- United States

- /

- Other Utilities

- /

- NYSE:CNP

CenterPoint Energy (NYSE:CNP) Completes 400 Miles Of Underground Power Lines For Resiliency

Reviewed by Simply Wall St

CenterPoint Energy (NYSE:CNP) completed its undergrounding project ahead of the hurricane season, achieving 100% of its goal, which was part of its resiliency initiative. This effort could enhance the reliability of its power system. Additionally, the company announced a first-quarter revenue increase to $2,920 million, though net income declined. Meanwhile, the broader market has seen mixed movements, with certain stocks reacting strongly to earnings and ongoing trade talks with China. These activities have all contributed to the company's 21% share price increase over the last quarter, highlighting investor interest amid broader market stability.

Find companies with promising cash flow potential yet trading below their fair value.

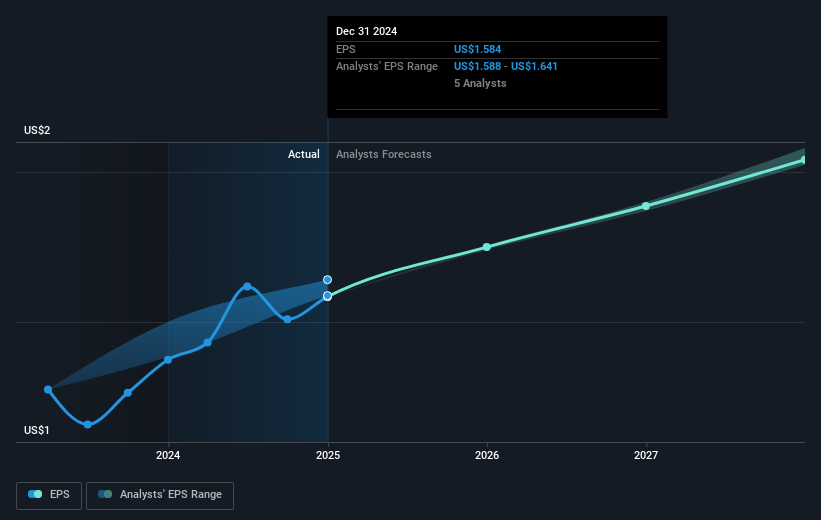

CenterPoint Energy's recent completion of its undergrounding project may bolster its resiliency initiatives, potentially improving operational efficiency and reducing costs, which are key components of future revenue and earnings projections. As the company aims for enhanced reliability, this could influence revenue growth forecasts that anticipate a 5.3% annual increase over the next three years, supported by the company's plans for extensive capital investments and grid automation.

Over a longer time frame, CenterPoint Energy's shares have delivered a substantial total return of 150.18% over the past five years, underscoring strong investor confidence in its strategic initiatives. This impressive performance contrasts with its 21% share price appreciation in just the last quarter, which has outpaced both the broader market's and the US Integrated Utilities industry's 1-year returns of 8.2% and 15.9%, respectively. Such robust growth indicates alignment with investor expectations surrounding the company's operational improvements.

In terms of valuation, CenterPoint Energy remains close to its analyst consensus price target, with the current share price slightly above the target of US$37.98. This proximity suggests that the market potentially views the stock as fairly priced, based on anticipated earnings growth and margin improvements. Investors should consider the potential impact of ongoing capital investments and regulatory developments on future earnings, while also noting the narrow difference between the current market price and analyst expectations.

Our valuation report here indicates CenterPoint Energy may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Proven track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives