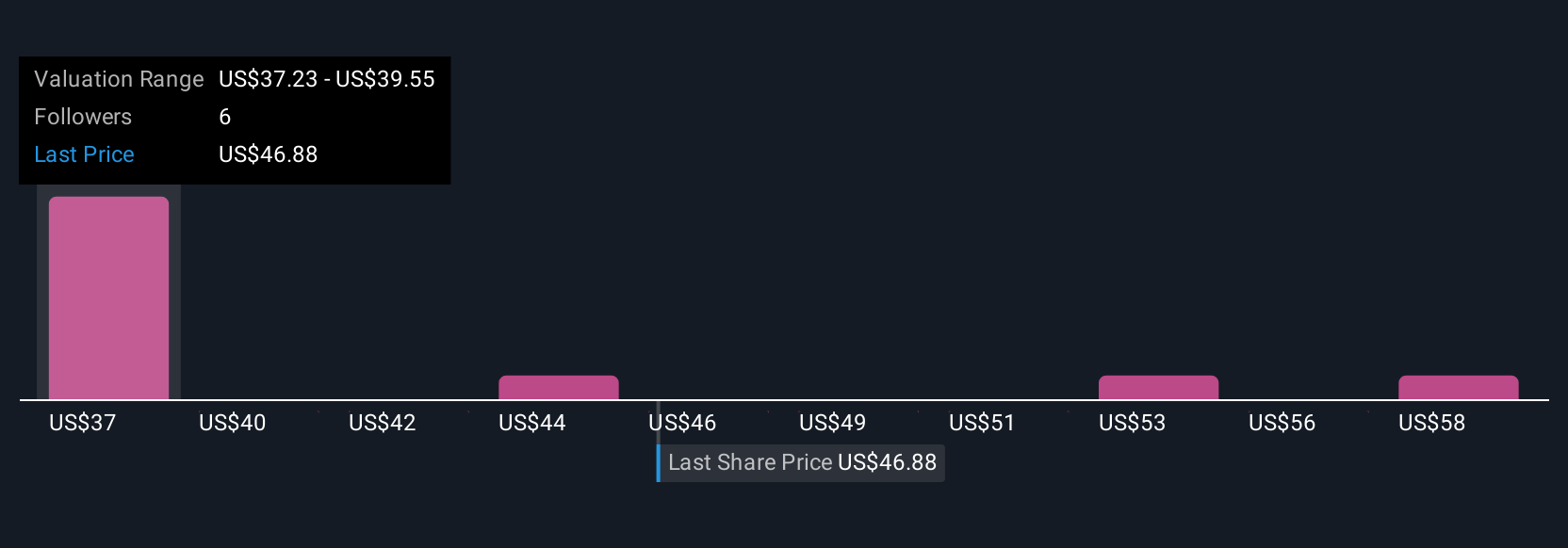

Four members of the Simply Wall St Community estimate California Water Service Group’s fair value at US$36.33 to US$60.39 per share. With regulatory risk around major rate cases still present, you can explore several alternative viewpoints here.

Explore 4 other fair value estimates on California Water Service Group - why the stock might be worth as much as 24% more than the current price!

Build Your Own California Water Service Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free California Water Service Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate California Water Service Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWT

California Water Service Group

Through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives