- United States

- /

- Water Utilities

- /

- NYSE:CWT

California Water Service Group's (NYSE:CWT) Dividend Will Be Increased To $0.26

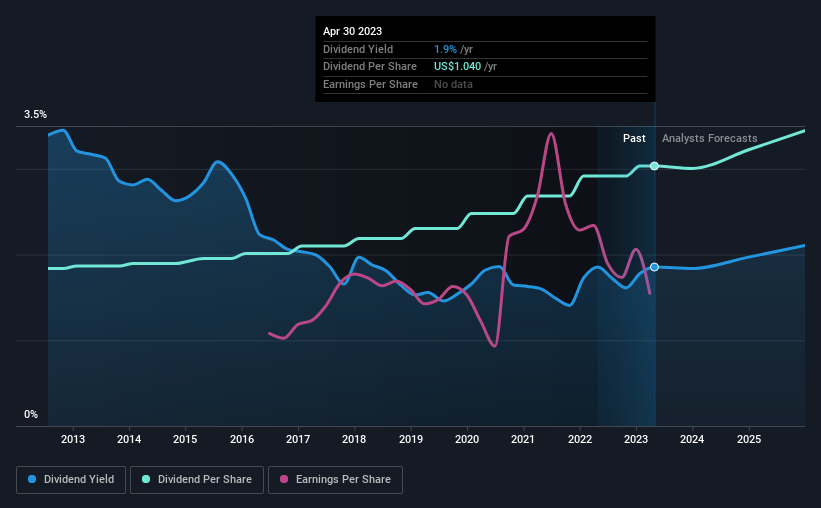

California Water Service Group's (NYSE:CWT) dividend will be increasing from last year's payment of the same period to $0.26 on 19th of May. This makes the dividend yield about the same as the industry average at 1.9%.

View our latest analysis for California Water Service Group

California Water Service Group's Dividend Is Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last dividend made up quite a large portion of free cash flows, and this was made worse by the lack of free cash flows. Generally, we think that this would be a risky long term practice.

Over the next year, EPS is forecast to expand by 75.6%. If the dividend continues along recent trends, we estimate the payout ratio will be 47%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

California Water Service Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2013, the dividend has gone from $0.63 total annually to $1.04. This works out to be a compound annual growth rate (CAGR) of approximately 5.1% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. California Water Service Group has seen earnings per share falling at 2.6% per year over the last five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think California Water Service Group's payments are rock solid. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for California Water Service Group you should be aware of, and 1 of them can't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CWT

California Water Service Group

Through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026